CompUSA 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement and

2009 Annual Report to Stockholders

Dear Fellow Stockholders,

In 2009 Systemax delivered all-time record revenues and solid bottom line results despite a business environment that was the

most challenging in several generations. We did this by executing on sales growth opportunities that were available to Systemax

as a financially strong company, while rationalizing our expenses with focused cost reduction initiatives that will not impact our

future growth. Throughout the year we strategically invested in areas that support our long-term growth strategy, including

investing in our sales force and B2B operations, improving our e-Commerce sites, enhancing our in-store consumer experience

and expanding our retail store footprint.

History has proven that challenging markets present unprecedented growth opportunities – and that was certainly the case for

Systemax in 2009. In May we acquired one of the most iconic brands in U.S. electronics retailing – the Circuit City brand and

select assets (certain trademarks, trade names, internet domain names including www.CircuitCity.com, customer lists and

information, and other intangible assets of Circuit City's e-Commerce business). This acquisition, coupled with our expanding

CompUSA store footprint, our innovative Retail 2.0 initiative and our industry leading TigerDirect e-Commerce business,

cemented our position as a leader in the consumer electronics retail market. Additionally, in September we acquired WStore

Europe, a supplier of business IT products, which significantly strengthened our France and U.K. operations. We believe these

strategic steps further strengthen our business and ability to drive future growth.

Below I outline our 2009 financial results as well as the progress we made on a number of key initiatives in our business segments.

Consolidated Result For Fiscal 2009

• Grew revenues by 4% to over $3.2 billion, an all time record;

• Delivered operating income of $73 million, and net income of $46 million, or $1.24 per diluted share;

• Paid a special dividend of $0.75 per share;

• Maintained high working capital of more than $252 million as of December 31, 2009;

• Increased short-term debt by approximately $15 million primarily revolving debt assumed as part of the WStore

acquisition;

• Maintained high availability of liquidity with an undrawn credit facility of $120 million and total cash and available

liquidity of over $150 million; and

• Grew total stockholders’ equity to a record $365 million.

While these results would be characterized as very good in a normalized economy, they are most impressive given the prevailing

economic environment. Systemax continues to prove itself to be a strong company, with highly recognized and valuable brands

and a loyal customer base.

Consumer Channels

On the consumer front, our operations performed well, with channel sales up over 12% compared to 2008. This growth was aided

by our expanding retail store footprint, one of our key growth initiatives. At the end of the year, we had 34 retail stores open and

operating in North America. During 2009 we opened five new CompUSA stores and entered several important markets, including

Delaware and Houston, Texas. Our strategy is to expand in the large metropolitan areas where we already maintain a presence and

in new markets that can support standalone destination stores. Our philosophy has been and will continue to be about opening

stores at a pace and in markets that will add to our long-term growth and profitability. We also continued to innovate and rollout

the Retail 2.0 platform – our pioneering concept, which empowers customers and revolutionizes how they shop for consumer

electronics – to the majority of our stores. Customer response to Retail 2.0 has been very positive, as this shopping format enhances

the in-store experience with interactive data and media previously only available online.

Table of contents

-

Page 1

..., In 2009 Systemax delivered all-time record revenues and solid bottom line results despite a business environment that was the most challenging in several generations. We did this by executing on sales growth opportunities that were available to Systemax as a financially strong company, while... -

Page 2

...significant growth opportunities for Systemax, as IT spending in the enterprise sector improves. In anticipation of this recovery, in 2009 we opened two new sales offices and we are selectively opening small B2B offices within a number of retail stores in our most attractive SMB markets. Thus far we... -

Page 3

... the New York Stock Exchange under the symbol SYX. CORPORATE GOVERNANCE Copies of the Company's 2009 Annual Report on Form 10-K, Proxy Statement for the 2010 Annual Meeting, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the Securities and Exchange Commission are available... -

Page 4

... under Rule 14a-12 Systemax Inc. (Name of Registrant as Specified in Its Charter Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): |x| |_| No fee required Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and... -

