Circuit City 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYSTEMAX INC

FORM 10-K

(Annual Report)

Filed 03/08/12 for the Period Ending 12/31/11

Address 11 HARBOR PARK DR

PORT WASHINGTON, NY 11050

Telephone 5166087000

CIK 0000945114

Symbol SYX

SIC Code 5961 - Catalog and Mail-Order Houses

Industry Retail (Catalog & Mail Order)

Sector Services

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2012, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

SYSTEMAX INC FORM 10-K (Annual Report) Filed 03/08/12 for the Period Ending 12/31/11 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 11 HARBOR PARK DR PORT WASHINGTON, NY 11050 5166087000 0000945114 SYX 5961 - Catalog and Mail-Order Houses Retail (Catalog & Mail Order) Services ... -

Page 2

... Number: 1-13792 Systemax Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 11-3262067 (I.R.S. Employer Identification No.) 11 Harbor Park Drive Port Washington, New York 11050 (Address of principal executive offices... -

Page 3

... market value of the voting stock held by non-affiliates of the registrant as of June 30, 2011, which is the last business day of the registrant's most recently completed second fiscal quarter, was approximately $164,511,601. For purposes of this computation, all executive officers and directors... -

Page 4

... OF C ONTENTS Part I Item 1. Business General Products Sales and Marketing Customer Service, Order Fulfillment and Support Suppliers Competition and Other Market Factors Employees Environmental Matters Financial Information About Foreign and Domestic Operations Available Information Risk Factors... -

Page 5

...to accept credit cards significant changes in the computer products retail industry, especially relating to the distribution and sale of such products timely availability of existing and new products risks associated with delivery of merchandise to customers by utilizing common delivery services the... -

Page 6

... the Company have been in business since 1949. Our headquarters office is located at 11 Harbor Park Drive, Port Washington, New York. Products We offer hundreds of thousands of brand name and private label products. We endeavor to expand and keep current the breadth of our product offerings in order... -

Page 7

... electronic data interchange ("EDI") ordering and customized billing services, customer savings reports and stocking of specialty items specifically requested by these customers. Our relationship marketers' efforts are supported by frequent catalog mailings and e-mail campaigns, both of which are... -

Page 8

...computer and office supply superstores. Timely introduction of new products or product features are critical elements to remaining competitive. Other competitive factors include product performance, quality and reliability, technical support and customer service, marketing and distribution and price... -

Page 9

... 32.7% of our net sales during 2011, 2010 and 2009, respectively were made by subsidiaries located outside of the United States. For information pertaining to our international operations, see Note 12, "Segment and Related Information," to the Consolidated Financial Statements included in Item 15 of... -

Page 10

... factors include price, availability, service and support. We compete with a wide variety of other resellers and retailers, including internet marketers, as well as manufacturers. Many of our competitors are larger companies with greater financial, marketing and product development resources... -

Page 11

... sell and could be adversely affected by a continuation of our customers' shift to lower-priced products. • Sales tax laws may be changed which could result in ecommerce and direct mail retailers having to collect sales taxes in states where the current laws do not require us to do so. This could... -

Page 12

... will be available in a timely manner and at reasonable prices. Any loss of, or interruption of, supply from key suppliers may require us to find new suppliers. This could result in production or development delays while new suppliers are located, which could substantially impair operating results... -

Page 13

.... We have 42 retail stores operating in North America at December 31, 2011 and one under construction. The Company needs to effectively manage its cost structure in order to maintain profitability including the additional inventory needs, retail point of sales IT systems, retail personnel and leased... -

Page 14

... operating results and financial condition . The computer and consumer electronics industry is highly price competitive and gross profit margins are narrow and variable. The Company's ability to further reduce prices in reaction to competitive pressure is limited. Timely introduction of new products... -

Page 15

..., trademark or other intellectual property matters, employment law matters product liability, commercial disputes, consumer sales practices, or other matters. In addition, as a public company we could from time to time face claims relating to corporate or securities law matters. The defense and... -

