Circuit City 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYSTEMAX INC

FORM 10-K

(Annual Report)

Filed 03/30/07 for the Period Ending 12/31/06

Address 11 HARBOR PARK DR

PORT WASHINGTON, NY 11050

Telephone 5166087000

CIK 0000945114

Symbol SYX

SIC Code 5961 - Catalog and Mail-Order Houses

Industry Retail (Catalog & Mail Order)

Sector Services

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2008, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

SYSTEMAX INC FORM 10-K (Annual Report) Filed 03/30/07 for the Period Ending 12/31/06 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 11 HARBOR PARK DR PORT WASHINGTON, NY 11050 5166087000 0000945114 SYX 5961 - Catalog and Mail-Order Houses Retail (Catalog & Mail Order) Services ... -

Page 2

... executive offices, including zip code) Registrant's telephone number, including area code: (516) 608-7000 Securities registered pursuant to Section 12(b) of the Act: Name of each exchange on which registered New York Stock Exchange Title of each class Common Stock, par value $ .01 per share... -

Page 3

... Part I Item 1. Business General Products Sales and Marketing Customer Service, Order Fulfillment and Support Suppliers Competition and Other Market Factors Employees Environmental Matters Financial Information About Foreign and Domestic Operations Available Information Item 1A. Risk Factors Item... -

Page 4

...part of the Company have been in business since 1955. Our headquarters office is located at 11 Harbor Park Drive, Port Washington, New York. Products We offer more than 100,000 brand name and private label products. We endeavor to expand and keep current the breadth of our product offerings in order... -

Page 5

... United States, we also have the ability to provide such customers with electronic data interchange ("EDI") ordering and customized billing services, customer savings reports and stocking of specialty items specifically requested by these customers. Our relationship marketers' efforts are supported... -

Page 6

... day delivery. Orders are generally shipped by third-party delivery services in the United States and in Europe. The locations of our distribution centers in Europe have enabled us to market into four additional countries with limited incremental investment. We maintain relationships with a number... -

Page 7

... the internet and by computer and office supply superstores. Timely introduction of new products or product features are critical elements to remaining competitive in the PC market. Other competitive factors include product performance, quality and reliability, technical support and customer service... -

Page 8

... Item 7, Management's Discussions and Analysis of Financial Condition and Results of Operations, for further information with respect to our operations. Available Information We maintain an internet web site at www.systemax.com . We file reports with the Securities and Exchange Commission and make... -

Page 9

... by the New York Stock Exchange in response to Sarbanes-Oxley, have required changes in corporate governance practices of public companies. These developments have already substantially increased our legal compliance, auditing and financial reporting costs and made them more time consuming. We... -

Page 10

... occur in the future. Changes to existing rules, such as the implementation of Financial Accounting Standard Board Interpretation No. 48 ("Fin 48") "Accounting for Uncertainty in Income Taxes (an interpretation of FASB Statement No. 109)", may adversely affect our reported financial results. Fin 48... -

Page 11

... our 2006 quarterly reports required under the Securities Exchange Act of 1934. Failure to file required reports on a timely basis could result in the delisting of the Company's common stock by the New York Stock Exchange. If we do not file our required annual and quarterly financial statements in... -

Page 12

... be any assurance that parts and supplies will be available in a timely manner and at reasonable prices. Any loss of, or interruption of supply, from key suppliers may require us to find new suppliers. This could result in production or development delays while new suppliers are located, which could... -

Page 13

... price of paper and periodic increases in postage rates significant changes in the computer products retail industry, especially relating to the distribution and sale of such products timely availability of existing and new products risks involved with e-commerce, including possible loss of business... -

Page 14

... of Security Holders. None. PART II Item 5. Market for Registrant's Common Equity and Related Stockholder Matters Systemax common stock is traded on the New York Stock Exchange under the symbol "SYX." The following table sets forth the high and low closing sales price of our common stock as reported... -

