Cogeco 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 COGECO CABLE INC. 2012 Management’s Discussion and Analysis (MD&A)

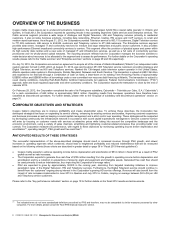

KEY PERFORMANCE INDICATORS

Cogeco Cable is dedicated to increasing shareholder value and consequently focuses on optimizing profitability while efficiently managing its

use of capital without jeopardizing future growth. The following key performance indicators are closely monitored to ensure that business

strategies and objectives are closely aligned with shareholder value creation. The key performance indicators are not measurements in

accordance with IFRS and should not be considered an alternative to other measures of performance in accordance with IFRS. The

Corporation’s method of calculating key performance indicators may differ from other companies and, accordingly, these key performance

indicators may not be comparable to similar measures presented by other companies.

Original projections

October 25, 2011(1)

Fiscal 2012

Revised projections

July 11, 2012(1)

Fiscal 2012

Actual

Fiscal 2012

Achievement

of the revised

projections(2)

Fiscal 2012

(in millions of dollars, except percentages and PSU growth) $$$

Financial guidelines

Operating income before depreciation and amortization 600 585 589 Achieved

Operating margin(3) 41.2% 45.7% 46.1% Achieved

Free cash flow 100 90 66 Under-achieved

PSU growth 90,000(4) 72,000 71,664 Achieved

(1) The original projections included Cabovisão, which was sold on February 29, 2012. Revised projections were changed to exclude Cabovisão and take into

account Management’s view of the 2012 fiscal year.

(2) Achievement of the projections is defined as within 1% above or below the projected amount.

(3) Operating margin does not have a standardized definitions prescribed by IFRS and therefore, may not be comparable to similar measures presented by othe

r

companies. For more details, please consult the “Non-IFRS financial measures” section.

(4) The PSU growth projections amounts in terms of RGU to 225,000 net additions as presented in the Fiscal 2012 financial guidelines of the 2011 Annual

Report.

OPERATING INCOME BEFORE DEPRECIATION AND AMORTIZATION AND OPERATING MARGIN

Operating income before depreciation and amortization and operating margin are benchmarks commonly used in the telecommunications

industry, as they allow comparisons with companies that have different capital structures and are more current measures since they exclude

the impact of historical investments in assets. Operating income before depreciation and amortization evolution assesses Cogeco Cable’s

ability to seize growth opportunities in a cost effective manner, to finance its ongoing operations and to service its debt. Operating income

before depreciation and amortization is a proxy for cash flow from operations(1) excluding the impact of the capital structure chosen.

Consequently, operating income before depreciation and amortization is one of the key metrics used by the financial community to value the

business and its financial strength. Operating margin is calculated by dividing operating income before depreciation and amortization by

revenue. In the 2011 annual report, the Corporation projected operating income before depreciation and amortization of $600 million for the

2012 year, which was then decreased to $585 million in the revised projections issued on July 11, 2012 in order to reflect the sale of the

Corporation’s Portuguese subsidiary in the second quarter of fiscal 2012 as well as the PSU growth increase at a lower pace than expected as

a consequence of a more competitive environment and tightening of credit controls, thus containing collection and bad debt expenses.

Operating income before depreciation and amortization for the 2012 fiscal year amounted to $589 million, achieving the Corporation’s revised

projections mainly as a result of PSU growth and rate increases. The operating margin reached 46.1% for the fiscal year, compared to the

revised projections of 45.7% issued on July 11, 2012.

FREE CASH FLOW

Free cash flow is defined as cash flow from operations less acquisitions of property, plant and equipment, intangible and other assets. The

financial community also closely follows this indicator since it measures the Corporation’s ability to repay debt, distribute capital to its

shareholders and finance its growth. On July 11, 2012, Cogeco Cable issued revised fiscal 2012 free cash flow projections of $90 million, a

decrease of $10 million over the initial projections of $100 million issued in the 2011 annual report as a result of the sale of the Portuguese

subsidiary. For the 2012 fiscal year, free cash flow amounted to $66 million, under-achieving the Corporation’s revised projections mainly due

to higher acquisitions of property, plant and equipment, intangible and other assets than projected, partly offset by the improvement of

operating income before depreciation and amortization.

(1) Cash flow from operations do not have standardized definitions prescribed by IFRS and therefore, may not be comparable to similar measures presented by

other companies. For more details, please consult the “Non-IFRS financial measures” section.