Page 5

... invited to attend the 2010 Annual Meeting of Stockholders of Systemax Inc. (the "Company") which will be held at the Company' s corporate offices, located at 11 Harbor Park Drive, Port Washington, New York at 2:00 p.m. on Friday, June 11, 2010. Your Board of Directors looks forward to greeting... -

Page 6

...of Systemax Inc. (the "Company") will be held at the Company' s offices, 11 Harbor Park Drive, Port Washington, New York, on Friday, June 11, 2010 at 2:00 p.m. for the following purposes, as more fully described in the accompanying proxy statement: 1. 2. 3. To elect the Company' s Board of Directors... -

Page 7

...NON-MANAGEMENT DIRECTORS...CORPORATE GOVERNANCE GUIDELINES...CORPORATE ETHICS POLICY...COMMUNICATIONS WITH DIRECTORS...DIRECTORS ATTENDANCE AT ANNUAL MEETINGS...BOARD MEETINGS...COMMITTEES OF THE BOARD...BOARD LEADERSHIP STRUCTURE...RISK OVERSIGHT...REPORT OF THE AUDIT COMMITTEE...EXECUTIVE OFFICERS... -

Page 8

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 11, 2010. Our Proxy Statement and Annual Report are available online at: www.proxyvote.com 5 -

Page 9

...of Directors (the "Board") of Systemax Inc., a Delaware corporation (the "Company"), for the 2010 Annual Meeting of Stockholders of the Company to be held on June 11, 2010 (the "Annual Meeting"). The Company has made the proxy materials available to stockholders of record as of the close of business... -

Page 10

...Section 219 of the Delaware General Corporation Law shall be available for inspection for any purpose germane to the Annual Meeting during normal business hours at the offices of the Company at least ten days prior to the Annual Meeting. On April 14, 2010, the record date, there were outstanding and... -

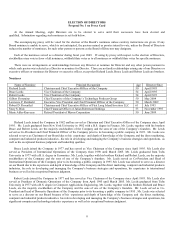

Page 11

... public company in 1995. Mr. Leeds was selected to serve as a director on our Board due to his experience and depth of knowledge of the Company and the direct marketing, computer and industrial products industries, his role in developing and managing the Company' s business strategies and operations... -

Page 12

... store retail sales. Lawrence P. Reinhold joined the Company in January 2007 and has served as Executive Vice President and Chief Financial Officer of the Company since that date. In addition, Mr. Reinhold has served as a Director since March 2009. Mr. Reinhold was a business, finance and accounting... -

Page 13

... of our website at www.systemax.com. The Corporate Governance Guidelines were amended in April 2010. Corporate Ethics Policy The Company has adopted a Corporate Ethics Policy that applies to all employees of the Company, including the Company' s Chief Executive Officer, Chief Financial Officer and... -

Page 14

... or the nonmanagement members of the Board as a group should address their inquires by mail sent to the attention of Robert D. Rosenthal, Lead Independent Director, at the Company' s principal executive office located at 11 Harbor Park Drive, Port Washington, NY 11050. All communications will be... -

Page 15

... Charter is available on the Company' s website (www.systemax.com). Stockholder Nominations for Director Stockholders may propose candidates for Board membership by writing to Systemax Inc., Attention: Nominating/Corporate Governance Committee, 11 Harbor Park Drive, Port Washington, NY 11050 so... -

Page 16

... employees in the context of how such policies affect and promote the Company' s risk management goals and objectives. The Compensation Committee Charter was last amended in April 2010. The Compensation Committee Charter is available on the Company' s website (www.systemax.com). Executive Committee... -

Page 17

... Director may specifically request the inclusion of certain material; (d) recommend to the Chairman the retention of consultants who report directly to the Board; (e) assist the Board and the Company' s officers in assuring compliance with and implementation of the corporate governance policies... -

Page 18

... Audit Committee will consider risk management issues as part of its quarterly agenda. We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach. 15 -

Page 19

... Registered Public Accounting Firm, to the Committee, the Audit Committee recommended to the Board that the financial statements of the Company for fiscal year 2009 as audited by Ernst & Young LLP be included in the Company' s Annual Report on Form 10-K filed with the Securities and Exchange... -

