E-Z-GO 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2011—with powerful brands in a broad mix of industries—

our Industrial businesses helped to energize the company’s

overall results. Industrial revenues approached $2.8 billion,

reflecting a 10 percent increase for the year. Together, these

businesses created $202 million in profit while significantly

reinvesting in strategic growth initiatives.

Profits rose at our Greenlee and Klauke tool businesses, as

we saw renewed sales activity with professional contractors

and electrical distribution customers. On job sites around the

world, these tools are renowned for their durability and speed,

helping contractors cut, crimp and drill an array of tough

materials. Greenlee’s power tool accessories business grew

by 25 percent during the year due to new product launches

and design improvements—and sales increased by 24 percent

for the company’s line of lithium-ion power tools. Greenlee

also acquired a majority stake in Shanghai Endura Tools,

a well-established brand of hand tools serving China’s home

centers and industrial distribution channels. In Latin America

and Mexico, Greenlee increased sales by 83 percent during

the year.

At Kautex, the business saw higher demand for its fuel

systems, as the global automotive market strengthened in

2011. Revenues grew by 11 percent and Kautex won several

highly competitive contracts from top automakers—including

contracts to produce 550,000 fuel tanks annually for

General Motors’ Chevrolet and Buick models, and with BMW

to provide 400,000 fuel tanks. Kautex also saw growing

demand for its Selective Catalytic Reduction Systems used to

reduce emissions from diesel engines. In order to capitalize on

worldwide opportunities, Kautex announced plans for new

plants in Asia, Europe and North America.

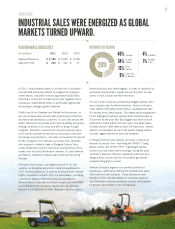

For our E-Z-GO, Cushman and Bad Boy Buggies brands, 2011

was a dynamic year for vehicle launches. Actions included a

major refresh of the utility vehicle lineup—updating more than

40 vehicles across these brands. This helped drive strong growth

for the redesigned Cushman vehicles which improved sales by

50 percent for the year. Bad Boy Buggies launched its Bone

Collector® Limited Edition XTO 4x4 and a new Work Series

of utility vehicles. With these product line extensions, Textron

added to its reputation as one of the world’s leading makers

of small, rugged vehicles for work and recreation.

In the golf and turf-care industry, Jacobsen continued to

reinvent its product line—launching the GP400™ riding

greens mower, the LF550™/570™ lightweight fairway

mowers and new blade reel technology. During the year,

Jacobsen’s Eclipse® 322 won additional customers and

design awards as the industry’s first hybrid gas-electric

powered riding greens mower.

Textron’s Industrial segment is a powerful portfolio of

businesses—with brands offering the durability and value

that customers are looking for. These businesses were

fortified in 2011 with the addition of numerous products

and distribution channels worldwide, and are well prepared

for growth opportunities in the coming years.

INDUSTRIAL SALES WERE ENERGIZED AS GLOBAL

MARKETS TURNED UPWARD.

INDUSTRIAL

7

PERFORMANCE HIGHLIGHTS REVENUES BY REGION

(In millions) 2011 2010 2009

Segment Revenues $2,785 $2,524 $2,078

Segment Profit $202 $162 $27 2011

2011

40% Europe 4% Canada

34% United

States 1% Middle

East

12% Asia

Pacific

9% Latin Am.

& Mexico