Page 16

... his direction such removed product inventory, without payment to the Company and for his own personal gain; ii) Mr. Fiorentino caused substantial amounts of Company inventory purchases to be effected through Company credit cards in order to accrue and/or use "reward points" for his personal benefit... -

Page 17

.... The $11 million settlement value included a financial statement benefit to the Company related to the surrender of shares and cash payment of approximately $8.4 million which was recorded in the second quarter of 2011 under special (gains) charges, net of related legal and professional fees of... -

Page 18

...11.77 12.09 On December 31, 2011, the last reported sale price of our common stock on the New York Stock Exchange was $16.41 per share. As of December 31, 2011, we had 192 shareholders of record. Depending in part upon profitability, the strength of our balance sheet, our cash position and the need... -

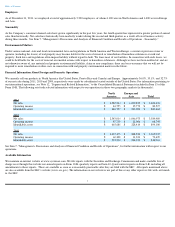

Page 19

... Consolidated Financial Statements and the notes thereto, and "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained elsewhere in this report. The selected statement of operations data for fiscal years 2011, 2010 and 2009 and the selected balance sheet data... -

Page 20

... business sales are sales made direct to other businesses through managed business relationships, outbound call centers and extranets. Sales in the Industrial Products segment and Corporate and other are considered to be business to business sales. Consumer channel sales are sales from retail stores... -

Page 21

... a market risk premium, the beta of a reporting unit, reporting unit specific risk premiums and terminal growth values. Critical assumptions related to the forecast inputs used in our discounted cash flow models include projected sales growth, same store sales growth, gross margin percentages, new... -

Page 22

... and using existing expenditures for which funding is available, determining products whose market price would indicate coverage for markdown or price protection is available and estimating the level of our performance under agreements that provide funds or allowances for purchasing volumes... -

Page 23

... gain or loss adjustment. A change of 5% in our effective tax rate at December 31, 2011 would impact net income by approximately $1.2 million. The recording of reorganization, restructuring and other charges may involve assumptions and judgments about future costs and timing for amounts related to... -

Page 24

... are not applicable to the Company's current or reasonably foreseeable operating structure. Below are the new authoritative pronouncements that management believes are relevant to the Company's current operations. In 2011, the FASB issued guidance which provides companies with the option to perform... -

Page 25

... 0.1% Industrial products 10.8% 9.5% 1.3% Consolidated operating margin 2.2% 1.9% 0.3% Effective income tax rate 30.9% 35.6% (4.7)% Net income $ 54.4 $ 42.6 27.7% Net margin 1.5% 1.2% 0.3% *includes special (gains) charges. See Note 8 of Notes to Consolidated Financial Statements. NET SALES SEGMENTS... -

Page 26

...of the number of retail stores in the United States and Canada and the continued sales contribution from our Circuit City and WStore Europe SA ("WStore") acquisitions in 2009. On a constant currency basis, excluding the impact of the WStore acquisition on results, Technology Product sales would have... -

Page 27

... to the retail stores, additional headcount and a full year of operation of the second distribution center. Technology Products operating margin decreased in 2010 versus 2009 due to price promotions, freight discounts offered during the year, start up costs related to the new distribution center... -

Page 28

...for new retail stores, capital expenditures, payment of interest on outstanding debt, special dividends declared by our Board of Directors and acquisitions. We rely principally upon operating cash flows to meet these needs. We believe that cash flows from operations and our availability under credit... -

Page 29

... and excess tax benefits from stock option exercises provided approximately $1.7 million of cash. On December 15, 2011, the Company entered into an amendment of its second amended and restated credit agreement. The amendment increased the maximum availability under the United States revolving loan... -

Page 30

... consolidated financial statements. Tax contingencies are related to uncertain tax positions taken on income tax returns that may result in additional tax, interest and penalties being paid to taxing authorities. As of December 31, 2011, the Company had no uncertain tax positions. Off-Balance Sheet... -

