DSW 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 DSW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

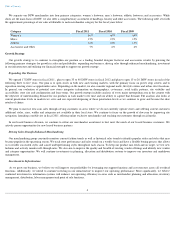

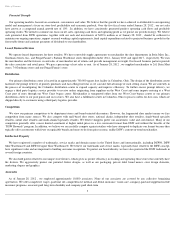

We separate our DSW merchandise into four primary categories: women’s footwear; men’

s footwear; athletic footwear; and accessories. While

shoes are the main focus of DSW, we also offer a complementary assortment of handbags, hosiery and other accessories. The following table sets forth

the approximate percentage of our sales attributable to each merchandise category for the fiscal years below:

Growth Strategy

Our growth strategy is to continue to strengthen our position as a leading branded designer footwear and accessories retailer by pursuing the

following primary strategies for growth in sales and profitability: expanding our business, driving sales through enhanced merchandising, investment

in our infrastructure and utilizing our financial strength to support our growth strategy.

Expanding Our Business

We opened 17 DSW stores in fiscal 2011 , plan to open 35 to 40 DSW stores in fiscal 2012 and plan to open 15 to 20

DSW stores in each of the

following three to five years. Our plan is to open stores in both new and existing markets, with the primary focus on power strip centers and to

reposition existing stores as opportunities arise. Depending on the market, we also consider regional malls, lifestyle centers and urban street locations.

In general, our evaluation of potential new stores integrates information on demographics, co-

tenancy, retail traffic patterns, site visibility and

accessibility, store size and configuration and lease terms. Our growth strategy includes analysis of every major metropolitan area in the country with

the objective of understanding demand for our products in each market over time and our ability to capture that demand. The analysis also looks at

current penetration levels in markets we serve and our expected deepening of those penetration levels as we continue to grow and become the shoe

retailer of choice.

We plan to increase dsw.com sales through serving customers in areas where we do not currently operate stores and offering current customers

additional styles, sizes, widths and categories not available in their local store. We continue to focus on the growth of dsw.com by improving site

navigation, launching a mobile site in fiscal 2011, offering online exclusive merchandise and reaching our customers through social media.

In our leased business division, we continue to refine our merchandise assortment to best meet the needs of our leased business customers. We

actively pursue opportunities for new leased business partners.

Driving Sales through Enhanced Merchandising

Our merchandising group constantly monitors current fashion trends as well as historical sales trends to identify popular styles and styles that may

become popular in the upcoming season. We track store performance and sales trends on a weekly basis and have a flexible buying process that allows

us to reorder successful styles and cancel underperforming styles throughout each season. To keep our product mix fresh and on target, we test new

fashions and actively monitor sell-

through rates. We also aim to improve the quality and breadth of existing vendor offerings and identify new vendor

and category opportunities. We will continue investments in planning, allocation and distribution systems to improve our inventory and markdown

management.

Investment in Infrastructure

As we grow our business, we believe we will improve our profitability by leveraging our support functions and cost structure across all overhead

functions. Additionally, we intend to continue investing in our infrastructure to improve our operating performance. Most significantly, we believe

continued investment in information systems will enhance our operating efficiency in areas such as merchandise planning and allocation, inventory

management, distribution, labor management and point of sale functions.

4

Category

Fiscal 2011

Fiscal 2010

Fiscal 2009

Women’s

66

%

66

%

66

%

Men’s

15

%

15

%

15

%

Athletic

12

%

13

%

13

%

Accessories and Other

7

%

6

%

6

%