Page 15

... Fourth quarter $ 7.60 7.68 7.40 7.35 $ 5.16 5.58 6.51 5.65 On December 31, 2006, the last reported sale price of our common stock on the New York Stock Exchange was $17.45 per share. As of December 31, 2006, we had 235 shareholders of record. On March 14, 2007, the Company's Board of Directors... -

Page 16

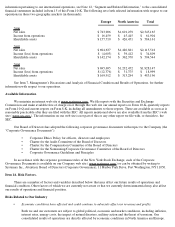

... the past several years. In response to poor economic conditions in the United States, we implemented a plan in the first quarter of 2004 to streamline our United States computer business. This plan consolidated duplicative back office and warehouse operations, which resulted in annual savings of... -

Page 17

... advertising and customer rebate reserves, and other vendor and employee related costs. While we believe that these estimates are reasonable, any significant deviation of actual costs as compared to these estimates could have a material impact on the Company's financial statements. Income Taxes . We... -

Page 18

... and annual financial statements. This Issue is effective for financial reporting periods beginning after December 15, 2006. The Company does not expect to change its presentation of such taxes, as its sales are currently recorded net of tax. In June 2006, the Financial Accounting Standards Board... -

Page 19

... successful internet-based marketing initiatives directed primarily at our consumer customers as reflected by an increase in our internet-related sales of approximately $169 million as well as an expansion of product offerings including private label products. Although our internet-related sales are... -

Page 20

... of our United States computer businesses' back office and warehouse operations, resulting in the elimination of approximately 200 jobs. We incurred $3.7 million of restructuring costs associated with this plan, including $3.2 million for staff severance and benefits for terminated employees and... -

Page 21

... 2006 the United Kingdom subsidiary recorded a profit and the Company's effective tax rate benefited by approximately 3.2% or $2.3 million.. The effective rate in 2005 also was unfavorably impacted by increased state and local taxes and losses in other foreign jurisdictions for which no tax benefit... -

Page 22

... occurred in Europe, resulting from our increased sales. This also increased our days of sales outstanding from 22 in 2005 to 23 in 2006.We expect that future accounts receivable and inventory balances will fluctuate with the mix of our net sales between consumer and business customers, as well... -

Page 23

... secured by accounts receivable, inventories and certain other assets. The undrawn availability under the facility may not be less than $15 million until the last day of any month in which the availability net of outstanding borrowings is at least $70 million. The revolving credit agreement requires... -

Page 24

... 31, 2006 we had no outstanding forward exchange contracts. Our exposure to market risk for changes in interest rates relates primarily to our variable rate debt. Our variable rate debt consists of short-term borrowings under our credit facilities. As of December 31, 2006, the balance outstanding on... -

Page 25

... in the SEC's rules and forms. Disclosure controls are also designed to provide reasonable assurance that such information is accumulated and reported to management, including the Chief Executive Officer and the Chief Financial Officer, to allow timely decisions regarding required disclosure. Our... -

Page 26

..., management may not be able to issue an unqualified opinion on the effectiveness of the Company's internal control over financial reporting as of December 31, 2007. Item 9B. Other Information. None. PART III Item 10. Directors, Executive Officers and Corporate Governance. The information required... -

Page 27

...not applicable or the required information is shown in the consolidated financial statements or notes thereto. 3. Exhibits. Exhibit No. 3.1 Description Composite Certificate of Incorporation of Registrant, as amended (incorporated by reference to the Company's annual report on Form 10-K for the year... -

Page 28

...'s annual report on Form 10K for the year ended December 31, 2005) First Amendment, dated as of June 12, 2006, to the Lease Agreement between the Company and Hamilton Business Center, LLC (Buford, Georgia facility) * (incorporated by reference to the Company's annual report on Form 10K for the year... -

