Chesapeake Energy 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letter to Shareholders

Dear Shareholders:

The theme of this year’s letter to our sharehold-

ers is

Leading the Way

in value creation. This

phrase reflects our performance during the past

year and the philosophy of how we run our busi-

ness. We focus on the details and strive to be

the best at what we do: profitably finding and

producing large amounts of natural gas, princi-

pally in the U.S. Mid-Continent region. We

believe superior results are achieved by focused

effort from talented professionals working on

high quality natural gas assets – attributes that

Chesapeake has in abundance.

Chesapeake’s performance in 2001 was consis-

tent with our goal of

Leading the Way

. For the

second consecutive year, our company estab-

lished new records for production, proved

reserves, ebitda, cash flow and recurring net

income. Chesapeake’s superior performance

in 2001 resulted from a series of important

management decisions made during the past

several years that highlight our contrarian

attitudes about how to best achieve success in

this highly competitive and mature industry.

Our decisions included:

•

Product strategy

– we favored domestic nat-

ural gas over oil because we believe natural gas

is the superior fuel for the future and has greater

price upside;

•

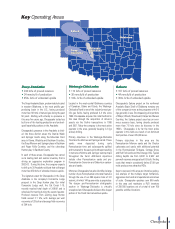

Geographic strategy

– we concentrated in our

own backyard, the Mid-Continent region of the

U.S., where our economies of scale provide high

returns on investment and where our deep gas

exploration and production expertise enables

us to locate large new reserves of natural gas;

•

Business strategy

– we continue to be equal-

ly adept at both drilling and acquiring, investing

over $1.1 billion last year to add 919 bcfe of new

natural gas reserves and delivering one of the

best finding cost records in the industry;

•

Investment strategy

– we reduced our drilling

activity last summer when drilling costs reached

their peak and have since responded counter-

cyclically by increasing our drilling activity as

costs have fallen sharply from last summer; and

•

Risk-management strategy

– we recognized

that oil and natural gas prices were unusually

high in early 2001 and we captured much of this

premium through hedging transactions, thereby

locking in high profit margins for 2001-03.

Leading the Way in Value Creation

The impact of these decisions is reflected both

in our exceptional 2001 performance and in our

outstanding three-year results from year-end

1998 through year-end 2001. During this period:

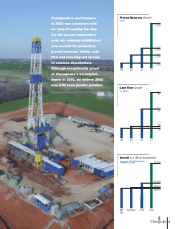

•Production increased from 130 bcfe to 161

bcfe, a compounded annual growth rate (CAGR)

of 7%;

•Proved reserves increased from 1,091 bcfe to

1,780 bcfe, a CAGR of 18%;

•Production replacement was 261% while

finding and development costs averaged only

$1.05 per mcfe for the 1,536 bcfe of new

reserves added through acquisitions and drilling;

•Ebitda increased from $183 million to

$620 million and cash flow grew from $115 mil-

lion to $522 million, CAGR’s of 50% and

66%, respectively;

•Net income available to common sharehold-

ers totaled $686 million and shareholders’ equi-

ty increased by $1.02 billion;

•Net long-term debt per mcfe of proved

reserves declined 18% from $0.83 to $0.68; and,

•Our stock price increased from $0.75 per

share to $6.61, a CAGR of 107%. This was the

best performance in the industry and in the top

10 among all publicly-traded stocks during

this period.

As a result of this exceptional performance,

Chesapeake has become the second largest

producer of natural gas in the Mid-Continent

region, among the largest independent gas pro-

ducers in the U.S. and one of the most profitable

producers of natural gas in the industry.

Chesapeake’s Contrarian Spirit

and Natural Gas Price Volatility

None of these accomplishments occurred

because Chesapeake’s management ran with

the pack. Instead, the company’s success has

been the result of a well-defined and well-

executed business strategy that focuses on one

product (gas), in one area (the Mid-Continent)

and on one consistent thesis: we believe natu-

ral gas prices will continue to stay strong in the

years ahead because of the difficulty in finding

new reserves of natural gas in North America

and the highly favorable environmental benefits

of using this fuel.

However, these strong natural gas prices will

likely be accompanied by volatility unmatched

among other publicly traded commodities.

Rather than complain about this volatility or

advocate intrusive governmental regulations in

an attempt to artificially reduce it, we will sim-

ply deal with this issue as we do other business

risks that confront us everyday. Successfully

managing this volatility will enable us to further

enhance shareholder value and continue

expanding the company’s operating margins.

Therefore, we have focused on understanding,

anticipating and acting decisively during natural

gas pricing cycles, which we believe are likely to

occur more frequently and with greater ampli-

tude in the years ahead.

Accordingly, you should not be surprised when

Chesapeake’s management team takes actions

that may seem occasionally out of sync with the

rest of the industry. As contrarians, we are com-

fortable “zigging” when others “zag”. Observing

twenty years of volatility and the “boom and

bust” nature of our industry has taught us the

value of hedging our oil and gas production dur-

ing the up cycles. While we may occasionally

give up some revenue in the boom portion of the

cycle, in return we will have more buying power

than our competitors in the bust portion of

the cycle.

As a result of these cycles, our industry suffers

from a historic paradox: most producers have

too much capital in the peak cycles (when

returns from investing are low) and too little cap-

ital in the down cycles (when returns from

investing are high). This results in an industry

average of a 10-15% ROI while we instead seek

to consistently generate a 25-30% ROI. If we

can solve this paradox and achieve our targeted

returns over several cycles, Chesapeake’s stock

price should reflect a premium valuation for the

successful execution of our business strategy.

2