Cisco 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 Cisco Systems, Inc.

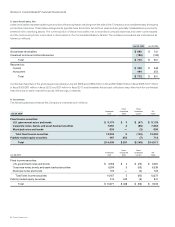

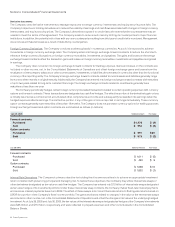

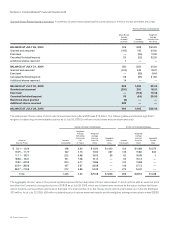

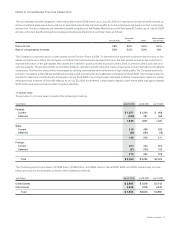

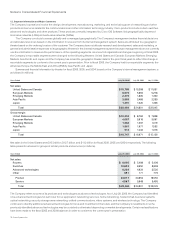

The table below reects net income and diluted net income per share for scal 2006 compared with the pro forma information for

scal 2005 and 2004 (in millions except per-share amounts):

Years Ended July 29, 2006 July 30, 2005 July 31, 2004

Net income—as reported for prior fiscal years(1) N/A $ 5,741 $ 4,401

Stock-based compensation expense related to employee stock options and employee stock purchases $ (1,050) (1,628) (2,025)

Tax benefit $ 294 594 810

Stock-based compensation expense related to employee stock options and employee

stock purchases, net of tax(2) $ (756) (1,034) (1,215)

Net income, including the effect of stock-based compensation expense(3) $ 5,580 $ 4,707 $ 3,186

Diluted net income per share—as reported for prior fiscal years(1 ) N/A $ 0.87 $ 0.62

Diluted net income per share, including the effect of stock-based compensation expense(3) $ 0.89 $ 0.71 $ 0.45

(1) Net income and net income per share prior to scal 2006 did not include stock-based compensation expense related to employee stock options and employee

stock purchases under SFAS 123 because the Company did not adopt the recognition provisions of SFAS 123.

(2) Stock-based compensation expense prior to scal 2006 is calculated based on the pro forma application of SFAS 123.

(3) Net income and net income per share prior to scal 2006 represents pro forma information based on SFAS 123.

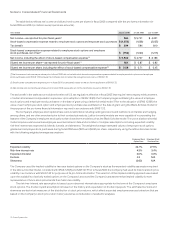

The tax benet in the table above includes the effect of U.S. tax regulations effective in scal 2005 that require intercompany reimbursement

of certain stock-based compensation expenses. Upon adoption of SFAS 123(R), the Company began estimating the value of employee

stock options and employee stock purchases on the date of grant using a lattice-binomial model. Prior to the adoption of SFAS 123(R), the

value of each employee stock option and employee stock purchase was estimated on the date of grant using the Black-Scholes model for

the purpose of the pro forma nancial information required in accordance with SFAS 123.

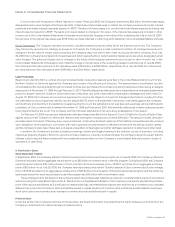

The Company’s employee stock options have various restrictions including vesting provisions and restrictions on transfer and hedging,

among others, and are often exercised prior to their contractual maturity. Lattice-binomial models are more capable of incorporating the

features of the Company’s employee stock options than closed-form models such as the Black-Scholes model. The use of a lattice-binomial

model requires extensive actual employee exercise behavior data and a number of complex assumptions including expected volatility,

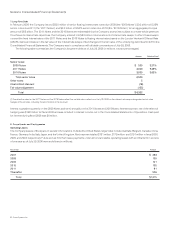

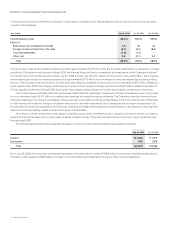

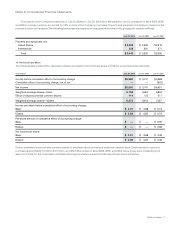

risk-free interest rate, expected dividends, kurtosis, and skewness. The weighted-average estimated values of employee stock options

granted and employee stock purchases during scal 2006 were $5.15 and $4.66 per share, respectively, using the lattice-binomial model

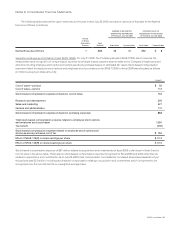

with the following weighted-average assumptions:

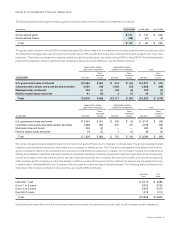

Employee Stock

Option Plans

Employee Stock

Purchase Plan

Expected volatility 23.7% 27.5%

Risk-free interest rate 4.3% 3.4%

Expected dividend 0.0% 0.0%

Kurtosis 4.3 N/A

Skewness (0.62) N/A

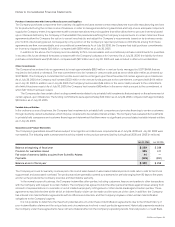

The Company used the implied volatility for two-year traded options on the Company’s stock as the expected volatility assumption required

in the lattice-binomial model, consistent with SFAS 123(R) and SAB 107. Prior to scal 2006, the Company had used its historical stock price

volatility in accordance with SFAS 123 for purposes of its pro forma information. The selection of the implied volatility approach was based

upon the availability of actively traded options on the Company’s stock and the Company’s assessment that implied volatility is more

representative of future stock price trends than historical volatility.

The risk-free interest rate assumption is based upon observed interest rates appropriate for the term of the Company’s employee

stock options. The dividend yield assumption is based on the history and expectation of dividend payouts. The estimated kurtosis and

skewness are technical measures of the distribution of stock price returns, which affect expected employee exercise behaviors that are

based on the Company’s stock price return history as well as consideration of academic analyses.

Notes to Consolidated Financial Statements