Page 20

... certain information with respect to the executive officers of the Company as of April 22, 2010. Name Richard Leeds Bruce Leeds Robert Leeds Gilbert Fiorentino Lawrence Reinhold Thomas Axmacher Curt Rush Benjamin White Age 50 54 54 50 50 51 56 41 Office Chairman and Chief Executive Officer; Director... -

Page 21

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table provides certain information regarding the beneficial ownership of the Shares as of April 22, 2010, by (i) each of the Directors, (ii) each of the named executive officers listed in the summary compensation table, (... -

Page 22

... all such filing requirements for fiscal year 2009, except for the inadvertent failure to timely file Form 4' s on behalf of certain executive officers and/or directors as follows: a Form 4 filed on April 13, 2009 on behalf of Gilbert Fiorentino concerning two transactions; a Form 4 filed on June... -

Page 23

...the Company' s Corporate Ethics Policy, all officers, Directors and employees (collectively the "Company ...benefits as a result of his or her position in the Company. Company Representatives cannot allow any consideration such as the receipt of gifts or financial interests in other businesses... -

Page 24

EQUITY COMPENSATION PLAN INFORMATION Information for our equity compensation plans in effect as of the end of fiscal year 2009 is as follows: (c) Number of securities remaining available for future issuance under Number of securities Weighted-average to exercise price of equity compensation plans be... -

Page 25

...and long-term financial and business objectives, promoting integrity and good corporate governance, and motivating our executive officers to manage the Company in a manner that will enhance its growth and financial performance for the benefit of our stockholders, customers and employees. Accordingly... -

Page 26

... respective employment agreement. Cash Bonuses - Incentive cash compensation of the Company' s NEO' s under the Systemax Executive Incentive Plan described below is based primarily upon an evaluation of Company performance as it relates to three general business areas: • Operational and Financial... -

Page 27

... Stock Incentive Plan for Non-Employee Directors, and the 2010 Long Term Incentive Plan, if approved by stockholders at the annual meeting) and the Systemax Executive Incentive Plan are structured to permit awards under such plans to qualify as performance-based compensation and to maximize the tax... -

Page 28

...plan, executive officers of the Company are eligible to receive an annual cash bonus, based on the Company' s achievement of certain performance-based goals established by the Compensation Committee relating to Operational and Financial Performance, Strategic Accomplishments and Corporate Governance... -

Page 29

... the 2009 Bonus Plan was based on (i) the Company' s Technology Products Group achieving certain earnings targets; (ii) the Company successfully implementing technology enhancements in certain retail stores; and (iii) the successful implementation of certain management financial reporting technology... -

Page 30

... of the Board. Mr. Fiorentino' s 2009 bonus was determined under the 2009 Bonus Plan as a specified percentage of the worldwide EBIT of the Company' s technology products business, and also took into account achievement of the retail store and technology enhancement and information technology goals... -

Page 31

... Systemax 2010 NEO Cash Bonus Plan In March 2010, pursuant to the 2010 Long Term Incentive Plan adopted by the Board of Directors (subject to stockholder approval at the Annual Meeting), our Compensation Committee, with input from our Chief Executive Officer, established our 2010 NEO Cash Bonus Plan... -

Page 32

...of our named executive officers. The 2010 Bonus Plan imposes a cap on the total bonus that could be payable to any executive at 200% of the target base case bonus. The Compensation Committee has the discretion to adjust financial targets based on such events as acquisitions or other one time charges... -

Page 33

.... The Company does not employ any member of the Compensation Committee and no member of the Compensation Committee has ever served as an officer of the Company. In addition, none of our directors has any interlocking relationship with our Board, Compensation Committee or executive officers that... -

Page 34

... and 2009: Name and Principal Position Richard Leeds Chairman and Chief Executive Officer Bruce Leeds Vice Chairman Robert Leeds Vice Chairman Gilbert Fiorentino Chief Executive - Technology Products Group Lawrence Reinhold Executive Vice President and Chief Financial Officer Stock Awards ($) Option... -

Page 35

... equivalent payment and (ii) $25,195 in auto-related expense and Company 401(k) contributions. (7) Includes $25,703 in auto-related expenses and Company 401(k) contributions. GRANTS OF PLAN-BASED AWARDS The following table sets forth the stock options granted to our named executive officers in 2009... -

