Emerson 2006 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2006 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

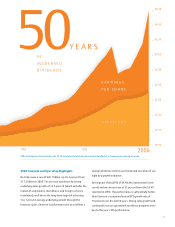

1956 1966 1976 1986 1996 2006

Financial Highlights and Letter to Shareholders

d e a r s h a r e h o l d e r s ,

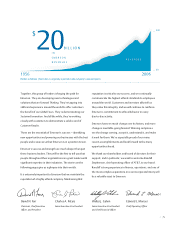

In 2006, Emerson once again obtained its nancial and

operating objectives and delivered record levels of sales,

earnings per share, and operating cash ow. Dividends

increased for the 50th consecutive year, and revenues topped

$20 billion, making 2006 a year of signicant milestones.

Over the last 50 years and especially over the past two decades,

Emerson has established a solid reputation as a strong global

company ready to face current and future challenges.

Continual strong performance doesn’t come by accident.

Dedicated, enthusiastic, and creative Emerson leaders

throughout the company apply our management process

to help meet and exceed operational objectives. This

strategic process allows us to address global opportunities

and continue to invest in next-generation innovation and

technologies to the benet of shareholders, customers,

and employees.

o n e -y e a r p e r f o r m a n c e

Years ended September 30 percent

Dollars in millions, except per share amounts2005 2006 change

Sales $17,305 $20,13316.3%

Earnings per share $ 3.40 $ 4.48 31.8%

Dividends per share $ 1.66 $ 1.78 7.2%

Operating cash ow $ 2,187 $ 2,512 14.9%

Return on total capital 15.5% 18.4%

Return on equity 19.4% 23.7%

f i v e -y e a r p e r f o r m a n c e

Years ended September 30 five-year

Dollars in millions, except per share amounts2001 2006 cagr

Sales $15,311 $20,1335.6%

Earnings per share $ 2.40 $ 4.48 13.3%

Dividends per share $ 1.53 $ 1.78 3.1%

Operating cash ow $ 1,708 $ 2,512 8.0%

Return on total capital 11.5% 18.4%

Return on equity 16.5% 23.7%