Cogeco 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

Cogeco Cable Inc. 2005

13

Cable Networks

Digital and VOD services are available to 98% and 87% of households,

respectively, and 89% of households passed are served by

a two-way cable plant. Cogeco Cable’s fiber optic network extends

over 8,100 kilometres and includes 79,200 kilometres of optical

fiber. Cogeco Cable has deployed optical fiber to nodes serving

clusters of typically 1,500 households, with many fibers per node

in most cases, which allows the Corporation to further extend

the fiber plant to smaller clusters of 500 households rapidly

with relative ease. Node splitting leads to further improvement

in the quality and reliability of services and allows for increasing

traffic of two-way services such as HSI and VOD.

Cogeco Cable is still using the DOCSIS 1.1 standard (Data Over Cable

Service Interface Specifications) for its IP platform. DOCSIS 1.1

allows the prioritization of the signal packets that must be

transmitted in real time, such as those of digital telephony service,

so as to ensure a continuous transmission flow. When appropriate,

the DOCSIS 2.0 transmission mode can be activated to increase

the speed and capacity of the return path, thus making it possible

to provide very high speed symmetrical services, which are

particularly well suited for commercial customer applications.

It is also more robust, allowing for the use of portions of the return

path spectrum that are normally not useable in a DOCSIS 1.1 mode.

In addition, the cable industry, in collaboration with CableLabs,

is in the process of developing a new standard, DOCSIS 3.0,

compatible with the earlier versions and will make it possible

to increase IP transmission speeds even more, up to 200 Mbps.

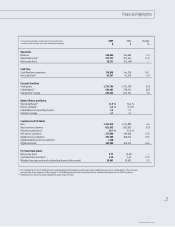

Key Performance Indicators

Cogeco Cable is dedicated to increasing shareholder value and

consequently focuses on optimizing profitability while efficiently

managing its use of capital without jeopardizing future growth.

The following key performance indicators are closely monitored

to ensure that business strategies and objectives are closely aligned

with shareholder value creation. The key performance indicators

are not measurements in accordance with Canadian GAAP and should

not be considered an alternative to other measures of performance

in accordance with GAAP. The Corporation’s method of calculating

key performance indicators may differ from other companies and,

accordingly, these key performance indicators may not be comparable

to similar measures presented by other companies.

Income Before Income Taxes

Per Home Passed and Return on Equity

Income before income taxes per home passed provides key insights

on how Cogeco Cable maximizes the value of its franchises.

Excluding income taxes from the profitability measure removes

an often volatile and non-controllable factor. The “per home passed”

concept measures Cogeco Cable’s effectiveness in improving

profitability in its franchised areas.

Return on Equity is defined as net income or loss divided by average

shareholders’ equity (computed on the basis of the beginning

and ending balance for a given fiscal year). Return on Equity

measures the Corporation’s effectiveness in generating net income

on a given capital base from our shareholders. Cogeco Cable’s key

goal in the coming years is to achieve a return on equity of 10%.

Operating Income Growth and Operating Margin

Operating Income is calculated as operating income before

amortization and unusual items that are non-recurring revenue

or expense items such as restructuring charges and gains

or losses on asset disposals. Operating Margin is calculated

by dividing Operating Income with revenue. Operating Income

growth and Operating Margin are benchmarks commonly used

in the telecommunications industry, as they allow comparisons

with companies that have different capital structures and are

more current measures since they exclude the impact of historical

investments in assets. Operating Income indicators assess

Cogeco Cable’s ability to seize growth opportunities in a cost

effective manner, to finance its ongoing operations, and to service

its debt. Operating Income is a proxy for cash flow generated

from operations excluding the impact of the capital structure

chosen. Consequently, Operating Income is one of the key

metrics used by the financial community to value the business

and its financial strength.

Free Cash Flow

Free Cash Flow is defined as cash flow from operations less capital

expenditures (including assets acquired under capital lease

that are disclosed in Note 12b) on page 50 which are not reflected

in the statements of cash flow) and increase in deferred charges.

The financial community also closely follows this indicator since

it measures the business’ ability to repay debt, distribute capital

to its shareholders and finance its growth.

RGU Growth and Penetration of Service Offerings

RGU expansion is a critical driver of revenue growth and measures

the success of the marketing strategy and the competitiveness

of the service offering and pricing. Penetration statistics measure

Cogeco Cable’s market share. Cogeco Cable computes the

penetration for basic services as a percentage of homes passed

and, in the case of all other services, as a percentage of basic

customers in the cable systems where the service is offered.

Customer Churn

Customer churn provides a key measure of customer satisfaction

and the effectiveness of loyalty programs. A retention focus

is more cost-effective than ongoing heavy acquisition efforts

with low retention success.

Productivity Indicators

Operating expenses per RGU is a prime measure of productivity

as RGU is the key driver of revenue growth. Cogeco Cable strives to

achieve strong RGU growth while closely monitoring its cost structure.