Coach 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Coach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TABLE OF CONTENTS

productivity in this channel by opening larger image-enhancing locations, expanding existing stores and closing smaller, less productive

stores. Coach’s most significant international wholesale customers are the DFS Group, Lotte Group, Shinsegae International, Shilla Group

and Tasa Meng Corp.

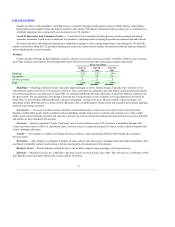

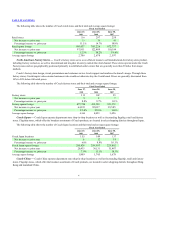

The following table shows the number of international wholesale locations at which Coach products are sold:

Fiscal Year Ended

June 27,

2009

June 28,

2008

June 30,

2007

International freestanding stores 44 37 25

International department store locations 81 83 74

Other international locations 34 23 25

Total international wholesale locations 159 143(1) 124(1)

(1) Excludes 24 and 16 stores in fiscal 2008 and fiscal 2007, respectively, that were part of the retail businesses operated by the ImagineX

group in Hong Kong, Macau and mainland China.

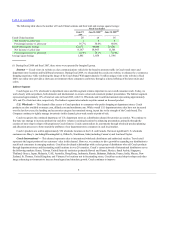

Licensing — In our licensing relationships, Coach takes an active role in the design process and controls the marketing and

distribution of products under the Coach brand. The current licensing relationships as of June 27, 2009 are as follows:

Category Licensing

Partner

Introduction

Date

Territory License

Expiration

Date

Watches Movado Spring ‘98 Worldwide 2015

Footwear Jimlar Spring ‘99 U.S. 2014

Eyewear Marchon Fall ‘03 Worldwide 2011

Products made under license are, in most cases, sold through all of the channels discussed above and, with Coach’s approval, these

licensees have the right to distribute Coach brand products selectively through several other channels: shoes in department store shoe salons,

watches in selected jewelry stores and eyewear in selected optical retailers. These venues provide additional, yet controlled, exposure of the

Coach brand. Coach’s licensing partners pay royalties to Coach on their net sales of Coach branded products. However, such royalties are

not material to the Coach business as they currently comprise less than 1% of Coach’s total revenues. The licensing agreements generally

give Coach the right to terminate the license if specified sales targets are not achieved.

Marketing

Coach’s marketing strategy is to deliver a consistent message each time the consumer comes in contact with the Coach brand through

our communications and visual merchandising. The Coach image is created internally and executed by the creative marketing, visual

merchandising and public relations teams. Coach also has a sophisticated consumer and market research capability, which helps us assess

consumer attitudes and trends and gauge the likelihood of a product’s success in the marketplace prior to its introduction.

In conjunction with promoting a consistent global image, Coach uses its extensive customer database and consumer knowledge to target

specific products and communications to specific consumers to efficiently stimulate sales across all distribution channels.

Coach engages in several consumer communication initiatives, including direct marketing activities and national, regional and local

advertising. In fiscal 2009, consumer contacts increased 14% to over 164 million. However, the Company continues to leverage marketing

expenses by refining our marketing programs to increase productivity and optimize distribution. Total expenses related to consumer

communications in fiscal 2009 were $50 million, representing less than 2% of net sales.

Coach’s wide range of direct marketing activities includes email contacts, catalogs and brochures targeted to promote sales to consumers

in their preferred shopping venue. In addition to building brand awareness, the

6