Chesapeake Energy 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

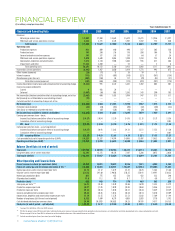

Revenues

Natural gas and oil sales

$ 5,049

$ 7,858 $ 5,624 $ 5,619 $ 3,273 $ 1,936 $ 1,297

Midstream and service operations revenue

2,653

3,771 2,176 1,707 1,392 773 420

Total revenues

$ 7,702 $ 11,629 $ 7,800 $ 7,326 $ 4,665 $ 2,709 $ 1,717

Operating costs

Production expenses

876

889 640 490 317 205 138

Production taxes

107

284 216 176 208 104 78

General and administrative expenses

349

377 243 139 64 37 24

Midstream and service operations expenses

2,498

3,648 2,063 1,590 1,358 755 410

Depreciation, depletion and amortization

1,615

2,144 1,988 1,462 945 611 386

Impairments and other

11,202

2,830 — 55 — 5 6

Total operating costs

16,647

10,172 5,150 3,912 2,892 1,717 1,042

Income (loss) from operations

(8,945 )

1,457 2,650 3,414 1,773 992 675

Other income (expense)

(28 )

(11 ) 15 26 10 5 1

Interest expense

(113 )

(271 ) (401 ) (316 ) (221 ) (167 ) (154 )

Miscellaneous gains (losses)

(202 )

(184 ) 83 117 (70 ) (25 ) (21 )

Total other income (expense)

(343 )

(466 ) (303 ) (173 ) (281 ) (187 ) (174 )

Income (loss) before income taxes and cumulative effect of accounting change

(9,288 )

991 2,347 3,241 1,492 805 501

Income tax expense (benefit):

Current

4

423 29 5 — — 5

Deferred

(3,487 )

(36 ) 863 1,242 545 290 185

Net income (loss) before cumulative effect of accounting change, net of tax

(5,805 )

604 1,455 1,994 947 515 311

Net (income) loss attributable to noncontrolling interest

(25 )

— — — — — —

Cumulative effect of accounting change, net of tax

—

— — — — — 2

Net Income (loss)

$ (5,830 ) $ 604 $ 1,455 $ 1,994 $ 947 $ 515 $ 313

Preferred stock dividends

(23 )

(33 ) (94 ) (89 ) (42 ) (40 ) (22 )

Gain (loss) on redemption of preferred stock

—

(67 ) (128 ) (10 ) (26 ) (36 ) —

Net income (loss) available to common stockholders

$ (5,853 ) $ 504 $ 1,233 $ 1,895 $ 879 $ 439 $ 291

Earnings per common share – basic:

Income (loss) before cumulative effect of accounting change

$ (9.57 )

$

0.94

$

2.70

$

4.76

$

2.73

$

1.73

$

1.36

Cumulative effect of accounting change

—

— — — — — 0.02

EPS – basic

$ (9.57 ) $ 0.94 $ 2.70 $ 4.76 $ 2.73 $ 1.73 $ 1.38

Earnings per common share – assuming dilution:

Income (loss) before cumulative effect of accounting change

$ (9.57 )

$ 0.93 $ 2.63 $ 4.33 $ 2.51 $ 1.53 $ 1.20

Cumulative effect of accounting change

—

— — — — — 0.01

EPS – assuming dilution

$ (9.57 ) $ 0.93 $ 2.63 $ 4.33 $ 2.51 $ 1.53 $ 1.21

Cash provided by (used in) operating activities (GAAP)

$ 4,356

$ 5,357 $ 4,974 $ 4,843 $ 2,407 $ 1,432 $ 939

Operating cash flow (non-GAAP) *

$ 4,333 $ 5,299 $ 4,675 $ 4,040 $ 2,426 $ 1,403 $ 897

Balance Sheet Data (at end of period)

Total assets

$ 29,914

$ 38,593 $ 30,764 $ 24,413 $ 16,114 $ 8,245 $ 4,572

Long-term debt, net of current maturities

12,295

13,175 10,178 7,187 5,286 3,075 2,058

Total equity (deficit)

$ 12,341 $ 17,017 $ 12,624 $ 11,366 $ 6,299 $ 3,163 $ 1,733

Other Operating and Financial Data

Proved reserves in natural gas equivalents (bcfe)

14,254 12,051 10,879 8,956 7,521 4,902 3,169

Future net natural gas and oil revenues discounted at 10% **

$ 9,449 $ 15,601 $ 20,573 $ 13,647 $ 22,934 $ 10,504 $ 7,333

Natural gas price used in reserve report (per mcf)