Page 31

... no outstanding balances under our variable rate credit facility. A hypothetical change in average interest rates of one percentage point is not expected to have a material effect on our financial position, results of operations or cash flows over the next fiscal year. Item 8. Financial Statements... -

Page 32

... Reporting There have been no changes in the Company's internal controls over financial reporting for the quarter ended December 31, 2011 that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting. Item 9B. Other Information... -

Page 33

... to the Proxy Statement. PART IV Item 15. Exhibits and Financial Statement Schedules. (a) 1. Consolidated Financial Statements of Systemax Inc. Reports of Ernst & Young LLP Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2011 and 2010 Consolidated... -

Page 34

...Non-Employee Directors* (incorporated by reference to the Company's annual report on Form 10-K for the year ended December 31, 2006) Form of 2005 Employee Stock Purchase Plan* (incorporated by reference to the Company's annual report on Form 10-K for the year ended December 31, 2006) Lease Agreement... -

Page 35

..., 2008 (incorporated by reference to the Company's annual report on Form 10-K for the year ended December 31, 2007) Asset Purchase Agreement, as amended, dated as of April 5, 2009 and May 14, 2009, by and among Systemax Inc., as Buyer and Circuit City Stores West Coast, Inc. and Circuit City Stores... -

Page 36

...Vice Chairman and Director March 8, 2012 Executive Vice President, Chief Financial Officer and Director (Principal Financial Officer) Vice President and Controller (Principal Accounting Officer) Director March 8, 2012 March 8, 2012 March 8, 2012 Director March 8, 2012 Director March 8, 2012 -

Page 37

... Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders of Systemax Inc. We have audited the accompanying consolidated balance sheets of Systemax Inc. (the "Company") as of December 31, 2011 and 2010, and the related consolidated statements of operations... -

Page 38

... over financial reporting as of December 31, 2011, based on the COSO criteria . We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Systemax Inc. as of December 31, 2011 and 2010 and the related... -

Page 39

...Contents SYSTEMAX INC. CONSOLIDATED BALANCE SHEETS (in thousands, except for share data) December 31, 2011 2010 ASSETS: Current assets: Cash Accounts receivable, net of allowances of $14,646 and $17,881 Inventories Prepaid expenses and other current assets Deferred income taxes Total current assets... -

Page 40

... Cost of sales Gross profit Selling, general and administrative expenses Special (gains) charges Operating income Foreign currency exchange loss Interest and other income, net Interest expense Income before income taxes Provision for income taxes Net income Net income per common share: Basic Diluted... -

Page 41

...related to equity compensation plans Return of common stock-special gain Excess tax benefit from exercises of stock options Loss on dispositions and abandonment Changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other current assets Income taxes payable... -

Page 42

... stock Exercise of stock options Return of common stock Surrender of fully vested options Income tax benefit on stock-based compensation Change in cumulative translation adjustment Net income Total comprehensive income Balances, December 31, 2011 See notes to consolidated financial statements... -

Page 43

... cash. Cash overdrafts are classified in accounts payable. Inventories - Inventories consist primarily of finished goods and are stated at the lower of cost or market value. Cost is determined by using the first-in, first-out method except in Europe and retail locations where an average cost is used... -

Page 44

... method, options will only have a dilutive effect when the average market price of common stock during the period exceeds the exercise price of the options. The weighted average number of stock options outstanding included in the computation of diluted earnings per share was 0.3 million for the year... -

Page 45

...consist primarily of investments in cash, trade accounts receivable debt and accounts payable. The Company estimates the fair value of financial instruments based on interest rates available to the Company and by comparison to quoted market prices. At December 31, 2011 and 2010, the carrying amounts... -

