Circuit City 1999 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1999 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of March 17, 2000, the Company had 277 stockholders of record.

The Company has not paid any dividends since its initial public offering and anticipates that all of its income in the foreseeable future will be

retained for the development and expansion of its business, and therefore does not anticipate paying dividends on its Common Stock in the

foreseeable future. See "Certain Relationships and Related Transactions" for a description of the Company's historical distributions.

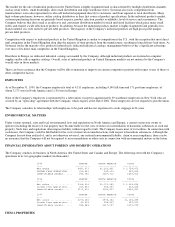

ITEM 6. SELECTED FINANCIAL DATA.

The following selected financial information is qualified by reference to, and should be read in conjunction with, the Company's Consolidated

Financial Statements and the notes thereto, and "Management's Discussion and Analysis of Financial Condition and Results of Operations"

contained elsewhere in this report. The selected income statement data for the years ended December 31, 1999, 1998 and 1997 and the selected

balance sheet data as of December 31, 1999 and 1998 is derived from the audited consolidated financial statements which are included

elsewhere in this report. The selected balance sheet data as of December 31, 1997, 1996 and 1995 and the selected income statement data for

the year ended December 31, 1996 is derived from the audited financial statements of the Company which are not included in this report. The

selected income statement data for the year ended December 31, 1995 is derived from the audited financial statements of interrelated

predecessor companies of Systemax which are not included in this report.

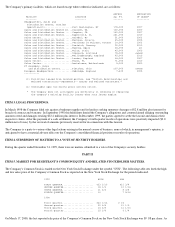

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

RESULTS OF OPERATIONS

The following table represents the Company's consolidated statement of income data expressed as a percentage of net sales for the three most

recent fiscal years:

INCOME STATEMENT DATA:

(IN MILLIONS, EXCEPT PER COMMON SHARE DATA, NUMBER OF CATALOG TITLES AND NUMBER OF COUNTRIES)

1999 1998 1997 1996 1995

---- ---- ---- ---- ----

Net sales........................................ $1,754.5 $1,435.7 $1,145.4 $911.9 $634.5

Gross profit..................................... $314.5 $288.6 $265.5 $249.6 $197.3

Selling, general and

administrative expenses...................... $254.7 $224.2 $206.3 $180.1 $143.2

Income from operations.......................... $59.8 $64.3 $59.3 $69.5 $54.1

Income taxes.................................... $24.5 $25.8 $23.3 $27.7 $21.0(2)

Net income...................................... $36.0 $41.3 $38.8 $43.7 $33.1(2)

Net income per common share:

Basic....................................... $1.01 $1.11 $1.02 $1.16 $.93(2)

Diluted..................................... $1.01 $1.11 $1.02 $1.15 $.93(2)

Weighted average common shares outstanding:

Basic....................................... 35.8 37.3 38.0 37.6 35.5(2)

Diluted..................................... 35.8 37.3 38.2 38.1 35.5(2)

SELECTED OPERATING DATA:

Active customers (1)............................ 1.8 1.8 1.8 1.7 1.7

Orders entered.................................. 4.4 3.8 3.5 3.4 2.5

Number of catalogs distributed.................. 171 179 162 160 122

Number of catalog titles........................ 37 44 41 40 32

Number of countries receiving catalogs.......... 14 14 13 12 10

BALANCE SHEET DATA (AT DECEMBER 31, IN MILLIONS):

Working capital ................................ $186.9 $194.6 $187.8 $194.4 $122.2

Total assets.................................... $550.0 $454.4 $399.7 $331.4 $247.5

Short-term debt................................. $9.0 $.5 $5.4

Long-term debt, excluding current portion....... $1.7 $2.5 $2.0 $2.0 $2.9

Stockholders' equity............................ $308.3 $286.6 $272.2 $228.6 $154.0

(1) An "active customer" is defined as a customer who has purchased from the Company within the preceding 12 months.

(2) Amount is calculated on a pro forma basis.

1999 1998 1997

---- ---- ----

Net sales................................... 100.0% 100.0% 100.0%

Gross profit................................ 17.9 20.1 23.2

Selling, general and administrative expenses 14.5 15.6 18.0

Income from operations...................... 3.4 4.5 5.2

Interest income............................. .1 .2 .3

Interest expense............................

Income taxes................................ 1.4 1.8 2.0

Net income.................................. 2.1 2.9 3.4