Dell 1998 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1998 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 32

<PAGE> 34

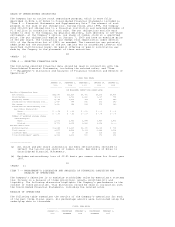

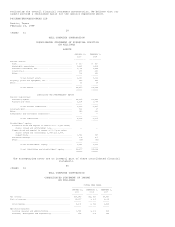

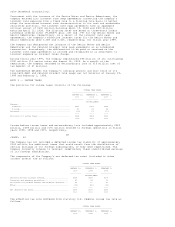

DELL COMPUTER CORPORATION

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(IN MILLIONS)

COMMON STOCK AND

CAPITAL IN EXCESS

OF PAR VALUE

------------------ RETAINED

SHARES AMOUNT EARNINGS OTHER TOTAL

------- ------- -------- ----- -------

Balances at January 28, 1996................ 2,990 $ 430 $ 570 $(27) $ 973

Net income................................ -- -- 518 -- 518

Stock issuance under employee plans,

including tax benefits................. 25 65 -- (18) 47

Purchase and retirement of 246 million

shares................................. (246) (22) (388) -- (410)

Purchase and reissuance of 76 million

shares for employee plans and preferred

stock conversion....................... -- -- (55) (6) (61)

Reclassification of put options........... -- (279) -- -- (279)

Other..................................... -- 1 2 15 18

----- ------ ------- ---- -------

Balances at February 2, 1997................ 2,769 195 647 (36) 806

Net income................................ -- -- 944 -- 944

Stock issuance under employee plans,

including tax benefits................. 84 274 -- (11) 263

Purchase and retirement of 278 million

shares................................. (278) (39) (984) -- (1,023)

Reclassification of put options........... -- 279 -- -- 279

Other..................................... -- 38 -- (14) 24

----- ------ ------- ---- -------

Balances at February 1, 1998................ 2,575 747 607 (61) 1,293

Net income................................ -- -- 1,460 -- 1,460

Stock issuance under employee plans,

including tax benefits................. 117 1,092 -- (7) 1,085

Purchase and retirement of 149 million

shares................................. (149) (60) (1,458) -- (1,518)

Other..................................... -- 2 (3) 2 1

----- ------ ------- ---- -------

Balances at January 29, 1999................ 2,543 $1,781 $ 606 $(66) $ 2,321

===== ====== ======= ==== =======

The accompanying notes are an integral part of these consolidated financial

statements.

33

<PAGE> 35

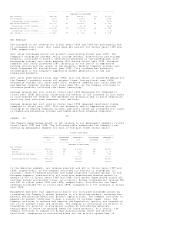

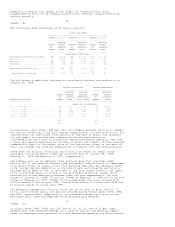

DELL COMPUTER CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 -- DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business -- Dell Computer Corporation, a Delaware corporation

(including its consolidated subsidiaries, the "Company") designs, develops,

manufactures, markets, services and supports a wide range of computer systems,

including desktop computer systems, notebook computers and enterprise systems

(includes servers, workstations and storage products), and also markets

software, peripherals and service and support programs. The Company is managed

on a geographic basis with those geographic segments being the Americas, Europe

and Asia-Pacific and Japan regions. The Company markets and sells its computer

products and services under the Dell(R) brand name directly to its various

customer groups. These customer groups include large corporate, government,

medical and education accounts, as well as small-to-medium businesses and

individuals. The Company conducts operations worldwide through wholly owned

subsidiaries; such operations are primarily concentrated in the North America,

Europe and Asia-Pacific and Japan regions.

Fiscal Year -- During fiscal year 1999, the Company changed its fiscal year from

the 52 or 53 week period ending on the Sunday nearest January 31 to the Friday

nearest January 31. The change in fiscal year had no material effect on the

Company's consolidated financial statements.

Principles of Consolidation -- The accompanying consolidated financial

statements have been prepared in accordance with generally accepted accounting

principles and include the accounts of the Company. All significant intercompany

transactions and balances have been eliminated.

Use of Estimates -- The preparation of financial statements in accordance with

generally accepted accounting principles requires the use of management's