Circuit City 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As a result of the factors discussed above, net income increased $2.4 million, or 6.3%, to $41.3 million in 1998.

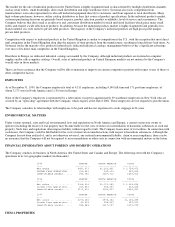

SEASONALITY

The operations of the Company are somewhat seasonal. In particular, net sales have historically been modestly weaker during the second and

third quarter as a result of lower business activity during the summer months. The following table sets forth the net sales, gross profit and

income from operations for each of the quarters since January 1, 1998 (AMOUNTS IN MILLIONS).

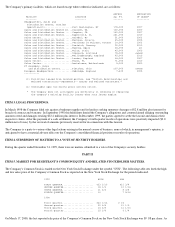

LIQUIDITY AND CAPITAL RESOURCES

The Company's primary capital needs are to finance working capital for sales growth, investments in property, equipment and information

technology and business acquisitions. The Company's primary source of financing has been cash from operations. The Company believes that

its cash flow from operations, existing cash and available lines of credit will be adequate to support its current and anticipated activities.

The Company continues to maintain a strong financial position. Cash flow is provided primarily by operations. Cash flow from operating

activities was $20.5 million in 1999, $37.8 million in 1998 and $33.1 million in 1997. The decrease in cash flow in 1999 resulted from

increased inventories, caused by a one-time buildup to service increased demand. Additionally, accounts receivable increased in 1999 as a

result of the increase in sales and an increase in the average days sales outstanding due to a change in the mix of sales by location. The increase

in inventories and accounts payable and accrued expenses in 1998 resulted from expansion activities in the Company's PC assembly operation

and increased sales activity.

In 1999 the Company used net cash of $36.1 million for investing activities. Expenditures for property, plant and equipment totaled $22.0

million and included expansion of the Company's PC assembly facility and improvements to information systems. Expenditures for business

acquisitions, including the payment of contingent consideration, totaled $19.2 million. Short-term investments decreased by $5.0 million to

partially fund these activities. Net cash of $13.0 million was used in 1998 in investing activities for business acquisitions and additions to

property, plant and equipment, offset by a $4.0 million decrease in short-term investments. This included capacity expansion at the PC

assembly facility, completion of the new Compton, California facility and improvements to information systems. Net cash used in investing

activities in 1997 was primarily for the acquisition of Midwest Micro and the acquisition of furniture, fixtures and leasehold improvements

needed to accommodate increased staff levels at the new Compton, California facility. Short- term investments were decreased by $22.0

million as partial funding for these activities resulting in net cash used of $25.2 million for investing activities for the year.

In 1999 $3.8 million of cash was used in financing activities. In 1998 $25.4 million was used and in 1997 $0.5 million was used. In 1999, $10.1

million was used to repurchase additional shares of the Company's common stock and $2.5 million was used to repay a mortgage loan. This

was partially funded by $9.0 million in short-term bank borrowings. In 1998, the Company used $28.6 million of cash to purchase shares of its

common stock. The use of funds in 1997 was for the repayment of long-term debt.

The Company maintains secured and unsecured lines of credit with various financial institutions under which the maximum aggregate amount

available is approximately $74 million. As of December 31, 1999, the Company had $9 million of outstanding borrowings under these lines of

credit. Borrowings under the lines bear interest based on either the prime rate or LIBOR. The maximum borrowings under the facilities are

reduced where applicable by the value of any outstanding letters of credit issued on behalf of the Company. The Company does not anticipate

any difficulty in renewing or replacing any if its lines of credit as they expire.

The Company is party to certain litigation, as disclosed in "Commitments and Contingencies" in the Notes to Consolidated Financial

Statements, the outcome of which the Company believes will not have a material adverse effect on its consolidated financial statements.

Anticipated capital expenditures in 2000 are expected to approximate $20 million, which the Company plans to fund out of cash from

operations and its lines of credit. These capital expenditures are primarily for the purchase of a new distribution center in Georgia and the

acquisition of information technology systems and other fixed assets.

YEAR 2000 COMPLIANCE

Based on current information, management believes that the Company is now Y2K compliant. The cost of achieving such compliance did not

have a materially adverse effect on the Company's results of operations or financial condition.

1999 MARCH 31 JUNE 30 SEPTEMBER 30 DECEMBER 31

---- -------- ------- ------------ -----------

NET SALES...................................... $422 $414 $440 $478

GROSS PROFIT................................... $79 $76 $78 $81

INCOME FROM OPERATIONS......................... $17 $9 $16 $18

1998 MARCH 31 JUNE 30 SEPTEMBER 30 DECEMBER 31

---- -------- ------- ------------ -----------

Net sales...................................... $358 $331 $360 $387

Gross profit................................... $75 $67 $72 $75

Income from operations......................... $20 $12 $16 $17