Dominion Power 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

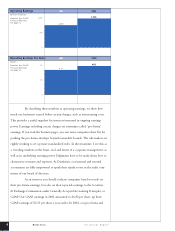

63.4

67.0

60.8

56.4**

Debt to Capitalization

Percent

Per GAAP

Financial Statements.

* The first balance sheet

after our merger with CNG.

** Ratio is reduced to

55.6 percent with inclusion of

$500 million held in escrow

at year end for a January 2003

debt repayment.

Dec. 2000March 2000* Dec. 2001 Dec. 2002

40

80

60

10 Dominion ’02 Annual Report

have done the same. No matter how excited we are about our work, no matter

how bullish we are in the long-term, good leadership is not founded in delusion.

In our case, the agencies wanted us to run our businesses with a more conserva-

tively financed balance sheet.

Fundamental to Dominion’s advantage is our investment-grade rat-

ing—“BBB-plus”—an asset that tells lenders what rate to expect on the money

we borrow. This isn’t mysterious. Think of it as you would your own household

credit rating. Being able to borrow reasonably priced money when we need it is

critical to our ability to grow revenues and profits. It gives us a competitive

advantage when so many others are falling below investment grade.

Last year, we told you we were working to achieve a 55 percent

debt-to-capital ratio. We’re now close to our goal—at 56.4 percent when 2002

ended. We’re even closer—55.6 percent—when you count $500 million we had

escrowed for debt repayment in January 2003. Over time, credit-rating agencies

want us to achieve an even lower ratio. We plan to meet this or any other reason-

able goal and sustain your dividend, because our high investment-grade rating is

our target, not a numeric ratio. First, we’ll expect to retain more earnings. And

we expect to boost our equity account by more than $160 million annually from

customers and employees who increase their investment in Dominion through

dividend reinvestment, employee-matching stock and direct-stock purchase plans.

Our world-class nuclear opera-

tions are a critical competitive

advantage. Dominion’s North

Anna Unit 1 and Surry Unit 1

in 2002 were among the top

12 commercial reactors

world-wide as measured by

their capacity factors, accord-

ing to

Nucleonics Week

,a

division of the McGraw-Hill

Companies. Out of 436

nuclear units reporting, North

Anna Unit 1 and Surry Unit 1

ranked in 9th and 11th place,

respectively.