Dish Network 1997 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

5. Long-Term Debt – Continued

F–20

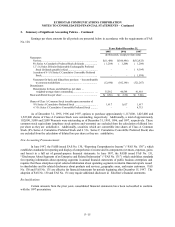

exceed the sum of the difference of cumulative consolidated cash flow (calculated in accordance with the 1997

Notes Indenture) minus 150% of consolidated interest expense of DBS Corp (calculated in accordance with the 1997

Notes Indenture), in each case from July 1, 1997 plus an amount equal to 100% of the aggregate net cash proceeds

received by DBS Corp and its subsidiaries from the issuance or sale of certain equity interests of DBS Corp or

EchoStar.

In the event of a change of control, as defined in the 1997 Notes Indenture, DBS Corp will be required to

make an offer to repurchase all of the 1997 Notes at a purchase price equal to 101% of the aggregate principal

amount thereof, together with accrued and unpaid interest thereon, to the date of repurchase.

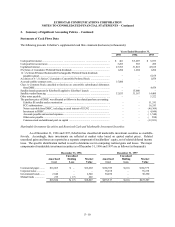

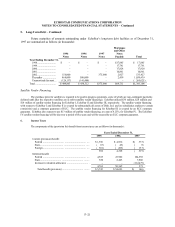

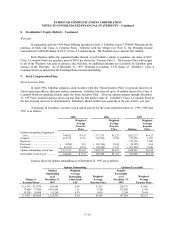

Mortgages and Other Notes Payable

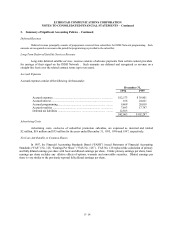

Mortgages and other notes payable consists of the following (in thousands):

December 31,

1996 1997

8.25% note payable for satellite vendor financing for EchoStar I due in equal monthly

installments of $722, including interest, through February 2001 ............................. $ 30,463 $ 24,073

8.25% note payable for satellite vendor financing for EchoStar II due in equal

monthly installments of $562, including interest, through November 2001 .............. 27,161 22,489

8.25% note payable for satellite vendor financing for EchoStar III due in equal

monthly installments of $294, including interest, through October 2002 .................. –13,812

Mortgages and other unsecured notes payable due in installments through April 2009

with interest rates ranging from 8% to 10.5% ................................ ......................... 5,138 9,357

Total ................................ ................................ ................................ ........................ 62,762 69,731

Less current portion ................................ ................................ ................................ .. (11,334) (17,885)

Mortgages and other notes payable, net of current portion ................................ .......... $ 51,428 $ 51,846