Coach 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Coach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.service as of July 1, 2001 receive three times the above profit sharing

contribution.

All contributions are allocated among the various investment options

according to the participant's selected investment direction.

Participant Accounts:

Each participant's account is credited with the participant's contributions

and employer's matching and profit sharing contributions, as well as an

allocation of each selected fund's earnings or losses. Allocations are based on

participant account balances as defined in the Plan document.

Vesting and Forfeitures:

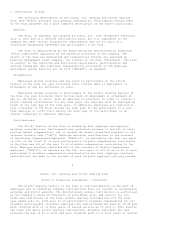

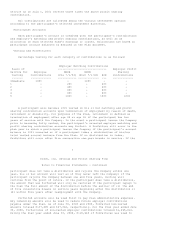

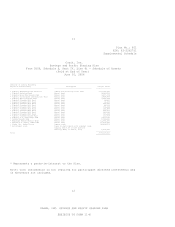

Percentage vesting for each category of contributions is as follows:

Employer Matching Contributions

Years of ------------------------------- Employer Profit

Service for Employee NHCE NHCE Sharing

Vesting Contributions (Pre 7/1/02) (Post 7/1/02) HCE Contributions

------- ------------- ------------ ------------- --- -------------

Immediate 100% - 100% - -

1 - 20% - 20% -

2 - 40% - 40% -

3 - 60% - 60% -

4 - 80% - 80% -

5 - 100% - 100% 100%

A participant also becomes 100% vested in his or her matching and profit

sharing contribution accounts upon termination of employment by reason of death,

retirement or disability. For purposes of the Plan, retirement is defined as

termination of employment after age 65 or age 55 if the participant has ten

years of service with the Company. In the event a participant leaves the Company

prior to becoming fully vested, the participant's unvested employer matching and

profit sharing contribution accounts may forfeit. A forfeiture will occur in the

plan year in which a participant leaves the Company if the participant's account

balance is 100% unvested or if a participant takes a distribution of his/her

total vested account balance from the Plan. If no distribution is taken,

forfeiture will occur after five consecutive one-year breaks in service. If the

7

Coach, Inc. Savings and Profit Sharing Plan

Notes to Financial Statements - Continued

participant does not take a distribution and rejoins the Company within one

year, his or her account will vest as if they never left the Company; if the

participant rejoins the Company between one and five years, vesting will

continue from the point of rehire. If the participant does take a distribution,

the amount that was forfeited will only be restored if the participant repays to

the Plan the full amount of the distribution before the earlier of (1) the end

of five consecutive breaks in service years beginning after the distribution or

(2) within five years after reemployment with the Company.

Forfeited accounts will be used first to pay Plan administrative expenses.

Any remaining amounts will be used to reduce future employer contributions

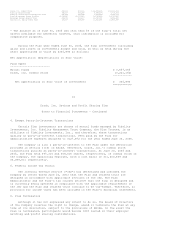

payable under the Plan. As of June 30, 2006 and 2005, forfeited non-vested

amounts totaled $137,495 and $47,042, respectively. For the Plan year ended June

30, 2006, forfeitures of non-vested employer contributions totaled $1,295,814.

During the Plan year ended June 30, 2006, $116,945 of forfeitures was used to