Chesapeake Energy 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letter to Shareholders

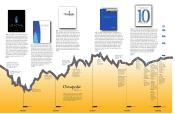

The cover to this year’s Annual Report makes clear that

Chesapeake celebrated its tenth anniversary as a public

company in 2002. Despite experiencing extremely

volatile oil and natural gas prices during the past ten

years, Chesapeake has grown from little more than a

start-up to become the eighth largest independent

natural gas producer in the U.S. Along the way,

Chesapeake has delivered a total return to shareholders

of 482%, a Compounded Annual Growth Rate

(CAGR) of 20%.

We are especially proud that many of Chesapeake’s

operational results in 2002 were its best ever. The com-

pany ended 2002 with 2.2 trillion cubic feet of gas

equivalent (tcfe)

proved reserves

and produced

181.5 billion

cubic feet of gas

equivalent (bcfe)

during the year.

Both of these

were records and

represented

increases of 24%

and 12%, respectively, over last year’s results.

And, we are already off to a great start in 2003. During

the first quarter of 2003, Chesapeake purchased $830

million of attractively priced, high-quality Mid-

Continent gas reserves from ONEOK, Inc., El Paso

Corporation and Vintage Petroleum, Inc. These pur-

chases ensure that in 2003 Chesapeake will once again

reach record levels of proved reserves and production.

We are currently estimating that the company’s year-

end 2003 proved reserves will exceed 2.75 tcfe, and

2003 production levels should exceed 230 bcfe, both

increases of approximately 25% over 2002’s results.

Chesapeake’s Business Strategy

The driver of Chesapeake’s accomplishments during the

past decade has been the company’s unique focus on

building one of the nation’s largest onshore natural gas

asset bases through balanced programs of deep gas

exploration and opportunistic producing property

acquisitions. The successful execution of this balanced

business strategy has enabled Chesapeake to build

unique economies of scale, an unrivaled backlog of

drilling opportunities and the most accomplished

Mid-Continent team of land, geoscience, engineering

and operations personnel.

Because natural gas has become the fuel of choice to

meet steadily increasing energy demand in the U.S.,

Chesapeake’s focus on natural gas should provide sub-

stantial growth and financial return opportunities for its

shareholders in the years ahead. With an undeveloped

prospect inventory of 2,000 drillsites and further Mid-

Continent consolidation opportunities likely in the

coming years, our goal is to continue increasing

Chesapeake’s proved

reserves, natural gas

production, cash flow

from operations and

earnings per share by at

least 15% per year on

average. We also plan

to continue improving

Chesapeake’s balance

sheet and believe that

further credit rating

agency upgrades are likely as we continue executing the

company’s business strategy.

Chesapeake’s Mid-Continent Focus

This strategy includes staying focused on the Mid-

Continent, which is the nation’s third-largest gas supply

region and the location of 90% of Chesapeake’s assets.

Geographically, this area consists of Oklahoma, western

Arkansas, the Texas Panhandle and southwest Kansas.

In this region, Chesapeake is the largest natural gas

producer (with a gas production market share greater

than the combined share of the next two largest pro-

ducers – BP and Apache), the most active driller (by

a 4:1 margin over the second most active driller) and

the most aggressive consolidator of under-exploited

producing assets.

We have a number of reasons for concentrating in this

region. The Mid-Continent is characterized by long-

lived natural gas reserves that have predictable decline

curves, multiple drilling targets that significantly reduce

Chesapeake 2002 Annual Report

2

Growth in a $100 Investment Feb. 4, 1993 (CHK IPO date) through March 31, 2003

Chesapeake

$589.50

Peers*

$260.88

Dow Jones $233.91

NASDAQ $189.20

S&P $188.67

126%

152%

212%

212%

CHK Outperforms By:

* Peers = APA, APC, BR, COG, DVN, EOG, FST, KMG, NBL, NFX, OEI, PPP, PXD, VPI, XTO