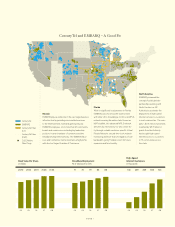

CenturyLink 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

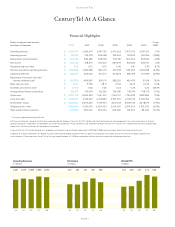

15-year period ending December 31, 2008, CenturyTel delivered

total shareholder returns of 183.5 percent, three times higher than

the S&P Telecom Index and higher than the S&P 500.

Our strong balance sheet has enabled us to invest strategically

and withstand competitive and economic challenges. We main-

tain a strong liquidity position, an investment-grade credit rating

and a low debt-to-operating cash ow ratio compared to most of

our peers.

With no pressing need to access credit markets, we are well posi-

tioned to deal with current market conditions. We have minimal

2009 debt maturities of approximately $20 million and reasonable

maturities of approximately $520 million in 2010. Additionally,

we have arranged all nancing necessary to complete the

EMBARQ transaction.

In June 2008, CenturyTel’s Board of Directors increased the

annual cash dividend to $2.80 per share from $0.27 per share.

The increase represents an approximately 50 percent payout

of free cash ow. We also continued to return cash to sharehold-

ers through share repurchases under the current $750 million

share repurchase program. In 2008, we returned more than

$567 million to shareholders through share repurchases and

common dividends.

Concurrent with the announcement of the proposed merger with

EMBARQ, we suspended share repurchases under the existing

program. Following the anticipated close of the transaction in

second quarter 2009, we expect to reconsider our share repur-

chase strategy in light of market conditions and other factors at

that time.

A Stronger Competitor

I believe we enter 2009 as a stronger and more procient pro-

vider of advanced communications services. Our experienced

management team has worked well together for many years,

and built a track record of superior shareholder returns. With

our planned network investments and increasingly sophisticated

marketing and customer care capabilities, we look forward to

continued industry-leading performance.

We expect to apply our proven leadership experience and busi-

ness model to the operations of the combined CenturyTel/

EMBARQ company. Upon the successful close of the EMBARQ

transaction, we will be a stronger, larger company, dedicated to

delivering high-quality communications services to both rural

and urban markets throughout the country, creating one of the

leading communications companies in the United States.

We are excited about the opportunities we believe the EMBARQ

merger will create for our customers, employees, shareholders

and the communities we serve. We will work diligently in the

years ahead to realize those opportunities, and create a clear

industry leader in providing advanced communications services.

Glen F. Post, III

Chairman of the Board and

Chief Executive Ocer