Dish Network 1997 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

2. Summary of Significant Accounting Policies – Continued

F–15

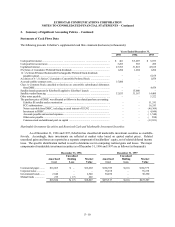

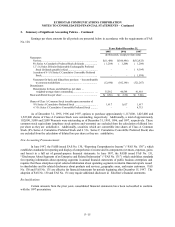

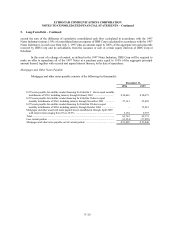

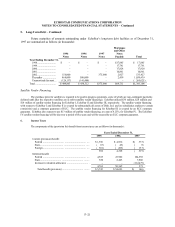

Earnings per share amounts for all periods are presented below in accordance with the requirements of FAS

No. 128.

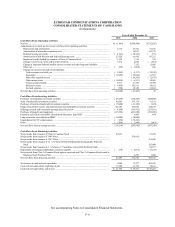

Years Ended December 31,

1995 1996 1997

(In thousands, except per share data)

Numerator:

Net loss................................ ................................ .................. $(11,486) $(100,986) $(312,825)

8% Series A Cumulative Preferred Stock dividends ................... ( 1,204) ( 1,204) ( 1,204)

12 1/8% Series B Senior Redeemable Exchangeable Preferred

Stock dividends payable in-kind ................................ ........... – – ( 6,164)

Accretion of 6 ¾% Series C Cumulative Convertible Preferred

Stock................................ ................................ .................. – – ( 1,074)

Numerator for basic and diluted loss per share − loss attributable

to common stockholders ................................ ...................... (12,690) (102,190) (321,267)

Denominator:

Denominator for basic and diluted loss per share −

weighted-average shares outstanding ................................ .... 35,562 40,548 41,918

Basic and diluted loss per share ................................ .................... $( 0.36) $( 2.52) $( 7.66)

Shares of Class A Common Stock issuable upon conversion of:

8% Series A Cumulative Preferred Stock ................................ . 1,617 1,617 1,617

6 ¾% Series C Cumulative Convertible Preferred Stock .......... – – 4,715

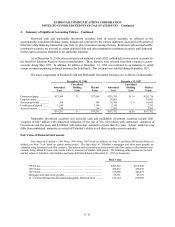

As of December 31, 1995, 1996 and 1997, options to purchase approximately 1,117,000, 1,025,000 and

1,525,000 shares of Class A Common Stock were outstanding, respectively. Additionally, a total of approximately

102,000, 3,000 and 2,000 Warrants were outstanding as of December 31, 1995, 1996, and 1997, respectively. These

common stock equivalents (employee stock options and warrants) are excluded from the calculation of diluted loss

per share as they are antidilutive. Additionally, securities which are convertible into shares of Class A Common

Stock (8% Series A Cumulative Preferred Stock and 6 ¾% Series C Cumulative Convertible Preferred Stock) also

are excluded from the calculation of diluted loss per share as they are antidilutive.

New Accounting Pronouncements

In June 1997, the FASB issued FAS No. 130, “ Reporting Comprehensive Income” (“ FAS No. 130” ), which

establishes standards for reporting and display of comprehensive income and its components (revenues, expenses, gains

and losses) in a full set of general-purpose financial statements. In June 1997, the FASB issued FAS No. 131,

“ Disclosures About Segments of an Enterprise and Related Information” (“ FAS No. 131” ) which establishes standards

for reporting information about operating segments in annual financial statements of public business enterprises and

requires that those enterprises report selected information about operating segments in interim financial reports issued

to shareholders and for related disclosures about products and services, geographic areas, and major customers. FAS

No. 130 and FAS No. 131 are effective for financial statements for periods beginning after December 15, 1997. The

adoption of FAS No. 130 and FAS No. 131 may require additional disclosure in EchoStar’s financial statements.

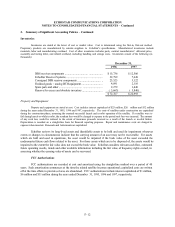

Reclassifications

Certain amounts from the prior years consolidated financial statements have been reclassified to conform

with the 1997 presentation.