Page 46

...The following table provides information related to the carrying value of goodwill (in thousands): December 31, 2011 $ 3,280 $ 3,280 December 31, 2010 $ 930 1,350 1,000 $ 3,280 Balance January 1 Deferred tax adjustment Adjustments to finalize purchase price allocation Balance December 31 Indefinite... -

Page 47

...receivable, inventory and certain other assets, subject to limited exceptions. The amended and restated credit agreement contains certain operating, financial and other covenants, including limits on annual levels of capital expenditures, availability tests related to payments of dividends and stock... -

Page 48

45 -

Page 49

... Products segment. Other costs totaling $0.3 million were recorded in selling, general and administrative expenses within the Corporate and other segment. The following table details the associated liabilities incurred related to this plan (in thousands): Severance and Personnel Costs Balance... -

Page 50

.... The $11 million settlement value included a financial statement benefit to the Company related to the surrender of shares and cash payment of approximately $8.4 million which was recorded in the second quarter of 2011 under special (gains) charges, net of related legal and professional fees of... -

Page 51

...Compensation cost related to non-qualified stock options recognized in operating results (selling, general and administrative expense) for 2011, 2010 and 2009 was $1.0 million, $1.5 million, and $2.2 million respectively. The related future income tax benefits recognized for 2011, 2010 and 2009 were... -

Page 52

... market price of the Company's stock at the date of the award. Compensation expense related to the restricted stock award was approximately $0.1 million in 2011, and $0.6 million in each of 2010 and 2009. As part of the settlement agreement (see Note 8 of Notes to Consolidated Financial Statements... -

Page 53

49 -

Page 54

... 78,683 $ 66,033 $ 73,085 United States Foreign Total The provision for income taxes consists of the following (in thousands): $ $ 2011 Current: Federal State Foreign Total current Deferred: Federal State Foreign Total deferred TOTAL $ Year Ended December 31, 2010 2009 $ 9,535 2,269 7,106 18,910... -

Page 55

... of accruals, our effective tax rate in a given financial statement period could be affected. There were no accrued interest or penalty charges related to unrecognized tax benefits recorded in income tax expense in 2011 or 2010. As of December 31, 2011 the Company had no uncertain tax positions. 51 -

Page 56

... and Industrial Products. The Company's chief operating decision-maker is the Company's Chief Executive Officer. The Company evaluates segment performance based on income from operations before net interest, foreign exchange gains and losses, special (gains) charges and income taxes. Corporate costs... -

Page 57

...662 $ $ 573,977 136,909 183,214 894,100 $ $ 524,540 103,370 188,991 816,901 Financial information relating to the Company's operations by geographic area was as follows (in thousands): Year Ended December 31, 2010 2009 $ 2,329,530 418,865 628,110 213,484 3,589,989 51,532 15,953 3,417 2,863 73... -

Page 58

...) Quarterly financial data is as follows (in thousands, except for per share amounts): First Quarter Second Quarter Third Quarter Fourth Quarter 2011: Net sales Gross profit Net income Net income per common share: Basic Diluted 2010: Net sales Gross profit Net income Net income per common share... -

Page 59

... to Expenses 3,202 3,268 4,698 $ $ $ Balance at End of Period 14,646 17,881 22,532 Description Allowance for sales returns and doubtful accounts 2011 2010 2009 Allowance for deferred tax assets 2011 Current Noncurrent 2010 Current Noncurrent 2009 Current (3) Noncurrent (3) (4) Write-offs (6,437... -

Page 60

... the Company's offices located in Miami, Florida, subject to travel and other duties outside of such location consistent with the Company's business as determined by the Reporting Person. Nothing in this Agreement shall be construed to prohibit the Employee from serving on the board of directors and... -

Page 61

... the performance of all duties, responsibilities and services by the Employee hereunder during the Employment Period, the Company shall pay to the Employee, and the Employee agrees to accept, a base salary (the "Base Salary") at an annual rate of Seven Hundred Thousand Dollars ($700,000), payable in... -

