Cisco 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 53

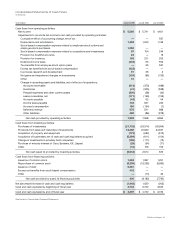

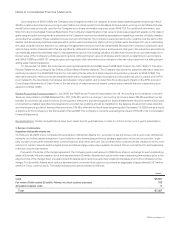

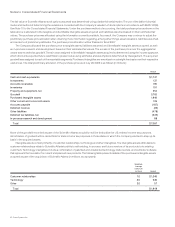

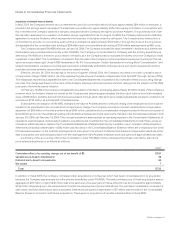

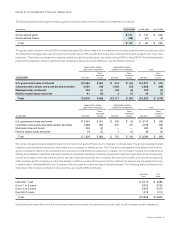

Unaudited Pro Forma Financial Information

The unaudited nancial information in the table below summarizes the combined results of operations of Cisco and Scientic-Atlanta, on

a pro forma basis, as though the companies had been combined as of the beginning of each of the scal years presented. The unaudited

pro forma nancial information for scal 2006 combines the results for Cisco for scal 2006, which include the results of Scientic-Atlanta

subsequent to February 24, 2006, and the historical results for Scientic-Atlanta for the six months ended December 30, 2005 and the

month ended February 24, 2006. The unaudited pro forma nancial information for scal 2005 combines the historical results for Cisco for

scal 2005, with the historical results for Scientic-Atlanta for its scal year ended July 1, 2005.

The pro forma nancial information is presented for informational purposes only and is not indicative of the results of operations that

would have been achieved if the acquisition of Scientic-Atlanta and issuance of $6.5 billion of debt (see Note 7 to the Consolidated Financial

Statements) had taken place at the beginning of each of the scal years presented. The debt was issued to nance the acquisition of

Scientic-Atlanta as well as for general corporate purposes. For the purposes of these unaudited pro forma combined nancial statements,

the entire debt and the related interest expense, including the effect of hedging, were included in the pro forma adjustments. The pro forma

nancial information for scal 2006 includes incremental stock-based compensation expense due to the acceleration of Scientic-Atlanta

employee stock options prior to the acquisition of Scientic-Atlanta, investment banking fees, and other acquisition-related costs, recorded

in Scientic-Atlanta’s historical results of operations during February 2006. The pro forma nancial information for each scal year presented

also includes the purchase accounting adjustments on historical Scientic-Atlanta inventory, adjustments to depreciation on acquired

property and equipment, a charge for in-process research and development, amortization charges from acquired intangible assets,

adjustments to interest income and expense, and related tax effects. The following table summarizes the pro forma nancial information

(in millions, except per-share amounts):

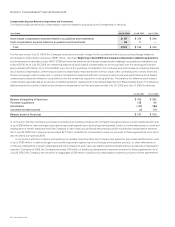

Years Ended July 29, 2006 July 30, 2005

Net sales $ 29,632 $ 26,712

Net income $ 5,366 $ 5,406

Net income per share—basic $ 0.87 $ 0.83

Net income per share—diluted $ 0.86 $ 0.82

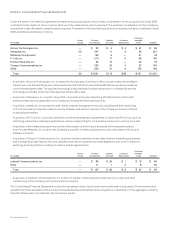

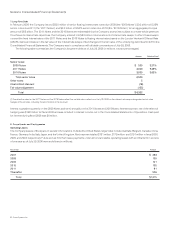

Other Purchase Acquisitions

A summary of the purchase acquisitions and asset purchases in scal 2006 other than the Scientic-Atlanta acquisition is as follows

(in millions):

Shares Issued

Purchase

Consideration

Liabilities

Assumed

In-Process

R&D

Expense

Purchased

Intangible

Assets Goodwill

KiSS Technology A/S 1 $ 51 $ 18 $ 2 $ 19 $ 39

Metreos Corporation — 27 1 — 2 25

Sheer Networks, Inc. — 96 7 — 29 56

SyPixx Networks, Inc. — 37 3 — 12 29

Other — 59 2 1 41 24

Total 1 $ 270 $ 31 $ 3 $ 103 $ 173

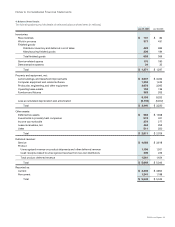

• Acquisition of KiSS Technology A/S to develop networked entertainment products for the consumer.

• Acquisition of Metreos Corporation to strengthen the Cisco Service-Oriented Network Architecture (SONA).

• Acquisition of Sheer Networks, Inc. to provide technology that is designed to adapt to network changes, scale to large networks,

and help extend new technologies and services to simplify the task of monitoring and maintaining complex networks.

• Acquisition of SyPixx Networks, Inc. to further develop the Company’s portfolio of physical security products.

Notes to Consolidated Financial Statements