Eli Lilly 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

medicines. We believe no other company will be better

positioned to meet the needs of people with diabetes across

the treatment spectrum. (See page 8.)

In January 2011, Lilly entered into a global alliance

with Boehringer Ingelheim to jointly develop and com-

mercialize two new oral diabetes therapies: Trajenta®, the

oral DPP-4 inhibitor we launched in 2011—now approved

in more than 60 countries—and empagliozin, an SGLT-2

inhibitor. e Lilly-BI partnership also includes Lilly’s new

insulin glargine product.

In addition to the products in the

alliance, Lilly is advancing our basal

insulin peglispro and our GLP-1 receptor

agonist, dulaglutide—further expanding

the potential reach of our portfolio.

Even as we continue to deliver solid

performance with our marketed products,

we can take full advantage of our existing

commercial footprint as we launch as

many as four new diabetes medicines in

the next two to three years.

Empagliozin was submitted for

regulatory approval in the U.S., Europe,

and Japan in 2013. We’re encouraged by the

data from three Phase III studies which all

met their primary objectives. We observed

statistically signicant reductions in HbA1c,

a measure of average blood glucose, and

we also saw decreases in body weight and

reductions in systolic blood pressure.

Dulaglutide was submitted in late 2013 in the U.S. and

Europe. We’ve completed six Phase III trials; dulaglutide

1.5mg was superior to comparator drugs in lowering HbA1c

in ve trials, and met the primary endpoint of non-inferiority

in the sixth. Further, in the three trials presented to date, we’ve

shown that the percent of patients achieving the American

Diabetes Association goal for HbA1c was signicantly greater

than the comparators. Patients taking dulaglutide 1.5mg also

showed weight loss for the duration of those trials.

In combination with our ready-to-use pen delivery

device, we believe once-a-week dulaglutide will be a very

competitive entry in the GLP-1 market.

In addition to empagliozin and dulaglutide, we have

two basal insulins in late-stage development.

In partnership with Boehringer Ingelheim, we submitted

our new insulin glargine product in the U.S., Europe, and Japan

in 2013. In addition, Lilly’s next-generation basal insulin, basal

insulin peglispro, is currently in Phase III trials. If the studies are

successful, we could submit basal insulin peglispro to regulatory

authorities as early as this year.

While we believe each of our potential new diabetes

medicines will oer important benets, it is our comprehen-

sive portfolio that gives Lilly a unique opportunity to help

people with diabetes meet their needs, while contributing

signicantly to Lilly’s return to growth post-2014.

Building on Lilly Leadership in Oncology

We also reached key milestones last year in oncology, an

important area of focus for our company. e unmet need is

huge: It’s estimated that, over a lifetime, cancer will strike one

of every two men and one of every three women in the United

States. We believe that, with our existing products Alimta® and

Erbitux®, our late-stage molecules ramucirumab and necitu-

mumab—both of which came from our acquisition of ImClone

in 2008—and our early- to mid-phase pipeline, we are well-

positioned to continue to be a leader in

oncology for many years to come.

Ramucirumab, which could launch

this year, has shown positive results in

two Phase III trials in patients with ad-

vanced gastric cancer. is is a devastat-

ing disease with no approved standard

of care in the U.S. or Europe.

In 2013, based on data from the

REGARD trial, we completed regulatory

submissions in the U.S. and Europe for

ramucirumab as a single-agent bio-

logic therapy in patients with advanced

gastric cancer. Based upon the results of

the RAINBOW trial, we also intend to

submit an application for ramucirumab

in combination with chemotherapy in

the rst half of 2014.

We recently announced that ramu-

cirumab improved overall survival in

patients with non-small cell lung cancer

(NSCLC) when combined with chemotherapy in a Phase III

trial. We intend to submit the rst regulatory application for

ramucirumab in NSCLC later this year.

In addition, we have ongoing Phase III ramucirumab

trials, expected to read out this year, in liver and colorectal

cancer. Depending on the trial data, we could submit the liver

cancer indication to regulators before the end of 2014. It’s

important to note that a Phase III study of ramucirumab in

breast cancer did not meet its primary endpoint.

Along with ramucirumab, we announced positive

Phase III results in 2013 for necitumumab, a fully-human

monoclonal antibody. Necitumumab demonstrated increased

overall survival as a rst-line treatment when patients with

stage IV metastatic squamous NSCLC were administered

necitumumab in combination with chemotherapy, versus

chemotherapy alone.

We believe that necitumumab represents an important

milestone for patients with squamous NSCLC—30 percent of

all NSCLC patients. is is a dicult-to-treat disease for which

there have been very limited advances in the last two decades.

We anticipate submitting necitumumab to regulatory

authorities before the end of 2014. If approved, necitumumab

would be the rst biologic agent approved to treat squamous

NSCLC—adding to Lilly’s leadership in lung cancer treatment.

(See page 10.)

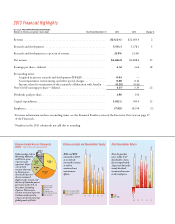

$232.6 +12%

$215.7 +9%

$160.6 +181%

$115.1 +6%

$108.7 +4%

$104.7 +142%

Cialis

Humalog

Trajenta

Animal Health

Alimta

Axiron

Key Contributors to 2013 Revenue Growth

($ in millions represent growth in revenue,

percent growth)

Five products and

a product line—

Cialis, Humalog,

Trajenta, Alimta,

Axiron, and

Animal Health—

together generated

revenue growth of

$937 million

during 2013 over

2012. is growth

was driven

primarily by

volume increases.