Dominion Power 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

'20,1,21 5(6285&(6 6XPPDU\ $QQXDO 5HSRUW

:H GR RXU EHVWWR VXSSRUW

HGXFDWLRQWKH HQYLURQPHQW

KXPDQ VHUYLFHVWKH DUWV DQG

PDQ\ RWKHU SKLODQWKURSLF

HQGHDYRUVLQ WKH FRPPXQLWLHV

ZH VHUYH

'RPLQLRQ GRQDWHG PLOOLRQ WKURXJK 7KH 'RPLQLRQ

)RXQGDWLRQWRPRUHWKDQRUJDQL]DWLRQVLQ

2XU HPSOR\HHV YROXQWHHUHG KRXUVRI WKHLU

WLPH WR LPSURYH WKHLU FRPPXQLWLHV

:H GRQDWHG PLOOLRQ WR (QHUJ\6KDUH LQ

:H FRQWULEXWHG PRUHWKDQ PLOOLRQ WR VXSSRUW

HQYLURQPHQWDO RUJDQL]DWLRQVKRXVLQJ RUJDQL]DWLRQV

DQG KRPHOHVV VKHOWHUV LQ VWDWHV

:H ODXQFKHG D QHZ FRPSHWLWLYH KLJKHU HGXFDWLRQ

JUDQWVSURJUDP LQ 9LUJLQLDZLWK D GRQDWLRQ

IURP WKH IRXQGDWLRQ

rating agencies, and we are positioned to report future

dividend and earnings growth from our ongoing

infrastructure investments. Here is a summary of our

progress, our operating achievements in 2010, and our

outlook for the future.

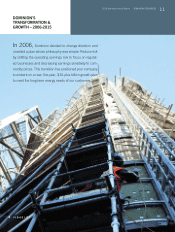

$),9(<($5 75$16)250$7,21

In 2006, senior management and the Board of Direc-

tors decided on a new direction for Dominion. At the

time, there was a growing gap in our Virginia franchise

area between demand and available generation — and

uncertainty in putting vast amounts of capital into

new infrastructure projects. We were producing large

amounts of natural gas and oil in wells across the U.S.,

the Gulf of Mexico and Canada, adding commodity

price exposure and volatility to our earnings and the

need for significant credit capacity and cash to cover

hedging programs. Three-fifths of Dominion’s oper-

ating earnings were derived from commodity-based

businesses, such as gas and oil exploration and produc-

tion (E&P) and power stations in the Northeast selling

electricity into non-regulated markets. That percentage

was expected to increase.

Investors asked, Is Dominion a utility? An E&P

company? An independent power producer? Our price-

to-earnings ratio — a common metric to value a stock

— reflected those concerns. Back then our P/E valu-

ation was at a 12 percent discount to the average P/E

ratio of the 14 companies we identified as representing

our peer group.*

7+( 3/$1

Seeking to alleviate investor concerns, senior manage-

ment unveiled a plan whose philosophy was simple:

Reduce risk by shifting the operating earnings mix to

focus on regulated businesses and decreasing earnings

sensitivity to commodity prices.

We developed a strategy to grow federal- and state-

regulated assets. In the Virginia General Assembly,

Dominion supported a regulatory model that allowed

the State Corporation Commission to set customers’

rates while providing forward-looking cost-recovery

mechanisms and performance incentives for new infra-

structure to meet rising demand. We considered selling

* As of December 31, 2010, our peer companies consisted of Ameren, AEP,

Constellation Energy Group, DTE Energy, Duke Energy, Entergy, Exelon,

FirstEnergy, NextEra Energy, NiSource, PPL, Progress Energy, Public

Service Enterprise Group, and Southern Company. Going forward, CMS

Energy and Xcel Energy will be part of Dominion’s peer group.