Page 62

... of Directors (the "Compensation Committee"), the Employee shall receive an option to purchase 100,000 shares of the Company's common stock (in accordance with the Company's 2010 Long Term Incentive Plan) (a) exercisable at an exercise price per share equal to the fair market value of a share of... -

Page 63

...). The Restricted Stock Agreement shall provide that if your employment with the Company or its successor shall be terminated by the Company or its successor without Cause or by you for Good Reason within six (6) months following a Change in Control, all of your outstanding restricted shares shall... -

Page 64

... the Systemax Companies or any director, officer or employee of the Systemax Companies which is injurious to the business or operations of any of the Systemax Companies, or which may in any material respect interfere with the goodwill of any of the Systemax Companies or its relations with customers... -

Page 65

... that are materially inconsistent with your positions or offices held with the Company; (iii) a decrease in your then current annual base salary (other than in connection with a general decrease in the salary of all employees of the North America Technology Products Group with a title of senior vice... -

Page 66

... of the applicable stock option agreement or applicable restricted stock agreement, respectively. In addition, the Company shall pay to the Employee that portion of the annual Bonus, on the date set forth herein, that is equal to the number of days the Employee was employed by the Company (based on... -

Page 67

...of the applicable stock option agreement or applicable restricted stock agreement, respectively. In addition, the Company shall pay to such designated person or the estate that portion of the annual Bonus, on the date set forth herein, that is equal to the number of days the Employee was employed by... -

Page 68

... or medical plan or other employee benefit plan or arrangement of the Company then in effect and provided further that any stock option or restricted stock held by the Employee shall be treated in accordance with the applicable stock option agreement or restricted stock agreement. The payment of any... -

Page 69

... Systemax Companies' internal operations. Such Confidential Information includes, but is not limited to: (i) financial and business information, such as information with respect to costs, commission, fees, profits, sales, markets, mailing lists, strategies and plans for future business, new business... -

Page 70

... the Reporting Person, directly or indirectly, own, manage, operate, control, consult with or be employed in a capacity similar to the position(s) held by Employee with the Company by any company or other for-profit entity engaged in the sale of computer, consumer electronic and industrial products... -

Page 71

... deleterious written or oral statements or remarks regarding the Company, any Systemax Company or any of its affiliates or any members of their respective boards of directors or managements, or any of their respective business affairs or performance. During the Employment Period and thereafter, you... -

Page 72

... constituting Trade Secrets or Confidential Information as defined in Section 6 hereof (referred to collectively as "Intellectual Property"), that were conceived, developed or made by Employee during employment by the Company, including Intellectual Property related to the sale of computer, consumer... -

Page 73

..., trademark, or copyright application, disclosed by the Employee in any manner to a third person, or created by the Employee or any person with whom he has any business, financial or confidential relationship, within one (1) year after cessation of his employment with the Company, was conceived or... -

Page 74

... such payments or other benefits shall be restructured, to the extent possible, in a manner determined by the Company that does not cause such acceleration or additional tax. All references in this Agreement to the termination of your employment shall mean your separation from service within... -

Page 75

... permitted by applicable law and Section 409A of the Code, to offset any payment the Company owes you by the amount determined by the Company to be owed by you to the Company. IN WITNESS WHEREOF, the parties have executed this Agreement as of the date and year first above written. SYSTEMAX INC. By... -

Page 76

EXHIBIT 10.19 Dated December___, 2011 MISCO UK LIMITED and PERMINDER DALE EXECUTIVE DIRECTOR'S SERVICE AGREEMENT -

Page 77

... not limited to) information relating to financial and business information (inclu information relating to costs, commissions, fees, profits and sales) rnarkets, mailing strategies, plans for future business, product or other development, potential acquisit new marketing ideas, product and technical... -

Page 78

... person (whether party to this agreement or not) rel to the employment of the Employee under this agreement other than as expressly se in this agreement or any documents referred to in it. those parts of the business of the Company or any Group Company with which Employee was involved to a material... -

