Electrolux 1997 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1997 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

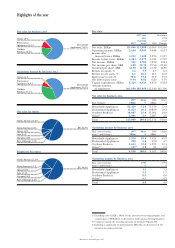

Household Appliances

Operations in Western Europe

The market for white goods in Western

Europe improved gradually and showed

an increase in volume of about 4%

for the full year, referring mainly to

Scandinavia, Spain, the UK and France.

In Germany, which accounts for about

30% of total market volume in Europe,

demand was somewhat weaker than in

1996. The West European market for

1997 is estimated at about 46.3 (44.4)

million units.

Group sales were higher than in

the previous year. Market share was

largely unchanged. Operating income

improved despite lower volume and

a less favorable product mix in the

German market.

Operations in the US

The American white-goods market

increased in volume by almost 2%.

All product areas showed growth, the

largest increases being for dishwashers,

washing machines, spin-driers and freez-

ers. Demand for room air-conditioners

declined considerably as a result of a

cool summer.

The market for core appliances in

the US, i.e. deliveries from domestic

producers plus imports, excluding

microwave ovens and room air-condi-

tioners, amounted to 32.9 (32.3) mil-

lion units in 1997.

The Group achieved good sales

growth in white goods and strengthened

its market position. Sales of room air-

conditioners were considerably lower

than in the previous year, however.

A marked improvement in operating

income for the US operation was

reported on the basis of higher capacity

utilization and lower operating costs.

Operations in Brazil

From the second quarter onward, the

white-goods market in Brazil declined

sharply for refrigerators and freezers,

which account for the largest share of

Group sales. The total market showed

an 8% decrease in volume for all pro-

duct areas. However, demand for refrig-

erators declined by 15% and freezers by

27%. In the previous year, the total

market increased by more than 20%.

The Group’s sales in Brazil declined and

income was substantially lower than the

high level for the previous year. Income

was also adversely affected during the

fourth quarter by a charge of approxi-

mately SEK 130m for adjustment to

the deteriorated market situation.

The Group’s market share was

largely unchanged from 1996. In the

course of the year the Prosdócimo

brand was replaced by Electrolux.

The Group increased its stake in

the Brazilian company through a public

offer in November, increasing its share

of capital from 50% to more than 90%.

Structural changes

Within the framework of the current

restructuring program, it was decided

that two refrigerator plants would be

shut down, one in the UK with about

600 employees, and one in Finland

with about 200 employees. It was also

decided that a freezer unit in Hungary

would be shut down and that produc-

tion of washing machines and spin-driers

in Germany would be rationalized.

The two latter decisions affect about

250 employees. The above changes

will be implemented at various dates

during 1998 and 1999.

A number of changes were imple-

mented in functions for marketing, sales

and logistics to obtain greater efficiency

and improved customer service. During

the past two years, the total number of

employees in these functions has been

reduced by about 1,000, or more than

10%. In several countries, organizations

for different brands have been coordi-

nated in a common sales company. It

was also decided that about 15 ware-

houses would be shut down.

Acquisition in Romania

At the end of the year the Group

acquired S.C. Samus S.A, the leading

producer of cookers in Romania. The

company has annual sales of approxi-

mately SEK 150m and about 2,200

employees. In addition to a strong posi-

14

Electrolux Annual Report 1997

The new AEG dishwasher has a built-in

water-sensor that enables automatic selec-

tion of the program that gives the best

washing results with minimal consumption

of water and energy.

The Group’s latest Frigidaire-brand dishwashers

in the US feature lower consumption of water

and lower noise levels than comparable American

products.