Cisco 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

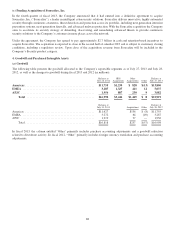

The Company acquired privately held Ubiquisys Limited (“Ubiquisys”) in the fourth quarter of fiscal 2013. Ubiquisys offers

service providers intelligent 3G and long-term evolution (LTE) small-cell technologies for seamless connectivity across

mobile networks. With its acquisition of Ubiquisys, the Company intends to strengthen its commitment to global service

providers by enabling a comprehensive small-cell solution that supports the transition to next-generation radio access

networks. The Company has included revenue from the Ubiquisys acquisition, subsequent to the acquisition date, in its NGN

Routing product category.

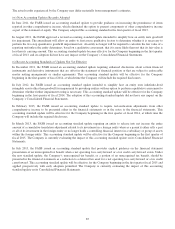

The total purchase consideration related to the Company’s business combinations completed during fiscal 2013 consisted of

cash consideration, repayment of debt, and vested share-based awards assumed. The total in cash and cash equivalents

acquired from these business combinations was approximately $156 million.

Fiscal 2012 and 2011

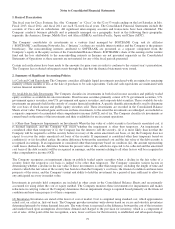

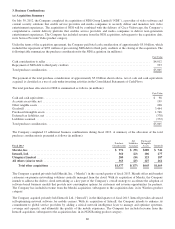

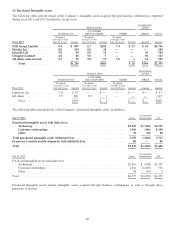

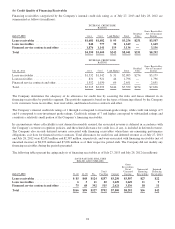

Allocation of the purchase consideration for business combinations completed in fiscal 2012 is summarized as follows (in millions):

Fiscal 2012

Purchase

Consideration

Net

Liabilities

Assumed

Purchased

Intangible

Assets Goodwill

Lightwire, Inc. ...................................................... $239 $(15) $ 97 $157

All others (six in total) ............................................... 159 (24) 103 80

Total acquisitions ............................................... $398 $(39) $200 $237

The Company acquired Lightwire, Inc. (“Lightwire”) in the third quarter of fiscal 2012. With its acquisition of Lightwire, a

developer of advanced optical interconnect technology for high-speed networking applications, the Company aimed to develop

and deliver cost-effective, high-speed networks with the next generation of optical connectivity. The Company included

revenue from the Lightwire acquisition, subsequent to the acquisition date, in its Switching product category.

The total purchase consideration related to the Company’s business combinations completed during fiscal 2012 consisted of

either cash consideration or cash consideration along with vested share-based awards assumed. The total cash and cash

equivalents acquired from these business combinations was immaterial.

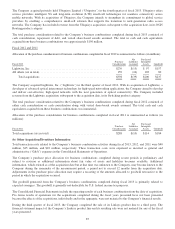

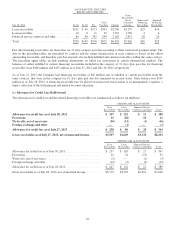

Allocation of the purchase consideration for business combinations completed in fiscal 2011 is summarized as follows (in

millions):

Fiscal 2011

Purchase

Consideration

Net

Liabilities

Assumed

Purchased

Intangible

Assets Goodwill

Total acquisitions (six in total) ......................................... $288 $(10) $114 $184

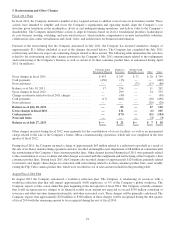

(b) Other Acquisition/Divestiture Information

Total transaction costs related to the Company’s business combination activities during fiscal 2013, 2012, and 2011 were $40

million, $15 million, and $10 million, respectively. These transaction costs were expensed as incurred as general and

administrative (“G&A”) expenses in the Consolidated Statements of Operations.

The Company’s purchase price allocation for business combinations completed during recent periods is preliminary and

subject to revision as additional information about fair value of assets and liabilities becomes available. Additional

information, which existed as of the acquisition date but at that time was unknown to the Company, may become known to the

Company during the remainder of the measurement period, a period not to exceed 12 months from the acquisition date.

Adjustments in the purchase price allocation may require a recasting of the amounts allocated to goodwill retroactive to the

period in which the acquisition occurred.

The goodwill generated from the Company’s business combinations completed during fiscal 2013 is primarily related to

expected synergies. The goodwill is generally not deductible for U.S. federal income tax purposes.

The Consolidated Financial Statements include the operating results of each business combination from the date of acquisition.

Pro forma results of operations for the acquisitions completed during the fiscal years presented have not been presented

because the effects of the acquisitions, individually and in the aggregate, were not material to the Company’s financial results.

During the third quarter of fiscal 2013, the Company completed the sale of its Linksys product line to a third party. The

financial statement impact of the Company’s Linksys product line and its resulting sale were not material for any of the fiscal

years presented.

87