Chrysler 2011 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2011 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

195

Consolidated

Financial Statements

at 31 December 2011

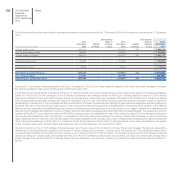

In order to maintain the necessary operating flexibility over an adequate time period and given that their authorisation expired on 27 September 2010, on 26

March 2010 Shareholders in general meeting extended the term permitted for the purchase and disposal of treasury shares, including transactions carried

out through subsidiary companies, by a further 18 months period, at the same time revoking the authorisation given by them in the general meeting of

27 March 2009 to the extent not exercised at that date. The authorisation provided for the purchase of a maximum number of shares, for all three classes

combined, not to exceed 10% of share capital or a purchase value of €1.8 billion, inclusive of the €657 million in Fiat shares already held by the Company.

At the extraordinary general meeting of 16 September 2010, in consideration of the reduction in the par value of Fiat S.p.A. shares from €5.00 to €3.50 per

share as a result of the Demerger, Shareholders approved a reduction in the authorisation for the purchase of treasury shares to a maximum value of €1.2

billion, without altering the condition that the total number of shares, in all three classes, may not exceed 10% of share capital or any of the other provisions

approved by Shareholders on 26 March 2010, and without amending the authorisation expiry date of 26 September 2011. Reaffirming that the share

buy-back programme has been placed on hold, in order to maintain the necessary operating flexibility for an adequate period, Shareholders at the Annual

General Meeting on 30 march 2011, approved, the authorisation for the purchase be renewed for a period of 18 months and for the maximum amount of

shares for the three classes not to exceed the legally established percentage of share capital, and €1.2 billion including the existing restricted reserve for

treasury shares, which after the effects of the Demerger discussed earlier amounted to €289 million.

On 22 February 2012 the Board of Directors proposed to Shareholders the renewal, for a period of eighteen months, of the authorization already granted to

purchase own shares of the three categories such not to exceed the legal limitation of the share capital and the maximum counter value of approximately

€1.2 billion, including reserves allocated for treasury shares already held for €259 million. Such authorisation is requested in order to service the incentive

plans based on financial instruments approved by Fiat S.p.A. and, more generally, in order for the Company to benefit from a strategic investment

opportunity for all purposes permissible under applicable law.

On the same date the number of Treasury shares resulted reduced by 4,000,000 due the assignment to the Chief Executive Officer of the shares vested

under the 2009 Stock Grant Plan (see Note 25). As a result there were 34,568,458 treasury shares at that date.

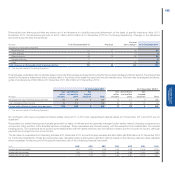

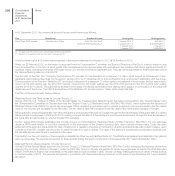

Capital reserves

At 31 December 2011, capital reserves amounting to €147 million (€601 million at 31 December 2010) were reduced by €457 million as a consequence

of the Demerger.

Revenue reserves

The main revenue reserves are as follows:

the legal reserve of Fiat S.p.A. of €524 million at 31 December 2011 (€716 million at 31 December 2010) which was reduced by €215 million as a

consequence of the Demerger;

retained earnings of €1,952 million at 31 December 2011 (retained earnings of €2,796 million at 31 December 2010);

the profit attributable to owners of the parent of €1,334 million at 31 December 2011 (a profit of €520 million for the year ended 31 December 2010);

the reserve for share-based payments of €52 million at 31 December 2011 (€113 million at 31 December 2010).

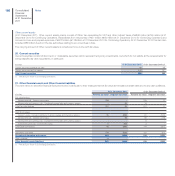

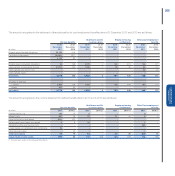

As discussed in Note 25 below, on the Demerger the underlying of the outstanding stock option and stock grant plans at 31 December 2010 was

adjusted by allowing the beneficiaries to receive one ordinary Fiat share and one ordinary Fiat Industrial share for each right held, with the pre-established

option exercise price (for stock option plans) and the free granting of shares (for the stock grant plan) remaining unchanged. In accordance with IFRS 2

– Share based payment, this change required that the stock option and stock grant plans be accounted for as compound financial instruments and in

particular that the Reserve for share-based payments at that date be separated into a liability component (the counterparty’s right to receive one Fiat

Industrial S.p.A. share) and an equity component (the counterparty’s right to receive one Fiat S.p.A. share). All stock option and stock grant plans, with

the exception of the portion of the 2006 Plan relating to managers for which a capital increase was approved, will additionally be serviced by the use of

Treasury shares held by Fiat S.p.A. and the Fiat Industrial ordinary shares that were allotted as a result of the Demerger. The alignment of the underlying

of the above plans led to the reclassification of a portion of this reserve (amounting to €62 million) to Other provisions for employees and liabilities for

share-based payments (Note 26). On the day on which the Fiat Industrial S.p.A. shares were first quoted, this amount represented the portion of the

book value of the Reserve for share-based payments attributable to each plan and relating to the component of the plans which will be serviced by Fiat

Industrial S.p.A. shares, calculated on the basis of the weighting of the quotations of the two shares at that date.