Circuit City 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in recognition of restructuring charges. These actions require management to make judgments and utilize significant estimates

regarding the nature, timing and amounts of costs associated with the activity. When we incur a liability related to a

restructuring action, we estimate and record all appropriate expenses, including expenses for severance and other employee

separation costs, facility consolidation costs (including estimates of sublease income), lease cancellations, asset impairments

and any other exit costs. Should the actual amounts differ from our estimates, the amount of the restructuring charges could

be impacted, which could materially affect our consolidated financial position and results of operations.

Recently Adopted and Newly Issued Accounting Pronouncements

Effective January 1, 2006, the Company adopted the provisions of SFAS 123(R), using the modified-prospective-transition

method. Under that transition method, compensation cost recognized for the year ended December 31, 2006 includes: (a)

compensation cost for all share-based payments granted prior to, but not yet vested as of January 1, 2006, based on the grant-

date fair value estimated in accordance with the original provisions of SFAS 123, and (b) compensation cost for the vested

portion of share-based payments granted subsequent to January 1, 2006, based on the grant-date fair value estimated in

accordance with the provisions of SFAS 123(R). Results for prior periods have not been restated.

The fair value of employee share options is recognized in expense over the vesting period of the options, using the graded

attribution method. The fair value of employee share options is determined on the date of grant using the Black-Scholes

option pricing model. The Company has used historical volatility in its estimate of expected volatility. The expected life

represents the period of time (in years) for which the options granted are expected to be outstanding. The Company used the

simplified method for determining expected life as permitted in SEC Staff Accounting Bulletin 107 for options qualifying for

such treatment (“plain-vanilla” options) due to the limited history the Company currently has with option exercise activity.

The risk-free interest rate is based on the U.S. Treasury yield curve.

In June 2006, the FASB ratified the consensus reached by the EITF on Issue No. 06-3, “How Taxes Collected from

Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That Is, Gross versus

Net Presentation).

” The consensus requires disclosure of either the gross or net presentation, and any such taxes reported on a

gross basis should be disclosed in the interim and annual financial statements. This Issue is effective for financial reporting

periods beginning after December 15, 2006. The Company does not expect to change its presentation of such taxes, as its

sales are currently recorded net of tax.

In June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48 “Accounting for

Uncertainty in Income Taxes (an interpretation of FASB Statement No. 109)", which is effective for fiscal years beginning

after December 15, 2006. This interpretation was issued to clarify the accounting for uncertainty in income taxes recognized

in the financial statements by prescribing a recognition threshold and measurement attribute for the financial statement

recognition and measurement of a tax position taken or expected to be taken in a tax return. The Company is currently

evaluating the potential impact, if any, of this pronouncement.

In September 2006, the SEC issued Staff Accounting Bulletin No. 108 (“SAB 108”) “Considering the Effects of Prior Year

Misstatements when Quantifying Misstatements in Current Year Financial Statements”. SAB 108 provides interpretative

guidance on how the effects of the carryover or reversal of prior year misstatements should be considered in quantifying a

current year misstatement. The SEC staff believes that registrants should quantify errors using both a balance sheet and an

income statement approach and evaluate whether either approach results in quantifying a misstatement that, when all relevant

quantitative and qualitative factors are considered, is material. This pronouncement is effective for fiscal years ending after

November 15, 2006. This pronouncement had no impact on the Company

’s consolidated financial statements for the year

ended December 31. 2006.

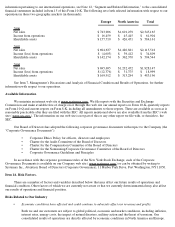

Highlights from 2006

The discussion of our results of operations and financial condition that follows will provide information that will assist

in understanding our financial statements and information about how certain accounting principles and estimates affect the

consolidated financial statements. This discussion should be read in conjunction with the consolidated financial statements

included herein.

•

Sales increase of 10.9% to $2.3 billion in 2006 from $2.1 billion in 2005

•

Continued growth (26.0%) in e

-

commerce sales to $819 million in 2006 from $650 million in 2005

•

Decrease of selling, general and administrative expense to 12.0% of net sales in 2006 from 12.7% of net sales in

2005

•

Increase in income from operations in 2006 of $27 million or 78%