Page 36

...at the end of fiscal year 2009. The market value of the stock award is based on the closing price of one share of our common stock as of December 31, 2009, which was $15.71. Name (a) Gilbert Fiorentino Option Awards Number of Number of Securities Securities Underlying Underlying Option Unexercised... -

Page 37

... vesting of the restricted stock unit, determined by the market value of the underlying shares of common stock on the vesting date. POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL Gilbert Fiorentino Pursuant to Mr. Fiorentino' s employment agreement, the Company may terminate the agreement... -

Page 38

... the closing price of our common stock on December 31, 2009. These amounts are estimates and the actual amounts to be paid can only be determined at the time of the termination of the officer' s employment. Value of Accelerated Vesting of Stock Awards ($) 1,571,000 (2) - Name Gilbert Fiorentino... -

Page 39

...Note 8 to our audited consolidated financial statements, included in our Annual Report on Form 10K for fiscal year 2009. (3) Ms. Adler-Kravecas became a director in June 2009. Ms. Leven was a director of the Company until June 2009; in connection with her resignation from the Board, she entered into... -

Page 40

...than the number of shares delivered in exercise of such options. Shares Available Under the Plan Subject to adjustment in the case of certain corporate changes, awards may be granted under the 2010 Long Term Plan with respect to an aggregate of 7,500,000 shares of the Company' s Common Stock. During... -

Page 41

... adjust the number of shares of Common Stock available for grant under the Plan and any shall adjust outstanding Awards (including the number of shares subject to the Awards and the exercise price of stock options) in order to prevent dilution or enlargement of the benefits or potential benefits... -

Page 42

... under the Plan shall be determined in a manner consistent with the methods used in the Company' s Forms 10-K and 10-Q, except that adjustments will be made for certain items, including special, unusual or non-recurring items, acquisitions and dispositions and changes in accounting principles. 39 -

Page 43

... three months prior to the date of exercise (one year prior to the date of exercise if the grantee is disabled, as that term is defined in the Code). The excess of the fair market value of the Stock at the time of the exercise of an incentive stock option over the exercise price is an adjustment... -

Page 44

.... NEW PLAN BENEFITS 2010 Long Term Incentive Plan Name and Position Richard Leeds: Chairman and Chief Executive Officer Bruce Leeds: Vice Chairman Robert Leeds: Vice Chairman Gilbert Fiorentino: Chief Executive Technology Products Group Lawrence Reinhold: Executive Vice President and Chief Financial... -

Page 45

... Group Non-Executive Director Group Non-Executive Officer Employee Group 5,375,000 - - (1) Based on achieving 2010 financial and non-financial goals at 100% base case target levels under the 2010 Bonus Plan. See "2010 NEO Cash Bonus Plan" for additional discussion regarding the determination... -

Page 46

...accountants for the Company for fiscal year 2010. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting and to be available to respond to appropriate questions. They will have an opportunity to make a statement if they so desire. Principal Accounting Fees and Services... -

Page 47

...web site or any report the Company files with, or furnishes to, the SEC is not part of this proxy statement. The Board has adopted the following corporate governance documents (the "Corporate Governance Documents"): ฀Corporate Ethics Policy for officers, Directors and employees; ฀Charter for the... -

Page 48

In accordance with the corporate governance rules of the New York Stock Exchange, each of the Corporate Governance Documents is available on the Company' s Company web site (www.systemax.com). 45 -

Page 49

Annex A SYSTEMAX INC. 2010 Long-Term Incentive Plan SECTION 1 Purpose The purposes of this Systemax Inc. 2010 Long Term Incentive Plan are to promote the interests of Systemax Inc. and its stockholders by (i) attracting and retaining exceptional executive personnel and other key employees, ... -

Page 50

.... "Person" shall mean any individual, corporation, partnership, association, joint-stock company, trust, unincorporated organization, government or political subdivision thereof or other entity. "Plan" shall mean this Systemax 2010 Long-Term Incentive Plan. "Restoration Option" shall mean an Option... -