Page 79

... period the Company may carry out relevant employment related checks on him in order to determine his suitability for the position. During the probationary period the Employee's performance and suitability for continued employment will also be monitored. The Employee will be informed in writing... -

Page 80

... employment under this agreement to an Associated Employer at any time during the Appointment. Employee warranties 3.1 The Employee represents and warrants to the Company that, by entering into this agreement or performing any of his obligations under it, he will not be in breach of any court order... -

Page 81

... employee or director of any Group Company to the Chairman and CEO of Systemax Inc. immediately on becoming aware of it; use his best endeavours to promote, protect, develop and extend the business of the Company and any Group Company; consent to the Company or Group Company monitoring and recording... -

Page 82

... shall be based on Systemax Inc.'s bonus plan for named executive officers (referred to as the NEO Plan). If no performance objectives are established and agreed in writing in any calendar year, the Bonus will not be payable in that calendar year. The Bonus payment due to the Employee, if any, shall... -

Page 83

... the Employee shall be entitled to participate in the Company's medical plan and any other insurance or benefit plan or arrangement that is made available for Company Directors based in the United Kingdom, subject to: 10.1.1 10.1.2 10.1.3 the terms of those schemes, as amended from time to time; the... -

Page 84

... involving the car (whether or not these take place while the Employee is on business); immediately inform the Company if he is convicted of a driving offence or disqualified from driving; and return the car, its keys and all documents relating to it to the HR Department or such other place as the... -

Page 85

...listed or dealt in on a recognised stock exchange) where such company does not carry on a business similar to or competitive with any business for the time being carried on by the Company or any Group Company. The Employee agrees to disclose to the Company any matters relating to his spouse or civil... -

Page 86

... 18.3 until such time as the Company has agreed in writing that the Employee may offer them for sale to a third party. The Employee agrees: 18.4.1 18.4.2 to give the Company full written details of all Employment Inventions which relate to or are capable of being used in the business of any Group... -

Page 87

... of association of the Company or the relevant Group Company, as amended from time to time, or by statute or court order) the Appointment shall continue with the Employee as an employee only and the terms of this agreement (other than those relating to the holding of the office of director) shall... -

Page 88

... might otherwise have been due during the period for which the Payment in lieu is made; any payment or benefit in relation to share options or restricted stock which have not yet vested; any payment in respect of benefits which the Employee would have been entitled to receive during the period for... -

Page 89

... or any of its or their directors, officers or employees; is guilty of a serious breach of any rules issued by the Company from time to time regarding its electronic communications systems; or is unable by reason of Incapacity to perform his duties under this agreement for a continuous period of 13... -

Page 90

... of the Appointment however arising the Employee shall not be entitled to any compensation for the loss of any rights or benefits under any share option, bonus, long-term incentive plan or other profit sharing scheme operated by the Company or any Group Company in which he may participate. -

Page 91

...of the total issued share capital of any company, whether or not it is listed or dealt in on a recognised stock exchange; or being engaged or concerned in any business concern insofar as the duties of the Employee or work shall relate solely to geographical areas where the business concern is not in... -

Page 92

... is subject to the disciplinary and grievance procedures of the Company, copies of which are available from the HR Manager from time to time. These procedures do not form part of the contract of employment of the Employee. If the Employee wants to raise a grievance, he may apply in writing to... -

Page 93

...are available from the HR Manager from time to time. The Company does not make any contributions to the Scheme. The Employee may make contributions to the Scheme of an amount up to the lower of 100% of the Employee's salary and the annual allowance set by HM Revenue & Customs from time to time. Such... -

Page 94

... receipt is at 9.00 am on the next business day. 31.4 31.5 32 A notice required to be given by the Employee under this agreement shall not be validly given if sent by e-mail unless authorised by the Company. This clause does not apply to the service of any proceedings or other documents in any... -

