Cisco 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

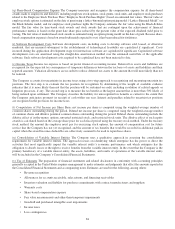

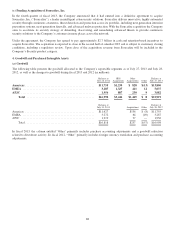

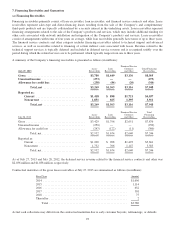

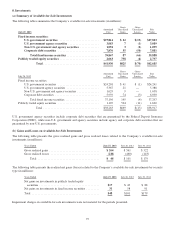

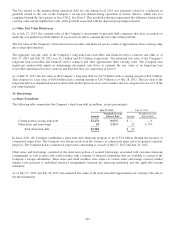

(b) Credit Quality of Financing Receivables

Financing receivables categorized by the Company’s internal credit risk rating as of July 27, 2013 and July 28, 2012 are

summarized as follows (in millions):

INTERNAL CREDIT RISK

RATING

July 27, 2013 1to4 5to6 7 and Higher Total

Residual

Value

Gross Receivables,

Net of Unearned

Income

Lease receivables ................................ $1,681 $1,482 $ 93 $3,256 $251 $3,507

Loan receivables ................................ 842 777 30 1,649 — 1,649

Financed service contracts and other ............... 1,876 1,141 119 3,136 — 3,136

Total .......................................... $4,399 $3,400 $242 $8,041 $251 $8,292

INTERNAL CREDIT RISK

RATING

July 28, 2012 1to4 5to6 7 and Higher Total

Residual

Value

Gross Receivables,

Net of Unearned

Income

Lease receivables ................................. $1,532 $1,342 $ 31 $2,905 $274 $3,179

Loan receivables ................................. 831 921 44 1,796 — 1,796

Financed service contracts and other .................. 1,552 1,030 69 2,651 — 2,651

Total ........................................... $3,915 $3,293 $144 $7,352 $274 $7,626

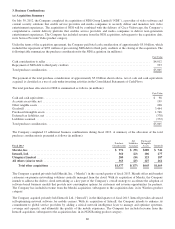

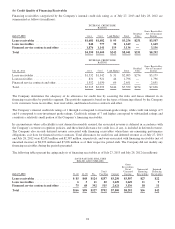

The Company determines the adequacy of its allowance for credit loss by assessing the risks and losses inherent in its

financing receivables by portfolio segment. The portfolio segment is based on the types of financing offered by the Company

to its customers: lease receivables, loan receivables, and financed service contracts and other.

The Company’s internal credit risk ratings of 1 through 4 correspond to investment-grade ratings, while credit risk ratings of 5

and 6 correspond to non-investment grade ratings. Credit risk ratings of 7 and higher correspond to substandard ratings and

constitute a relatively small portion of the Company’s financing receivables.

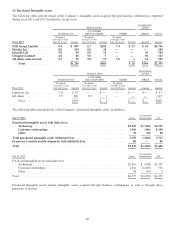

In circumstances when collectibility is not deemed reasonably assured, the associated revenue is deferred in accordance with

the Company’s revenue recognition policies, and the related allowance for credit loss, if any, is included in deferred revenue.

The Company also records deferred revenue associated with financing receivables when there are remaining performance

obligations, as it does for financed service contracts. Total allowances for credit loss and deferred revenue as of July 27, 2013

and July 28, 2012 were $2,453 million and $2,387 million, respectively, and were associated with financing receivables (net of

unearned income) of $8,292 million and $7,626 million as of their respective period ends. The Company did not modify any

financing receivables during the periods presented.

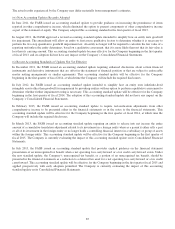

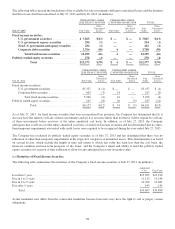

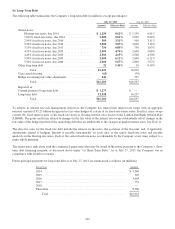

The following tables present the aging analysis of financing receivables as of July 27, 2013 and July 28, 2012 (in millions):

DAYS PAST DUE (INCLUDES

BILLED AND UNBILLED)

July 27, 2013 31-60 61-90 91+

Total

Past Due Current

Gross

Receivables,

Net of

Unearned

Income

Nonaccrual

Financing

Receivables

Impaired

Financing

Receivables

Lease receivables ........................ $ 85 $48 $124 $257 $3,250 $3,507 $27 $22

Loan receivables ........................ 6 3 11 20 1,629 1,649 11 9

Financed service contracts and other ....... 75 48 392 515 2,621 3,136 18 11

Total .................................. $166 $99 $527 $792 $7,500 $8,292 $56 $42

94