Emerson 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

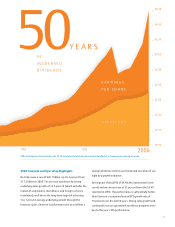

_ $4.50

_ $4.00

_ $3.50

_ $3.00

_ $2.50

_ $2.00

_ $1.50

_ $1.00

_ $0.50

_ $0.00

1956 1966 1976 1986 1996 2006

2006FinancialandOperatingHighlights

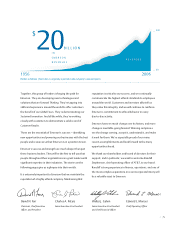

Net sales were a record $20.1 billion, up 16.3 percent from

$17.3 billion in 2005. The increase was driven by strong

underlying sales growth of 12.5 percent (which excludes the

impact of acquisitions, divestitures, and foreign currency

translation), well above the long-term target of achieving

5 to 7 percent average underlying growth through the

business cycles. Emerson’s performance this year reects a

strong industrial economy and continued execution of our

eight key growth initiatives.

Earnings per share (EPS) of $4.48 also represented a new

record and was an increase of 32 percent from the $3.40

reported in 2005. This performance is substantially better

than Emerson’s compound annual EPS growth rate of

10 percent over the last 50 years. Strong sales growth and

continued focus on operational excellence programs were

key to this year’s EPS performance.

2002 earnings per share is before the $2.23 per share charge from the cumulative effect of a change in accounting principle.

| 1

e a r n i n g s

p e r s h a r e

d i v i d e n d s

50y e a r s

o f

i n c r e a s e d

d i v i d e n d s