Cisco 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

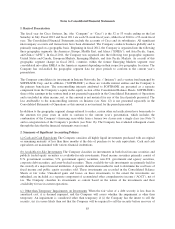

for each fiscal period using the treasury stock method. Under the treasury stock method, the amount the

employee must pay for exercising stock options, the amount of compensation cost for future service that the

Company has not yet recognized, and the amount of tax benefits that would be recorded in additional paid-in

capital when the award becomes deductible are collectively assumed to be used to repurchase shares.

(t) Consolidation of Variable Interest Entities The Company uses a qualitative approach in assessing the

consolidation requirement for variable interest entities. The approach focuses on identifying which enterprise has

the power to direct the activities that most significantly impact the variable interest entity’s economic

performance and which enterprise has the obligation to absorb losses or the right to receive benefits from the

variable interest entity. In the event that the Company is the primary beneficiary of a variable interest entity, the

assets, liabilities, and results of operations of the variable interest entity will be included in the Company’s

Consolidated Financial Statements.

(u) Use of Estimates The preparation of financial statements and related disclosures in conformity with

accounting principles generally accepted in the United States requires management to make estimates and

judgments that affect the amounts reported in the Consolidated Financial Statements and accompanying notes.

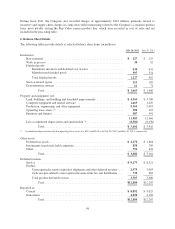

Estimates are used for the following, among others:

• Revenue recognition

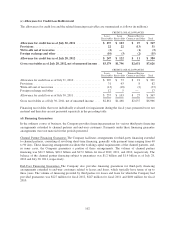

• Allowances for accounts receivable, sales returns, and financing receivables

• Inventory valuation and liability for purchase commitments with contract manufacturers and suppliers

• Warranty costs

• Share-based compensation expense

• Fair value measurements and other-than-temporary impairments

• Goodwill and purchased intangible asset impairments

• Income taxes

• Loss contingencies

The actual results experienced by the Company may differ materially from management’s estimates.

(v) New Accounting Update Recently Adopted

In May 2011, the Financial Accounting Standards Board (“FASB”) issued an accounting standard update to

provide guidance on achieving a consistent definition of and common requirements for measurement of and

disclosure concerning fair value as between U.S. GAAP and International Financial Reporting Standards

(“IFRS”). This accounting standard update became effective for the Company beginning in the third quarter of

fiscal 2012. As a result of the application of this accounting standard update, the Company has provided

additional disclosures in Note 9.

(w) Recent Accounting Standards or Updates Not Yet Effective

In June 2011, the FASB issued an accounting standard update to provide guidance on increasing the prominence

of items reported in other comprehensive income. This accounting standard update eliminates the option to

present components of other comprehensive income as part of the statement of equity and requires that the total

of comprehensive income, the components of net income, and the components of other comprehensive income be

presented either in a single continuous statement of comprehensive income or in two separate but consecutive

statements. This accounting standard update is effective for the Company beginning in the first quarter of fiscal

2013, and it will result in changes in the Company’s financial statement presentation.

92