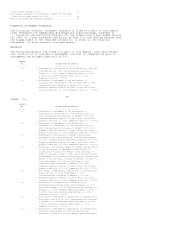

Dell 1998 Annual Report Download - page 37

Download and view the complete annual report

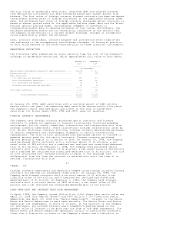

Please find page 37 of the 1998 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. FISCAL YEAR 1999

-------------------------------------

4TH 3RD 2ND 1ST

QUARTER QUARTER QUARTER QUARTER

------- ------- ------- -------

(IN MILLIONS, EXCEPT PER SHARE DATA)

Net revenue............................................. $5,173 $4,818 $4,331 $3,920

Gross margin............................................ 1,161 1,086 985 873

Net income.............................................. 425 384 346 305

Earnings per common share(a)(b):

Basic................................................. $ 0.17 $ 0.15 $ 0.14 $ 0.12

Diluted............................................... $ 0.15 $ 0.14 $ 0.12 $ 0.11

Number of weighted average shares outstanding(b):

Basic................................................. 2,527 2,527 2,529 2,547

Diluted............................................... 2,749 2,762 2,785 2,799

Stock sales prices per share(b):

High.................................................. $50.19 $34.63 $29.56 $21.06

Low................................................... 29.78 20.38 19.31 12.61

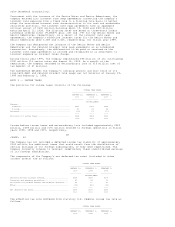

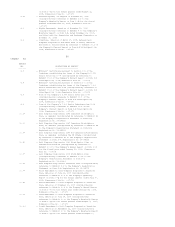

FISCAL YEAR 1998

-------------------------------------

4TH 3RD 2ND 1ST

QUARTER QUARTER QUARTER QUARTER

------- ------- ------- -------

(IN MILLIONS, EXCEPT PER SHARE DATA)

Net revenue............................................. $3,737 $3,188 $2,814 $2,588

Gross margin............................................ 822 718 624 558

Net income.............................................. 285 248 214 198

Earnings per common share(a)(b):

Basic................................................. $ 0.11 $ 0.09 $ 0.08 $ 0.07

Diluted............................................... $ 0.10 $ 0.09 $ 0.07 $ 0.07

Number of weighted average shares outstanding(b):

Basic................................................. 2,564 2,613 2,652 2,699

Diluted............................................... 2,823 2,884 2,915 2,937

Stock sales prices per share(b):

High.................................................. $12.63 $12.98 $10.84 $ 5.75

Low................................................... 8.75 9.13 5.53 3.74

---------------

(a) Earnings per common share are computed independently for each of the

quarters presented. Therefore, the sum of the quarterly per common share

information may not equal the annual earnings per common share.

(b) All share, per share and stock sales price information has been

retroactively restated to reflect the two-for-one splits of common stock.

See Note 6 -- Common Stock.

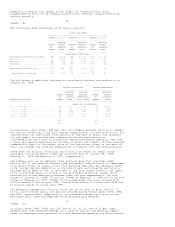

ITEM 9 -- CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

48

<PAGE> 50

PART III

The information called for by Part III of Form 10-K (consisting of Item

10 -- Directors and Executive Officers of the Registrant, Item 11 -- Executive

Compensation, Item 12 -- Security Ownership of Certain Beneficial Owners and

Management and Item 13 -- Certain Relationships and Transactions), to the extent

not set forth herein under "Item 1 -- Business -- Executive Officers of the

Company," is incorporated by reference from the Company's definitive proxy

statement, which will be filed with the Securities and Exchange Commission

within 120 days after the end of the fiscal year to which this Report relates.

PART IV

ITEM 14 -- EXHIBITS, FINANCIAL STATEMENT SCHEDULES AND REPORTS ON FORM 8-K

FINANCIAL STATEMENTS

The following financial statements are filed as a part of this Report under

"Item 8 -- Financial Statements and Supplementary Data":

PAGE

----

Report of Independent Accountants........................... 29

Consolidated Statement of Financial Position at January 29,

1999 and February 1, 1998................................. 30

Consolidated Statement of Income for the three fiscal years

ended January 29, 1999.................................... 31

Consolidated Statement of Cash Flows for the three fiscal