Page 51

...and binding upon all Persons, including the Company, and Affiliate, and Participant, any holder or beneficiary of any Award, any shareholder and any Employee. SECTION 4 Shares Available for Awards (a) Subject to adjustment as provided in Section 12, the number of Shares with respect to which Awards... -

Page 52

... Option. Incentive Stock Options only may be granted to employees of the Company. (b) Exercise Price. The Committee in it sole discretion shall establish the exercise price at the time each option is granted, but in no event shall the exercise price be less than the Fair Market Value of a share on... -

Page 53

...the terms and conditions of the Plan and the applicable Award Agreement which would have applied to the Participant. Special Rules for Incentive Stock Options. No Option that remains exercisable for more than three months following a Participant' s termination of employment for any reason other than... -

Page 54

... as of the date of termination. (d) Payment. (i) Upon vesting of a Restricted Stock Unit, the Company shall pay the holder of the Restricted Stock Unit the Fair Market Value of a Share on the date of vesting. Such payment shall be in cash, other securities or other property, as determined in the... -

Page 55

...special, unusual or non-recurring items, events or circumstances affecting the Company or the financial statements of the Company; all items of gain, loss or expense for a fiscal year that are related to (i) the disposal of a business or discontinued operations or (ii) the operations of any business... -

Page 56

...13 Adjustments (a) Shares Available for Grants. In the event of any change in the number of Shares outstanding by reason of any stock dividend or split, reverse stock split, recapitalization, merger, consolidation, combination or exchange of shares or similar corporate change, the maximum number of... -

Page 57

... payment of a stock dividend, or any other increase or decrease in the number of such shares effected without receipt of consideration by the Company, the Committee shall proportionally adjust the number of Shares subject to each outstanding Option and Stock Appreciation Right and the exercise price... -

Page 58

... class, the payment of any dividend, any increase or decrease in the number of shares of stock of any class or any dissolution, liquidation, merger or consolidation of the Company or any other corporation. Except as expressly provided in the Plan, no issuance by the Company of shares of stock of any... -

Page 59

securities, other Awards or other property) of any applicable withholding taxes in respect of an Award, its exercise, or any payment or transfer under an Award or under the Plan and to take such other action as may be necessary in the opinion of the company to satisfy all obligations for the payment... -

Page 60

... option granted hereunder remains outstanding. Unless otherwise expressly provided in the Plan or an applicable Award Agreement, any Award granted hereunder may, and the authority of the Board or the Committee to amend, alter, adjust, suspend, discontinue, or terminate any such Award or to waive any... -

Page 61

...) 11 Harbor Park Drive Port Washington, New York 11050 (Address of principal executive offices, including zip code) Registrant' s telephone number, including area code: (516) 608-7000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which... -

Page 62

...10. Item 11. Item 12. Item 13. Item 14. Part IV Item 15. Business General Products Sales and Marketing Customer Service, Order Fulfillment and Support Suppliers Competition and Other Market Factors Employees Environmental Matters Financial Information About Foreign and Domestic Operations Available... -

Page 63

...in the computer products retail industry, especially relating to the distribution and sale of such products timely availability of existing and new products risks associated with delivery of merchandise to customers by utilizing common delivery services the effect on us of volatility in the price of... -

Page 64

Item 1. Business. General Systemax is primarily a direct marketer of brand name and private label products. Our operations are organized in three reportable business segments - Technology Products, Industrial Products and Software Solutions. Our Technology Products segment sells computers, computer ... -

Page 65

... our sales to individual consumers by using retail outlet stores. Over the past several years, the Company has expanded its brick and mortar retail operations through the CompUSA acquisition and by opening new stores. We have established a multi-faceted direct marketing system to business customers... -

Page 66

... a disruption in phone service. Certain of our products are carried in stock, and orders for such products are fulfilled on a timely basis directly from our distribution centers, typically within one the day of the order. We operate out of multiple sales and distribution facilities in North America... -

Page 67

...computer and office supply superstores. Timely introduction of new products or product features are critical elements to remaining competitive. Other competitive factors include product performance, quality and reliability, technical support and customer service, marketing and distribution and price... -

