Electrolux 1997 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1997 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

Electrolux Annual Report 1997

Report by the President and CEO

Market conditions in Europe improved

gradually during the year in most of our

product areas, with the exception of

Germany and neighboring countries.

Demand in the US remained at a high

level. On the other hand, Brazil and

Southeast Asia showed a sharp decline

in market demand, particularly during

the second half of the year.

Electrolux achieved good sales

growth in both Europe and the US.

In terms of comparable units and after

adjustment for exchange-rate effects,

sales in the third and fourth quarters

rose by 8% and 9%, respectively. The

sales increase for the full year was 5%.

During the second quarter, Group

operating income was charged with a

provision of SEK 2,500m for the on-going

restructuring program. Exclusive of non-

recurring items and Gränges, operating

income rose by 13% to SEK 4,550m,

although with an unchanged low margin

of 4%. Net financial items were adversely

affected by a reduced interest-rate differ-

ential between the Swedish krona and

foreign currencies, as well as by higher

interest costs resulting from a stronger

dollar. Income after financial items rose

by 7% to SEK 3,128m. Minority interests

were lower than in the previous year,

as the Brazilian subsidiary reported a

substantial decline in income, and the

Group increased its share of capital in

the company. Group income before

taxes increased by 17% to SEK 3,179m.

Of our business areas, Outdoor

Products continued to report good

growth in sales and operating income,

as well as an improved operating margin

of 8.9%. It is also gratifying that white

goods in North America reported a

strong increase in results. White goods

in Europe also achieved higher income,

despite weak demand and a less favor-

able product mix in the important

German market. We also achieved

very good growth in white goods and

other product areas in new markets

in Eastern Europe.

Disappointments during the year

naturally include market trends in

Brazil and Asia, which had a substantial

adverse effect on income, particularly in

Household Appliances. In addition to the

effects of lower sales volume and prices,

we took a charge of SEK 150m during

the fourth quarter for adjustments in

response to lower demand in these mar-

kets. The performance of Professional

Appliances also continued to be weak.

The important task of streamlining

the Group’s structure continued during

the year and involved a number of

divestments. In addition to distributing

Gränges to shareholders, we divested

Husqvarna Sewing Machines and the

operation in goods protection. In Janu-

ary, 1998 an agreement was reached for

divestment of the operation in agricul-

tural implements and the SIA group,

which markets and sells items for inte-

rior decoration. These operations had

total annual sales of approximately

SEK 10,300m. Of the non-strategic

units outside Household Appliances,

Professional Appliances and Outdoor

Products, the only remaining operation

is Gotthard Nilsson, a recycling

company with annual sales of almost

SEK 2,000m.

Restructuring program authorized

For some years, Electrolux has reported

weak income growth and an unsatis-

factory return on equity. Following

an improvement in 1994–95, both

operating margin and return on equity

showed negative trends in 1996 and

early 1997. For the full year 1997, the

operating margin exclusive of non-

recurring items was 4.0% and the return

on equity was 7.9%.

In June we decided to implement

a comprehensive restructuring program

in order to create a framework that

will enable the Group to achieve its

long-term goals of an operating margin

of 6.5 –7% and a return on equity

of 15%. The program is aimed at

increasing capacity utilization and

productivity, and reducing operating

costs. The program does not involve

discontinuation of any product area

or geographical market.

The restructuring program will be

implemented over two years and will

involve personnel cutbacks of about

12,000, or 11%, through the shutdown

of about 25 plants and 50 warehouses

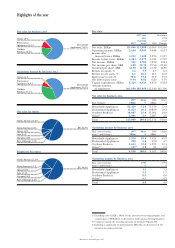

Sales and income

North America

93 94 95 96 97

0

30,000

45,000

60,000

75,000

90,000

15,000

Europe

Net sales in

Europe and North America, SEKm

12-month figures

Operating income,

excl. non-recurring items

Income after financial items,

excl. non-recurring items

93 94 95 96 97

Net sales 12-month figures

0

40,000

60,000

80,000

100,000

120,000

20,000

Income

0

2,000

3,000

4,000

5,000

6,000

1,000

Net sales

Net sales and income, SEKm