$ 3.13

$ 5.12 $ 6.19 $ 5.41 $ 8.76 $ 5.65 $ 5.68

Oil price used in reserve report (per bbl) $ 56.72

$ 41.60 $ 90.58 $ 56.25 $ 56.41 $ 39.91 $ 30.22

Natural gas production (bcf)

835

775 655 526 422 322 240

Oil production (mmbbl)

11.8

11.2 9.9 8.7 7.7 6.8 4.7

Production (bcfe)

906 843 714 578 469 363 268

Sales price per mcfe ***

$ 6.22

$ 8.38 $ 8.40 $ 8.86 $ 6.90 $ 5.23 $ 4.79

Production expense per mcfe

$ 0.97

$ 1.05 $ 0.90 $ 0.85 $ 0.68 $ 0.56 $ 0.51

Production taxes per mcfe

$ 0.12

$ 0.34 $ 0.30 $ 0.31 $ 0.44 $ 0.29 $ 0.29

General and administrative expense per mcfe

$ 0.38

$ 0.45 $ 0.34 $ 0.24 $ 0.14 $ 0.10 $ 0.09

Depreciation, depletion and amortization expense per mcfe

$ 1.78

$ 2.55 $ 2.78 $ 2.53 $ 2.02 $ 1.69 $ 1.44

Number of employees (full-time at end of period)

8,152

7,649 6,219 4,883 2,885 1,718 1,192

Cash dividends declared per common share

$ 0.30

$ 0.2925 $ 0.2625 $ 0.23 $ 0.195 $ 0.17 $ 0.135

Stock price (at end of period – split adjusted)

$ 25.88 $ 16.17 $ 39.20 $ 29.05 $ 31.73 $ 16.50 $ 13.58

* See page 13 for definition of this non-GAAP measure.

** PV-10 is the present value (10% discount rate) of estimated future gross revenues to be generated from the production of proved reserves, net of production and future development costs, using assumed prices and costs.

Please see page 129 of our Form 10-K for information on the standardized measure of discounted future net cash flows.

*** Excludes unrealized gains (losses) on natural gas and oil hedging.

S

tock

p

r

i

c

e

(

a

t

en

d

of

p

er

i

o

d

–

s

plit

adjusted

)

$

25.88

$

1

6.

17

$

39.20

$

29.05

$

3

1

.

7

3

$

1

6.50

$

1

3.58

P

r

oduc

t

ion

(

bcfe

)

9

0

6

843

714

5

7

8

4

6

9

3

6

3

2

68

P

r

o

v

ed

r

ese

rv

es

in

n

a

t

u

r

al

ga

s

e

q

u

i

va

l

ents

(

bcfe

)

14,25

4

12,05

1

1

0,879 8,956

7

,521

4

,902 3,16

9

F

utur

e

net natural

g

a

s

an

d

oil reve

n

ues discounte

d

a

t

1

0%

**

$

9

,44

9

$

15,

601

$

20

,57

3

$

1

3

,

6

47

$

22

,

93

4

$

1

0

,5

0

4

$

7,

333

To

t

al

e

q

u

i

t

y

(

deficit

)

$

12,341

$

17,017

$

12,62

4

$

11,366

$

6,29

9

$

3,16

3

$

1,73

3

T

otal asset

s

$

29

,

9

1

4

$

38

,5

93

$

30

,7

64

$

2

4,41

3

$

1

6

,11

4

$

8

,

2

45

$

4,57

2

O

perating cash

f

low (non-GAAP)

*

$

4,

333

$

5,

299

$

4,

6

75

$

4,

0

4

0

$

2

,4

26

$

1,4

03

$

897

EP

S

–

assum

i

n

g

dil

ut

i

on

$

(

9.5

7

)

$

0.93

$

2.63

$

4

.33

$

2.5

1

$

1

.53

$

1

.2

1

EP

S

– basi

c

$

(9.5

7

)

$

0.94

$

2.

7

0

$

4

.

7

6

$

2.

7

3

$

1

.

7

3

$

1

.38

Net

i

n

co

m

e

(

loss

)

a

v

ailable

t

o

co

mm

on

s

t

ockholde

r

s

$

(5

,

85

3

)

$

50

4

$

1

,

233

$

1

,

895

$

87

9

$

43

9

$

291

Net

I

n

co

m

e

(

loss

)

$

(

5,830

)

$

60

4

$

1

,

455

$

1,994

$

94

7

$

515

$

31

3

T

o

t

al

r

e

v

e

n

ues

$

7,702

$

11,629

$

7,800

$

7,326

$

4,665

$

2,70

9

$

1

,

717

Years Ended December 31

FINANCIAL REVIEW

($ in millions, except per share data)

Financial and Operating Data 2009 2008 2007 2006 2005 2004 2003

1 CHESAPEAKE ENERGY CORPORATION