Dollar General 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

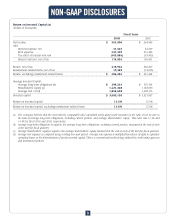

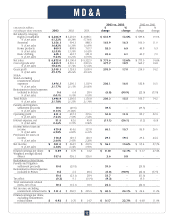

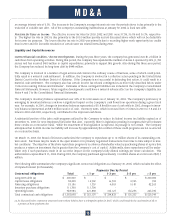

NON-GAAP DISCLOSURES

9

Return on Invested Capital (a)

(Dollars in thousands)

Fiscal Years

________________________________________________________________________________________________________________________________

2003 2002

________________________________________________________________________________________________________________________________

Net income $ 301,000 $ 264,946

Add:

Interest expense, net 31,503 42,639

Rent expense 247,309 216,345

Tax effect of interest and rent (103,886) (93,493)

_______________________________________________________________________________________________________________________________

Interest and rent, net of tax 174,926 165,491

_______________________________________________________________________________________________________________________________

Return, net of tax 475,926 430,437

Restatement-related items, net of tax 10,359 (14,073)

_______________________________________________________________________________________________________________________________

Return, excluding restatement-related items $ 486,285 $ 416,364

_______________________________________________________________________________________________________________________________

Average Invested Capital:

Average long-term obligations (b) $ 309,234 $ 570,764

Shareholders' equity (c) 1,421,308 1,148,030

Average rent x 8 (d) 1,854,608 1,608,713

_______________________________________________________________________________________________________________________________

Invested capital $ 3,585,150 $ 3,327,507

Return on invested capital 13.3% 12.9%

_______________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________

Return on invested capital, excluding restatement-related items 13.6% 12.5%

_______________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________

(a) The Company believes that the most directly comparable ratio calculated solely using GAAP measures is the ratio of net income to

the sum of average long-term obligations, including current portion, and average shareholders' equity. This ratio was 17.4% and

15.4% for fiscal 2003 and 2002, respectively.

(b) Average long-term obligations is equal to the average long-term obligations, including current portion, measured at the end of each

of the last five fiscal quarters.

(c) Average shareholders' equity is equal to the average shareholders' equity measured at the end of each of the last five fiscal quarters.

(d) Average rent expense is computed using a rolling two-year period. Average rent expense is multiplied by a factor of eight to capitalize

operating leases in the determination of pretax invested capital. This is a conventional methodology utilized by credit rating agencies

and investment bankers.