Page 95

... any dispute in relation to the separate agreements referred to in this agreement which are governed by the Laws of Delaware. This agreement has been entered into on the date stated at the beginning of this agreement. Executed as a deed by MISCO UK LIMITED acting by RICHARD LEEDS a director, in the... -

Page 96

....26 AMENDMENT NO. 1 AND WAIVER TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT This AMENDMENT NO. 1 AND WAIVER dated as of December 15, 2011 (this "Amendment") is made by and among SYSTEMAX INC., a corporation organized under the laws of the State of Delaware ("SYX"), each US Borrower listed on the... -

Page 97

...Credit for the account of the UK Borrower (" UK Letters of Credit ") under the Credit Agreement and (iii) the UK Administrative Agent shall have no further duties or obligations under the Credit Agreement...of the Credit Agreement and other Loan Documents which by their terms survive the payment of the... -

Page 98

... United States of America) and any other Person who becomes a party to this Agreement pursuant to a Joinder Agreement and their successors and assigns. " Material Adverse Effect " means a material adverse effect on (a) the condition, operations, assets, business or prospects of the applicable Loan... -

Page 99

(c) The definition of Applicable Rate in Section 1.01 of the Credit Agreement is hereby amended by amending the grid contained therein in its entirety to provide as follows: Trailing Quarterly Borrowing Base Availability Category 1 Less than $40,000,000 Category 2 $40,000,000 or more but less than $... -

Page 100

... of operating, administrative, cash management, collection activity, and other deposit accounts for the conduct of its business." (o) Section 5.16(a) of the Credit Agreement is hereby amended by deleting the reference therein to "if organized under the laws of the United States of America... -

Page 101

..., bank guaranties, bankers acceptances or similar interests obtained in the ordinary course of business. (u) Section 6.02 of the Credit Agreement is hereby amended by (x) changing clause (i) to clause (j) therein, and (y) inserting the following text after clause (h) therein: "(i) Liens granted... -

Page 102

... with applicable law and (y) legal, tax and accounting matters in connection with any of the foregoing activities." (aa) Article VII (k) is hereby amended by (x) adding the word "or" at the end of clause (ii) thereof and (y) deleting clause (iv) thereof. (bb) Article VII(s) of the Credit Agreement... -

Page 103

... (a "DACA") duly executed on behalf of each financial institution holding a deposit account of such Grantor as set forth in this Security Agreement, provided that (i) no DACA shall be required with respect to deposit accounts for retail store locations in which sums on deposit therein (or in the... -

Page 104

... laws of a state of the United States and (y) the Equity Interests of each Subsidiary of each Loan Party organized under the laws of Puerto Rico or a province of Canada which are pledged to US Administrative Agent pursuant to the Security Agreement, together with the corresponding original stock or... -

Page 105

... "UK Cash Collateral") with respect to the outstanding UK Letters of Credit, together with a fully executed cash collateral agreement and any other documents reasonably required by the Administrative Agents with respect to the outstanding UK Letters of Credit; (c) payment in full of all UK Revolving... -

Page 106

...operate as a waiver of any right, power or remedy of Administrative Agents and Lenders, nor constitute a waiver of any provision of the Credit Agreement, or any other documents, instruments or agreements... OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND PERFORMED IN SUCH STATE WITHOUT REGARD... -

Page 107

....COM INC. PAPIER CATALOGUES, INC. TEK SERV INC. PROFIT CENTER SOFTWARE INC. GLOBAL GOV/ED SOLUTIONS INC. GLOBAL GOVERNMENT & EDUCATION INC. SYX DISTRIBUTION INC. SYX SERVICES INC. STREAK PRODUCTS INC. NEW COMPUSA CORP. COMPUSA.COM INC. COMPUSA RETAIL, INC. WORLDWISE REBATES, INC. CIRCUITCITY.COM INC... -

