Coach 2005 Annual Report Download - page 5

Download and view the complete annual report

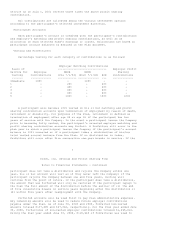

Please find page 5 of the 2005 Coach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Description of Plan

The following description of the Coach, Inc. Savings and Profit Sharing

Plan (the "Plan") provides only general information. Participants should refer

to the Plan document for a more complete description of the Plan's provisions.

General:

The Plan, as amended, was adopted by Coach, Inc. (the "Company") effective

July 1, 2001 and is a defined contribution plan. All U.S. employees of the

Company who meet certain eligibility requirements and are not part of a

collective bargaining agreement may participate in the Plan.

The Plan is administered by the Human Resources and Governance Committee

("Plan Committee") appointed by the Board of Directors of the Company. The

assets of the Plan are maintained and transactions therein are executed by

Fidelity Management Trust Company, the trustee of the Plan ("Trustee"). The Plan

is subject to the reporting and disclosure requirements, participation and

vesting standards, and fiduciary responsibility provisions of the Employee

Retirement Income Security Act of 1974 ("ERISA"), as amended.

Eligibility:

Employees become eligible and may elect to participate in the 401(k)

feature of the Plan one year following their initial date of employment or

attainment of age 21, whichever is later.

Employees become eligible to participate in the profit sharing feature of

the Plan one year following their initial date of employment or attainment of

age 21, whichever is later. Once an employee is eligible, in order to receive a

profit sharing contribution for any Plan year, the employee must be employed by

Coach on the last day of the Plan year. In addition, employees are required to

work a minimum of 750 hours during the Plan year if the participant is a part

time employee or 1,000 hours during the Plan year if the participant is an

intern, temporary or seasonal employee.

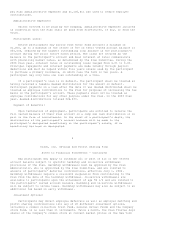

Contributions:

The 401(k) feature of the Plan is funded by both employee and employer

matching contributions. Participants may contribute between 1% and 50% of their

pre-tax annual compensation, not to exceed the amount permitted pursuant to the

Internal Revenue Code ("IRC"). Employer matching contributions to the accounts

of Non-Highly Compensated Employees ("NHCE's"), as defined by the IRS, are equal

to 100% of the first 3% of each participant's eligible compensation contributed

to the Plan and 50% of the next 2% of eligible compensation contributed to the

Plan. Employer matching contributions to the accounts of Highly Compensated

Employees ("HCE's"), as defined by the IRS, are equal to 50% of up to 6% of each

participant's eligible compensation contributed to the Plan. Employer matching

contributions are made to the account of each eligible employee each pay period.

6

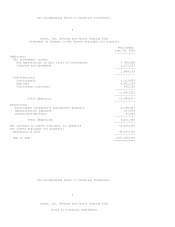

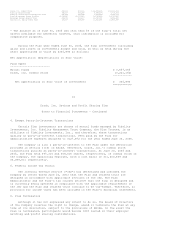

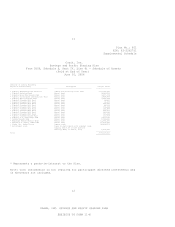

Coach, Inc. Savings and Profit Sharing Plan

Notes to Financial Statements - Continued

The profit sharing feature of the Plan is non-contributory on the part of

employees and is funded by Company contributions from its current or accumulated

earnings and profit amounts. The discretionary annual contribution is authorized

by the Company's Board of Directors in accordance with, and subject to, the

terms and limitations of the Plan. Profit sharing contributions for the Plan

year ended June 30, 2006 were 3% of participant's eligible compensation for all

eligible participants. Eligible employees who had attained the ages of 35-39 and

were credited with 10 or more years of vested service as of July 1, 2001 receive

two times the above profit sharing contribution. Eligible employees who had

attained the age of 40 or more and were credited with 10 or more years of vested