Page 29

....22 14 Form of 2006 Stock Incentive Plan for Non-Employee Directors* (filed herewith). Form of 2005 Employee Stock Purchase Plan* (filed herewith). Corporate Ethics Policy for Officers, Directors and Employees (revised as of March 30, 2005) (incorporated by reference to the Company's report on Form... -

Page 30

...2007 REPORT OF ERNST & YOUNG LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Shareholders and Board of Directors of Systemax Inc.: We have audited the accompanying consolidated balance sheets of Systemax Inc. as of December 31, 2006 and 2005, and the related consolidated statements of operations... -

Page 31

...accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor... -

Page 32

... financial statements. SYSTEMAX INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY FOR THE YEARS ENDED DECEMBER 31, 2006, 2005 AND 2004 (IN THOUSANDS) Common Accumulated Number Other Unearned of Shares Additional Comprehensive Treasury Restricted OutStock Paid-in Retained Income (Loss), Stock... -

Page 33

... deferred income taxes Provision for returns and doubtful accounts Compensation expense related to equity compensation plans Tax benefit of employee stock plans Changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other current assets Income taxes payable... -

Page 34

... prior year balance sheet amounts have been reclassified to conform to current year presentation. Use of Estimates In Financial Statements - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make... -

Page 35

...vendor drop shipments, sales returns and allowances, cooperative advertising and customer rebate reserves, and other vendor and employee related costs. Product Warranties - Provisions for estimated future expenses relating to product warranties for the Company's assembled PCs are recorded as cost of... -

Page 36

.... The dilutive effect of outstanding options issued by the Company is reflected in net income per share - diluted using the treasury stock method. Under the treasury stock method, options will only have a dilutive effect when the average market price of common stock during the period exceeds the... -

Page 37

... income (loss), as all options granted under the plans had an exercise price equal to the market value of the underlying stock on the date of grant (See Note 8). Recent Accounting Pronouncements In June 2006, the FASB ratified the consensus reached by the EITF on Issue No. 06-3, "How Taxes Collected... -

Page 38

...): Furniture and fixtures, office, computer and other equipment Less: Accumulated amortization 2006 ---$2,358 1,270 ----$1,088 ------ 2005 ---$1,582 754 --$ 828 ----- 4. RELATED PARTY TRANSACTIONS The Company leased its headquarters office/warehouse facility from affiliates during the years... -

Page 39

... building and the Company's shares of stock in its domestic and United Kingdom subsidiaries. The credit facility expires and outstanding borrowings thereunder are due on October 26, 2010. The borrowings under the agreement are subject to borrowing base limitations of up to 85% of eligible accounts... -

Page 40

... shares of common stock at a price equal to the fair market value at the date of grant of the option and restricted stock awards. Awards for a maximum of 200,000 shares may be granted under this plan. A total of 15,000 options were outstanding under this plan as of December 31, 2006. Shares issued... -

Page 41

... an income tax deduction for stock options exercised by employees in the United States equal to the excess of the market value of our common stock on the date of exercise over the option price. Prior to the adoption of SFAS 123(R), the income tax benefit from the exercise of stock options was... -

Page 42

... the closing stock price on the last day of trading in the year December 31, 2006 and the exercise price) that would have been received by the option holders had all options been exercised on December 31, 2006. This value will change based on the fair market value of the Company's common stock. The... -

Page 43

...a fair value alternative method as stated in SFAS 123, "Accounting for Stock-Based Compensation" (in thousands, except per share data): 2005 ---$11,441 647 2004 ---$10,188 886 Net income - as reported Add: Stock-based employee compensation expense included in reported net income, net of related tax... -

Page 44

..., the Company implemented a plan to streamline the back office and warehousing operations in its United States computer businesses. The Company recorded $3.8 million of costs related to this plan, including $3.2 million for severance and benefits for approximately 200 terminated employees and $483... -

