Dillard's 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

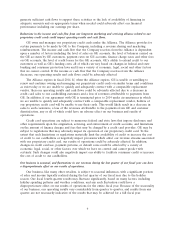

ITEM 6. SELECTED FINANCIAL DATA.

The selected financial data set forth below should be read in conjunction with our ‘‘Management’s

Discussion and Analysis of Financial Condition and Results of Operations’’, our consolidated audited

financial statements and notes thereto and the other information contained elsewhere in this report.

(Dollars in thousands of dollars,

except per share data) 2012(1) 2011 2010 2009 2008

Net sales ................ $ 6,593,169 $ 6,263,600 $ 6,120,961 $ 6,094,948 $ 6,830,543

Percent change .......... 5% 2% 0% ǁ11% ǁ5%

Cost of sales .............. 4,247,108 4,047,269 3,980,873 4,109,618 4,833,791

Percent of sales .......... 64.4% 64.6% 65.0% 67.4% 70.8%

Interest and debt expense, net . 69,596 72,059 73,792 74,003 88,821

Income (loss) before income

taxes and income on (equity

in losses of) joint ventures . . 479,750 396,669 268,716 84,525 (380,005)

Income taxes (benefit) ...... 145,060 (62,518) 84,450 12,690 (140,520)

Income on (equity in losses of)

joint ventures ........... 1,272 4,722 (4,646) (3,304) (1,580)

Net income (loss) .......... 335,962 463,909 179,620 68,531 (241,065)

Net income (loss) per diluted

common share ........... 6.87 8.52 2.67 0.93 (3.25)

Dividends per common share . 5.20 0.19 0.16 0.16 0.16

Book value per common share 41.24 41.50 34.79 31.21 30.65

Average number of diluted

shares outstanding ........ 48,910,946 54,448,065 67,174,163 73,783,960 74,278,461

Accounts receivable ........ 31,519 28,708 25,950 63,222 87,998

Merchandise inventories ..... 1,294,581 1,304,124 1,290,147 1,300,680 1,374,394

Property and equipment, net . . 2,287,015 2,440,266 2,595,514 2,780,837 2,973,151

Total assets ............... 4,048,744 4,306,137 4,374,166 4,606,327 4,745,844

Long-term debt ........... 614,785 614,785 697,246 747,587 757,689

Capital lease obligations ..... 7,524 9,153 11,383 22,422 24,116

Other liabilities ........... 233,492 245,218 205,916 213,471 220,911

Deferred income taxes ...... 255,652 314,598 341,689 349,722 378,348

Subordinated debentures ..... 200,000 200,000 200,000 200,000 200,000

Total stockholders’ equity .... 1,970,175 2,052,019 2,086,720 2,304,103 2,251,115

Number of stores

Opened(2) ............. 002010

Closed ................ 243621

Total—end of year ........ 302 304 308 309 315

(1) Fiscal 2012 contains 53 weeks.

(2) One store in Biloxi, Mississippi, not in operation during fiscal 2007 due to the hurricanes of 2005,

was re-opened in early fiscal 2008.

16