Page 68

...on our website is not part of this or any other report we file with, or furnish to, the SEC. Our Board of Directors has adopted the following corporate governance documents with respect to the Company (the "Corporate Governance Documents Corporate Ethics Policy for officers, directors and employees... -

Page 69

... the future. Competitive factors include price, availability, service and support. We compete with a wide variety of other resellers and retailers, as well as manufacturers. Many of our competitors are larger companies with greater financial, marketing and product development resources than ours. In... -

Page 70

...our systems, or the failure of our security/safety measures to protect our systems and websites, could have an adverse affect on our results of operations. We rely on a variety of information and telecommunications systems in our operations. Our success is dependent in large part on the accuracy and... -

Page 71

...currency exchange rates Difficulties with staffing and managing international operations Unexpected changes in regulatory requirements For example, we currently have operations located in numerous countries outside the United States, and non-U.S. sales (Europe, Canada and Puerto Rico) accounted for... -

Page 72

... cost reductions or new product line expansion to address gross profit and operating margin pressures; failure to mitigate these pressures could adversely affect our operating results and financial condition. The computer and consumer electronics industry is highly price competitive and gross... -

Page 73

... card information records. In processing our sales orders we often collect personal information and credit card information from our customers. The Company has privacy and data security policies in place which are designed to prevent security breaches, however, if a third party or a rogue employee... -

Page 74

...location, administrative offices, telephone call centers, distribution centers, computer assembly and retail stores. Certain facilities handle multiple functions. Most of our facilities are leased; certain are owned by the Company. North America As of December 31, 2009 we have 6 distribution centers... -

Page 75

... 12.06 14.04 8.75 On January 2, 2010, the last reported sale price of our common stock on the New York Stock Exchange was $15.71 per share. As of January 2, 2010, we had 215 shareholders of record. On November 16, 2009, the Company' s Board of Directors declared a special dividend of $.75 per share... -

Page 76

...accounting guidance concerning participating securities Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. Overview Systemax is primarily a direct marketer of brand name and private label products. Our operations are organized in three reportable business... -

Page 77

... ecommerce assets owned by Circuit City Stores, Inc. and Circuit City Stores West Coast, Inc for $14.0 million in cash plus a sales-based royalty over 30 months (See Note 2 to the Consolidated Financial Statements included in Item 15 of this Form 10-K). Critical Accounting Policies and Estimates Our... -

Page 78

... of operations. Recently Adopted and Newly Issued Accounting Pronouncements Public companies in the United States are subject to the accounting and reporting requirements of various authorities, including the Financial Accounting Standards Board ("FASB") and the Securities and Exchange Commission... -

Page 79

... the consolidated financial statements included herein Sales increase of 4.4% to $3.2 billion in 2009 over 2008. Completed CircuitCity.com asset purchase and WStore Europe SA and Subsidiaries ("WStore") stock purchase. Opened five new retail stores. Exited unprofitable Software Solutions segment... -

Page 80

... $120.9 million. Adjusting for the impact of the number of weeks, Technology products sales increased 8.3% for the year. North American technology products sales increased 14.3% in 2009 compared to 2008 benefiting from the opening of 5 retail stores and the Circuit City acquisition which contributed... -

Page 81

.... Industrial products operating margin decreased in 2009 compared to 2008 due to the slowdown in sales coupled with additional information technology staffing and other costs for the support of new products added and the newly launched e-commerce website. Software solutions segment operating margin... -

Page 82

... (3,010) Our primary liquidity needs are to support working capital requirements in our business, including working capital for new retail stores, to fund capital expenditures, to fund the payment of interest on outstanding debt, to fund special dividends declared by our Board of Directors and for... -

Page 83

...City assets, payment of $27.6 million for a special dividend, the $4.5 million cash purchase of WStore and common stock repurchases of $1.2 million. Inventory balances increased related to warehousing additional products as a result in the growth of sales and the stocking our retail stores. Accounts... -

Page 84

... needs to support our growth and expansion plans, continued investment in upgrading and expanding our technological capabilities and information technology infrastructure, opening of new retail stores, and in building out and expanding our distribution center facilities and inventory systems. These... -