Page 45

... to expense in 2005 Amounts utilized Balance at December 31, 2005 Amounts utilized Balance at December 31, 2006 10. INCOME TAXES The components of income (loss) before income taxes are as follows (in thousands): Years Ended December 31 United States Foreign Total 2006 ---$53,587 $16,108 ------$69... -

Page 46

... tax expense (benefit) and the computed income tax expense based on the Federal statutory corporate rate is as follows (in thousands): Years Ended December 31 Income tax at Federal statutory rate State and local income taxes (benefits) and changes in valuation allowances, net of federal tax benefit... -

Page 47

... principal shareholders and senior executive officers (see Note 4). The Company also acquires certain computer and communications equipment pursuant to capital lease obligations. At December 31, 2006, the future minimum annual lease payments for capital leases and related and third-party operating... -

Page 48

... fair value of financial instruments based on interest rates available to the Company and by comparison to quoted market prices. At December 31, 2006, 2005 and 2004, the carrying amounts of cash and cash equivalents, accounts receivable, income taxes receivable and payable and accounts payable are... -

Page 49

... 1,819 279,160 ------$504,544 ======== Financial information relating to the Company's operations by geographic area was as follows (in thousands): 2006 ---Net Sales: United States: Industrial products Technology Products United States total Other North America Europe Year Ended December 31 2005... -

Page 50

... EVENTS On March 14, 2007, the Company's Board of Directors declared a special dividend of $1.00 per share payable on April 12, 2007 to shareholders of record on April 2, 2007. The Company expects to use approximately $35.8 million in cash to satisfy this dividend obligation. 14. QUARTERLY... -

Page 51

... Company and Lawrence P. Reinhold. Form of 2006 Stock Incentive Plan for Non-Employee Directors. Form of 2005 Employee Stock Purchase Plan. Subsidiaries of the Registrant Consent of experts and counsel: Consent of Independent Registered Public Accountants Certification of the Chief Executive Officer... -

Page 52

... accounting/financial controls, financial statements, tax returns, etc. so as to resolve any outstanding Company business, accounting or tax issue. In consideration for the part-time employment services to be provided by the Employee the Company shall pay the Employee during the Part-Time Employment... -

Page 53

... shall be extended to include the period beginning on the first day of the Part-Time Employment Period and ending one (1) year following the last day of the PartTime Employment Period. 2. All other terms of the Employment Agreement shall remain unchanged. Dated: January 17, 2007 SYSTEMAX INC. By... -

Page 54

..., New York subject to travel and other duties outside of such location consistent with the Company's business as the CEO shall reasonably determine. In performing his duties, the Employee shall report to the Chief Executive Officer and Board of Directors and shall be subject to the direction of... -

Page 55

... comply with any policies of the Company or any directions of the Board of Directors consistent with the Employee's duties hereunder (including the Employee's responsibility to devote his full working time and attention to the business of the Company), other than any such failure resulting from the... -

Page 56

... contemplated by this Agreement (except as may otherwise be required by law or applicable regulation of any self-regulatory organization such as The New York Stock Exchange), or any other action by the Company which results in a material diminution in the Employee's compensation, position (including... -

Page 57

... the applicable Date of Termination; (iii) (A) If the Employee has been employed by the Company for less than two years through the Date of Termination the Company shall pay to the Employee a pro-rated bonus that is equal to the sum of the number of days the Employee was employed by the Company in... -

Page 58

...of the Employee's employment with the Company, the Employee will acquire and have access to Confidential Information and Trade Secrets belonging to the Systemax Companies. Such Confidential Information and Trade Secrets relates both to the Systemax Companies, their customers and their employees, and... -

Page 59

... in the sale of computer, consumer electronic and industrial products in direct and material competition with the Company. In recognition of the national nature of the Company's business, which includes the sale of its products and services throughout the United States of America, this restriction... -

Page 60

... as "Intellectual Property"), that were conceived, developed or made by Employee during employment by the Company, including Intellectual Property related to the sale of computer, consumer electronic and industrial products (the "Proprietary Interests"), shall belong to and be the property... -

