Cogeco 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

Cogeco Cable Inc. 2005

Adoption of New Accounting Standards

Fiscal 2004

Revenue Recognition

During the third quarter of fiscal 2004, Cogeco Cable adopted

the CICA’s Emerging Issues Committee Abstracts 141 and 142 issued

in December 2003, regarding the timing of revenue recognition and

certain related costs and the classification of certain items such as

revenue, expense or capitalized costs. Consequently, Cogeco Cable

adopted the following changes:

•

Installation revenue is now deferred and amortized over the

average life of a customer’s subscription, which is four years.

Previously, these revenue were recognized immediately

as they were considered a partial recovery of direct selling

costs incurred. Upon billing, the portion of unearned revenue

is now recorded as deferred and prepaid income.

•

The costs to reconnect customers are now recorded as deferred

charges up to a maximum amount not exceeding the revenue

generated by the reconnect activity, which are included in

installation revenue, and amortized over the average life of

a customer’s subscription, which is four years. Previously, these

costs, which include materials, direct labour and certain overhead

charges, were capitalized to fixed assets and generally amortized

over a period of five years.

•

Revenue from the sale of home terminal devices at a subsidized

price, which were recorded as a partial recovery of costs, are now

recorded as equipment revenue with an equal amount included

in operating costs.

•

The portion of advertising expense incurred to expand the digital

and HSI customer base that used to be recorded as a deferred

charge is now recorded as an operating cost.

As a result of the above changes, Operating Income was adjusted

downward by $8 million in fiscal 2004. The adjustments related

to the reversal of capitalized advertising expense and reconnection

costs amounted to $3.7 million and $1.2 million in fiscal 2004.

Cogeco Cable has decided to apply these changes retroactively

to enhance the comparability of its financial disclosure. The changes,

relating to revenue recognition, had the following impact on our

financial results and cash flow for fiscal 2004 and financial position

as at August 31, 2004 presented in the table below.

Other Accounting Standards

Information on the adoption of other accounting standards during

fiscal 2004, which did not have a significant impact on the financial

statements of the Corporation, except for Amortization of long-term

assets described in the “Fixed Charges” section on page 22

of the MD&A, is presented in Note 1c) on page 34.

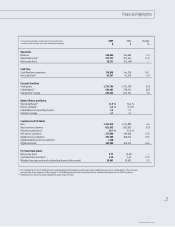

Year ended August 31, 2004

Before After

(in thousands of dollars, except per share data and percentages) adoption adoption

$$

Revenue 519,753 526,480

Operating Income 211,224 203,246

Operating Margin 40.6% 38.6%

Amortization 136,072 140,214

Income taxes 43,831 37,269

Net loss (26,636) (32,194)

Basic and diluted net loss per share (0.67) (0.81)

Capital expenditures and increase in deferred charges 106,893 101,244

Free Cash Flow 45,863 43,534

As at August 31, 2004

Before After

(in thousands of dollars) adoption adoption

$$

Fixed assets 739,547 687,960

Deferred charges 34,273 48,293

Deferred and prepaid income 16,070 32,437

Future income tax liabilities 214,296 195,523

Retained earnings 69,041 33,880

Management’s Discussion and Analysis