Page 85

... our liquidity or the availability of capital resources. The Company currently leases its facility in Port Washington, NY from Addwin Realty Associates, an entity owned by Richard Leeds, Bruce Leeds, and Robert Leeds, senior executives, Directors and controlling shareholders of the Company. Item 7A... -

Page 86

... or timely detection of unauthorized acquisition, use, or disposition of the Company' s assets that could have a material effect on the Company' s financial statements. Management, including the Company' s Chief Executive Officer and Chief Financial Officer, does not expect that the Company... -

Page 87

PART III Item 10. Directors, Executive Officers and Corporate Governance. The information required by Item 10 of Part III is hereby incorporated by reference to the Company' s Proxy Statement for the 2010 Annual Meeting of Stockholders. (the "Proxy Statement"). Item 11. Executive Compensation. The ... -

Page 88

...and Hamilton Business Center, LLC (Buford, Georgia facility) (incorporated by reference to the Company' s annual report on Form 10-K for the year ended December 31, 2005) Employment Agreement entered into on October 12, 2004 but effective as of June 1, 2004 between the Company and Gilbert Fiorentino... -

Page 89

..., 2009, by and among Systemax Inc., as Buyer and Circuit City Stores West Coast, Inc. and Circuit City Stores, Inc, as Sellers (incorporated by reference to the Company' s report on Form 8-K dated May 20, 2009). Corporate Ethics Policy for Officers, Directors and Employees (revised as of March, 2010... -

Page 90

..., Chief Financial Officer and Director (Principal Financial Officer) Vice President and Controller (Principal Accounting Officer) Chief Executive, Technology Products Group and Director Director March 18, 2010 /s/ THOMAS AXMACHER Thomas Axmacher /s/ GILBERT FIORENTINO Gilbert Fiorentino /s/ ROBERT... -

Page 91

...in Financial Accounting Standards Board ("FASB") Statement No. 141(R), "Business Combinations" (codified in FASB Accounting Standards Codification Topic 805, "Business Combinations") on January 1, 2009. We also have audited, in accordance with the standards of the Public Company Accounting Oversight... -

Page 92

... have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Systemax Inc. as of December 31, 2009 and 2008 and the related consolidated statements of operations, shareholders' equity, and cash flows for each of... -

Page 93

SYSTEMAX INC. CONSOLIDATED BALANCE SHEETS (in thousands, except for share data) December 31, 2009 2008 ASSETS: Current assets: Cash Accounts receivable, net of allowances of $22,532 and $17,523 Inventories Prepaid expenses and other current assets Deferred income taxes Total current assets Property... -

Page 94

SYSTEMAX INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) 2009 Year Ended December 31, 2008 2007 Net sales Cost of sales Gross profit Selling, general and administrative expenses Operating income Foreign currency exchange loss (gain) Interest and other income, net ... -

Page 95

... income taxes Provision for returns and doubtful accounts Compensation expense related to equity compensation plans Excess tax benefit from exercises of stock options Loss (gain) on dispositions and abandonment Changes in operating assets and liabilities: Accounts receivable Inventories Prepaid... -

Page 96

SYSTEMAX INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in thousands) Common Stock Number of Shares Outstanding Balances, January 1, 2007 Stock-based compensation expense Issuance of restricted stock Exercise of stock options Income tax benefit on stock-based compensation Cumulative effect of... -

Page 97

... and liabilities, average exchange rates for the statement of operations items and historical rates for equity accounts. Translation gains or losses are recorded as a separate component of shareholders' equity. Cash - The Company considers amounts held in money market accounts and other short-term... -

Page 98

...for an unrecognized tax benefit is established or is required to pay amounts in excess of the liability, the Company' s effective tax rate in a given financial statement period may be affected. Revenue Recognition and Accounts Receivable - The Company recognizes sales of products, including shipping... -

Page 99

..., including the Financial Accounting Standards Board ("FASB") and the Securities and Exchange Commission ("SEC"). These authorities issue numerous pronouncements, most of which are not applicable to the Company' s current or reasonably foreseeable operating structure. Below are the new authoritative... -

Page 100

... retail leases from CompUSA Inc. and certain fixtures located at these locations. This acquisition accelerated the Company' s planned expansion into the retail market place in North America and Puerto Rico. The Company has recorded assets of approximately $17.0 million for Trademarks and Trade Names... -

Page 101

... compliance with at December 31, 2009. The Company' s WStore UK subsidiary maintains a £2 million secured revolving credit agreement with a financial institution in the United Kingdom which is secured by WStore UK' s accounts receivable balances. Available amounts for borrowing under this facility... -

Page 102

... thousands): 2010 2011 2012 2013 2014 Maturities 7. BUSINESS EXIT COSTS $ 1,029 $ 737 $ 307 $ 150 - The Company announced plans to exit its Software Solutions segment, in the second quarter of 2009, as the result of economic conditions and difficulties in marketing the segment' s products... -

Page 103

... awards reduce stock options otherwise available for future grant. A total of 1,410,984 options and 400,000 restricted stock units were outstanding under this plan as of December 31, 2009. The 2006 Stock Incentive Plan For Non-Employee Directors - This plan, adopted by the Company' s stockholders on... -

Page 104

... between the closing stock price on the last day of trading in 2009 and the exercise price) that would have been received by the option holders had all options been exercised on December 31, 2009. This value will change based on the fair market value of the Company' s common stock. The following... -

Page 105

...in valuation allowances, net of federal tax benefit Foreign taxes at rates different from the U.S. rate Changes in valuation allowances for foreign deferred tax assets Decrease in tax reserves Refunds- prior years Non-deductible items Adjustment for prior year taxes Other items, net $ 25,580 2,402... -

Page 106

... to pay amounts in excess of accruals, our effective tax rate in a given financial statement period could be affected. Accrued interest and penalties related to unrecognized tax benefits are recorded in income tax expense in the current year. The following table details activity of the Company... -

Page 107

... at various dates through October 2026. The Company currently leases its headquarters office/warehouse facility in New York from an entity owned by the Company' s three principal shareholders and senior executive officers. The Company believes that these payments were no higher than would be paid to... -

Page 108

... as those of the Company described in Note 1. Financial information relating to the Company' s operations by reportable segment was as follows (in thousands): 2009 Year Ended December 31, 2008 2007 Net Sales: Technology Products Industrial Products Software Solutions Consolidated Depreciation and... -

Page 109

12. QUARTERLY FINANCIAL DATA (UNAUDITED) Quarterly financial data is as follows (in thousands, except for per share amounts): First Quarter Second Quarter Third Quarter Fourth Quarter 2009: Net sales Gross profit Net income Net income per common share: Basic Diluted 2008: Net sales Gross profit Net... -

Page 110

... resulting from changes in deferred tax assets due to changes in tax laws. (2) Other relates to WStore acquisition allowance for sales returns and doubtful accounts as of acquisition date. (3) Included in other is allowances recorded for deferred tax assets and net operating losses acquired in the... -

Page 111

... and report financial information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant' s internal control over financial reporting. Date: March 18, 2010 /s/ RICHARD LEEDS Richard Leeds, Chief Executive Officer 51 -

Page 112

...' s ability to record, process, summarize and report financial information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant' s internal control over financial reporting. Date: March 18, 2010 /s/ LAWRENCE P. REINHOLD... -

Page 113

... Exchange Act of 1934 (15 U.S.C. 78m or 78 (o)(d)) and that the information contained in such Form 10-K fairly presents, in all material respects, the financial condition and results of operations of Systemax Inc. Dated: March 18, 2010 /s/ RICHARD LEEDS Richard Leeds, Chief Executive Officer... -

Page 114

...Park Drive Port Washington, NY 11050 516- 608-7000 ext. 7181 Email: [email protected] Web Site: http://www.systemax.com STOCK EXCHANGE: The Company's shares are traded on the New York Stock Exchange under the symbol SYX. INDEPENDENT AUDITORS: ERNST & YOUNG LLP New York, NY CORPORATE EXECUTIVE... -

Page 115

... statements in this Annual Report constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include known and unknown risks, uncertainties and other factors as set forth within the Form 10K forming a part... -

Page 116

2009 Annual Report