Page 108

UK Borrower MISCO UK LIMITED By: Name: Title: -

Page 109

New Subsidiaries GLOBAL INDUSTRIAL HOLDINGS LLC SYX NORTH AMERICAN TECH HOLDINGS LLC REBATE HOLDINGS LLC SYX S.A. HOLDINGS INC. SYX S.A. HOLDINGS II INC. By: Name: Title: -

Page 110

JPMORGAN CHASE BANK, N.A., as US Administrative Agent and as a Lender By: Name: Donna M. DiForio Title: Authorized Officer J.P. MORGAN EUROPE LIMITED, as UK Administrative Agent and as a Lender By: Name: Title: -

Page 111

HSBC BANK USA, N.A., as a Lender By: Name: Title: WELLS FARGO CAPITAL FINANCE, LLC, as a Lender By: Name: Title: -

Page 112

Exhibit B See attached. Exhibit B - 1 -

Page 113

Exhibit G-1 See attached Exhibit G-1 -

Page 114

EXHIBIT G-2 See attached EXHIBIT G-2 -

Page 115

Schedule 1(a) Commitment Schedule Lender JPMorgan Chase Bank, N.A. HSBC Bank USA, N.A. Wells Fargo Capital Finance, LLC TOTAL Schedule 1(a) - 1 US Revolving Commitment $ $ $ $ 50,000,000 40,000,000 35,000,000 125,000,000 -

Page 116

...Commitment Fee: Outstanding Principal Amount Amount Due in USD(1): Letter of Credit Fees: Amount Due in GBP(2) Per diem for each day after December 15th: Commitment Fee: Letter of Credit Fees: (1) Wire Instructions for US Dollars: To For A/C# Attn JPMorgan Chase Bank, New York (CHASUS33) J.P. Morgan... -

Page 117

... Inc., Systemax Manufacturing Inc., New CompUSA Corp., Global Gov/Ed Solutions Inc., SYX Distribution Inc., Streak Products Inc., CompUSA Retail Inc., TigerDirect, Inc., Software Licensing Center Inc., Global Computer Supplies Inc., CompUSA.com Inc., Target Advertising Inc., SYX Services Inc., Tek... -

Page 118

The transfer of the ownership of the Equity Interests of Global Industrial Canada, Nexel, Industries Inc., Profitcenter Software Inc., Global Government & Education Inc. and Papier Catalogues, Inc. from SYX to Global Industrial Holdings LLC. The transfer of the ownership of the Equity Interests of ... -

Page 119

... Computer Supplies Inc. (a New York corporation) Global Equipment Company Inc. (a New York corporation) TigerDirect Inc. (a Florida corporation) Nexel Industries Inc. (a New York corporation) Systemax Manufacturing Inc. (a Delaware corporation) Profit Center Software Inc. (a New York corporation... -

Page 120

... Software Eurl (a French corporation) Misco Nederland BV (a Dutch corporation) Misco AB (a Swedish corporation) Misco Iberia Computer Supplies S.A. (a Spanish corporation) Misco Ireland Ltd (an Irish corporation) Systemax Europe Sarl (a Luxembourg corporation) SYX Services Private Limited (an Indian... -

Page 121

...to the consolidated financial statements and schedule of Systemax Inc., and the effectiveness of internal control over financial reporting of Systemax Inc. included in this Annual Report (Form 10-K) of Systemax Inc. for the year ended December 31, 2011. /s/ Ernst & Young LLP New York, New York March... -

Page 122

... design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b) any fraud, whether or not material, that involves management or other employees who have... -

Page 123

... design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b) any fraud, whether or not material, that involves management or other employees who have... -

Page 124

... 31, 2011 fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78 (o)(d)) and that the information contained in such Form 10-K fairly presents, in all material respects, the financial condition and results of operations of... -

Page 125

... UNDER SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 The undersigned, the Chief Financial Officer of Systemax Inc., hereby certifies that Systemax Inc.'s Form 10-K for the Year Ended December 31, 2011 fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities...