CenturyLink 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

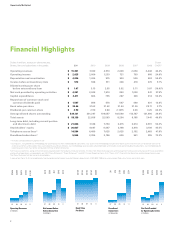

In total, our 2011 efforts resulted in a six percent increase in strategic revenues on a pro forma

basis. Strategic revenues now account for nearly 43 percent of our total revenues, up from

39 percent from pro forma 2010. With continued emphasis on managing costs and achieving

targeted synergies, we generated solid free cash flow in 2011 and returned $1.556 billion to our

stockholders through dividend payments.

Investing for growth

With the people, products and capabilities we’ve added through our three recent major

acquisitions, we have the right strategies and assets in place to continue transforming our

company. Our focus is on four key growth drivers that we believe offer the most attractive

strategic revenue opportunities and long-term advantage for CenturyLink.

• Broadbandexpansionandenhancements

We continue to invest in our broadband network – extending our footprint, enhancing speeds

and adding advanced features and functionality. More than 90 percent of our access lines are

broadband-enabled – 50 percent of which are capable of speeds of 10 Mbps or higher and

20 percent are capable of 20 Mbps or higher. We continue to build fiber deeper into our

network. In particular, we expect to enable approximately one million additional living units

in 2012 through our FTTN expansion initiative. Our product offerings include high-demand,

next-generation IP services such as high-speed Internet, Ethernet, CenturyLink Prism™ TV,

MPLS and VoIP.

• CenturyLinkPrism™TVexpansion

We are focused on growing our CenturyLink Prism™ TV subscriber base and pursuing a

capital-efficient approach to market expansions. Our Prism™ TV subscriber base grew by

approximately 35 percent in fourth quarter 2011, reaching nearly 70,000 subscribers at

year-end. Approximately 50 percent of these Prism™ TV customers are new CenturyLink

customers, and more than 90 percent of these customers also subscribe to our high-speed

Internet service. We expect to launch Prism™ TV in our first legacy Qwest market in 2012.

• Fiber-to-the-towerinitiative

Our fiber-to-the-tower (FTTT) investments strengthen our data transport capabilities and

enhance our local fiber networks. In addition to providing an avenue to participate in the

fast-growing wireless data market, our FTTT initiative opens new broadband opportunities

in our markets. We expect to build fiber to another 4,000 to 5,000 tower sites in 2012.

• Managedhostingandcloudservices

We believe managed hosting and cloud services offer significant growth potential in 2012

and beyond, and we are committed to investing in this business. We anticipate adding another

100,000 square feet of sellable data center space in 2012. We also are focused on achieving

efficiencies across our data center and network infrastructure by rationalizing the combined

legacy Qwest and legacy Savvis data center footprints and connecting all centers to our

network. We will continue to pursue cross-selling opportunities into our combined enterprise

customer base and expect to launch newly developed cloud services for small-to-medium-size

businesses this year. We also will evaluate growth opportunities outside the U.S., particularly

in the high-growth Asia-Pacific region.

To Our Stockholders continued ...

Opportunity Multiplied

6

BUILDING

• Wecompletedberbuildstoabout

5,800 cell sites, bringing our year-end

total to approximately 10,200 sites.

• Fiberbuildsleadtolong-termcontracts

for wireless data transport that will support

future revenue growth opportunities.