Page 61

... as all other executive officers of the Company in accordance with and as authorized by the Company's Certificate of Incorporation, by-laws, Board of Directors resolutions and applicable law. 12. Entire Agreement . This Agreement sets forth the entire understanding of the parties hereto with respect... -

Page 62

... of the Plan, Fair Market Value shall be the closing sales price per share as reported on the principal exchange on which the Shares are listed for the date in question, or if there were no sales on such date, on the first date prior thereto on which the Shares were so traded. Payment . Options may... -

Page 63

...in cash or by check payable to the order of the Company, to pay the full purchase price of the Shares, or (d) by a combination of the foregoing, provided that the combined value of all cash and cash equivalents and the Fair Market Value of any such Shares so tendered to the Company as of the date of... -

Page 64

...be, and the number of Shares subject to any outstanding option shall be increased or decreased proportionately, as the case may be, with appropriate corresponding adjustment in the purchase price per Share thereunder in order to prevent enlargement or dilution of the benefits intended to be provided... -

Page 65

at an earlier date by stockholders or is terminated by exhaustion of the Shares available for issuance hereunder. -

Page 66

... participate in any one or more of the Offerings under the Plan, provided that as of the first day of the applicable Offering (the "Offering Date") he or she has been an employee for at least one (1) year and is customarily employed by the Company or a Designated Subsidiary for more than twenty (20... -

Page 67

... any other employee stock purchase plan of the Company and its Parents and Subsidiaries, to accrue at a rate which exceeds $25,000 of the fair market value of such stock (determined on the option grant date or dates) for each calendar year in which the Option is outstanding at any time. The purpose... -

Page 68

...; provided, however, that if the Common Stock is traded on a national securities exchange or other primary trading market, the Fair Market Value of the Common Stock will equal the closing sales price as reported on the principal exchange or market for the Common Stock on such date. If there is no... -

Page 69

... by the employee. 16. Application of Funds. All funds received or held by the Company under the Plan may be combined with other corporate funds and may be used for any corporate purpose. 17. Adjustment in Case of Changes Affecting Common Stock. In the event of a subdivision of outstanding shares of... -

Page 70

... Computer Supplies Inc. (a New York corporation) Global Equipment Company Inc. (a New York corporation) Tiger Direct Inc. (a Florida corporation) Nexel Industries Inc. (a New York corporation) Systemax Manufacturing Inc. (a Delaware corporation) Profit Center Software Inc. (a New York corporation... -

Page 71

... the Company's restatement described in Note 2 to the consolidated financial statements, relating to the consolidated financial statements and financial statement schedule for the year ended December 31, 1002 of Systemax, Inc. and subsidiaries appearing in the Annual Report on Form 10-K of Systemax... -

Page 72

...-Term Stock Incentive Plan of Systemax Inc. of our report dated March 27, 2007 at and for the year ended December 31, 2006, with respect to the consolidated financial statements and schedule of Systemax Inc. in the Annual Report (Form 10-K) for the year ended December 31, 2006. New York, New York... -

Page 73

...Chief Executive Officer of Systemax Inc., certify that: 1. I have reviewed this annual report on Form 10-K of Systemax Inc. (the "registrant"); 2. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the... -

Page 74

...Chief Financial Officer of Systemax Inc., certify that: 1. I have reviewed this annual report on Form 10-K of Systemax Inc. (the "registrant"); 2. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the... -

Page 75

... for the Year Ended December 31, 2005 fully complies with the requirements of Section 13(a) or Section 15 (d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78 (o)(d)) and that the information contained in such Form 10K fairly presents, in all material respects, the financial condition and... -

Page 76

... for the Year Ended December 31, 2005 fully complies with the requirements of Section 13(a) or Section 15 (d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78 (o)(d)) and that the information contained in such Form 10K fairly presents, in all material respects, the financial condition and...