Dominion Power 2002 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2002 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

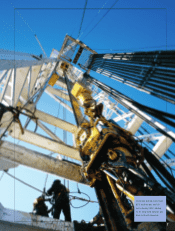

80

60

40

20

0

-20

-40

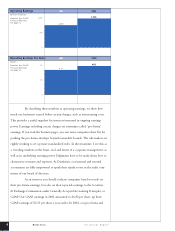

(4.6)

60.7 67.2

(30.0) (23.4) (20.2) (15.1)

8.7 5.8

(22.1)

(37.6)

(2.9)

1 Year Total Return

3 Year Total Return

5 Year Total Return

Total Return Comparison

Percent

Dominion S&P Utilities S&P Electric S&P 500

3

Dominion ’02 Annual Report

Did we have a good year? Absolutely.

In 2002, we produced our highest-ever operating earnings—$4.83

per share—nearly 16 percent better than the year before.* Yet, our share price

closed at $54.90, down from $60.10 a year earlier. Even with our steady $2.58

annual dividend, that’s a total negative return of about 4.6 percent. But we fared

better than most energy companies. The Dow Jones utilities index produced a

total negative return of more than 23 percent while S&P indexes tracking

the natural gas and power industries produced total negative returns of about

42 percent and 15 percent, respectively. The S&P 500 sank more than

22 percent under the weight of lingering economic uncertainty, accounting scan-

dals and a resulting loss of faith by investors.

Still, beating the indexes is cold comfort. Taking a slightly longer

view, I’m proud that our operating earnings per share are 60 percent higher than

before our merger with Consolidated Natural Gas in early 2000. At the end

of 2002, we’d delivered a 3-year total return of more than 60 percent.

Yet, if you follow Dominion’s share price on a regular basis, you

probably feel as though you stepped off a locomotive onto a roller coaster. Last

year, our shares traded as high as $67.06 and as low as $35.40—a wider range

than we’ve ever seen. We missed our target to deliver a 15 percent total return—

the combination of share price increase and dividend.

Dear Shareholders,

Customers,

Employees—

and Short-term

Traders,Too:

*See page 23 for

a reconciliation of

our non-GAAP

operating earnings to

our GAAP earnings.