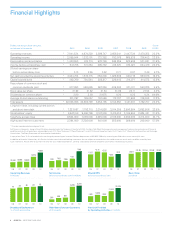

CenturyLink 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Embarqintegration:Progressingto completion

In 2010 we continued our integrationefforts related to the Embarq acquisition, whichclosed

July 1, 2009, and we are close to completion. We successfully implementedCenturyLink’s

provenlocaloperating modelin larger urban markets, includingLas Vegas, Nevada and

Orlando, Florida.Our operating modeldrives decisionmaking closer to the customer and

generatesstrategies tailored to eachmarket’sdemand profile and competitive landscape.

We experienced improved access line retention and increased broadband penetration in

legacyEmbarq markets followingthe transition to our localoperating model.

We have successfully completed the conversion of approximately 75 percentof legacy

Embarqcustomers to CenturyLink’scustomer care billing systems, andwe expect to

complete the remainingEmbarqcustomer records conversion in the third quarter of

2011. Overall, ourintegration activities areprogressingaccording to planand we are on

track to exceed the targeted $375 million in annualoperating expense synergiesfrom

the Embarqacquisition.

Thepositivemarket and operationaltrends we experienced in 2010were largely due

to execution by our employees. Their focus on serving our customers and controlling

expenses helped drive our marketplace successand solidfinancialperformance. We

generated$3.6 billion in operating cash flow in 2010, excluding nonrecurring items, com-

pared with $2.5 billion in 2009, which included sixmonths of Embarq financialresults.

Qwest acquisition

CenturyLink has a long history of combining successfulmarketplace execution with growth

through acquisition, through which we have been able to accelerateour developmentof

products andservicesand produce strong operating results. Theacquisition of Qwest

offersthe greatest scale andscope advantages of any transaction in CenturyLink history.

With the closeof the Qwest transaction, CenturyLink has a numberof opportunities and

advantages, including:

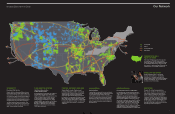

•An extensivefiber network covering190,000 routemiles that providesnationaland

local reach andpositions CenturyLinkas an industry-leadingcommunications provider,

•A large customer base – approximately 5.3million broadband customers, 1.6million

video customers and 15 million access lines – that enhances ourability to competitively

develop and deploy high-bandwidthproductsand servicesacross our advanced

broadband-enabled network,

•An enterprise business focusthat offersgrowth potential from customer demandfor

high-bandwidth data services, as wellas the potentialto providecustomized solutions

such as datahosting,managed servicesand cloud computing to business, wholesale

andgovernment customers, and

•A proven ability to successfully serveresidentialcustomers and small- to medium-size

businesses,whichcouldtranslate into marketsharegains in legacyQwest markets

over time.

92%

Approximately 92 percent of our access

lines are enabled to provide a speed of at

least 1. 5 Mbps.

10 MBPS

Of the lines that are broadband enabled,

65 percent are capable of speeds up

to 10 Mbps.

Business Solutions

With our national fiber network, we

have the ability to provide seamless

national service offerings that include

voice, Ethernet, MPLS and IP-based

applications to business customers.

to

COAST

COAST

+ Wireless

In early 2011,

we announced

an agreement with

Verizon Wireless

that will enable

CenturyLink to offer

Verizon Wireless

equipmentand servicesto residential

andsmallbusiness customers, further

expandingthe portfolio of communica-

tions products andserviceswe offer.

3