CenturyLink 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

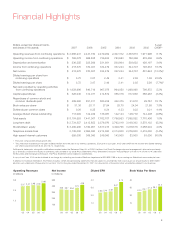

Dollars, except per share amounts, 5-year

and shares in thousands 2007 2006 2005 2004 2003 2002 CAGR(1)

Operating revenues from continuing operations $ 2,656,241 2,447,730 2,479,252 2,407,372 2,367,610 1,971,996 6.1%

Operating income from continuing operations $ 793,078 665,538 736,403 753,953 750,396 575,406 6.6%

Depreciation and amortization $ 536,255 523,506 531,931 500,904 503,652 450,197 3.6%

Income from continuing operations $ 418,370 370,027 334,479 337,244 344,707 193,533 16.7%

Net income $ 418,370 370,027 334,479 337,244 344,707 801,624 (12.2%)(2)

Diluted earnings per share from

continuing operations $ 3.72 3.07 2.49 2.41 2.35 1.35 22.5%

Diluted earnings per share $ 3.72 3.07 2.49 2.41 2.35 5.56 (7.7%)(2)

Net cash provided by operating activities

from continuing operations $ 1,029,986 840,719 967,078 964,050 1,069,068 798,872 5.2%

Capital expenditures $ 326,045 314,071 414,872 385,316 377,939 386,267 (3.3%)

Repurchase of common stock and

common dividends paid $ 489,360 831,011 583,225 432,475 31,618 29,757 75.1%

Book value per share $ 31.36 28.11 27.54 25.70 24.04 21.55 7.8%

Dividends per common share $ 0.26 0.25 0.24 0.23 0.22 0.21 4.4%

Average diluted shares outstanding 113,094 122,229 136,087 142,144 148,779 144,408 (4.8%)

Total assets $ 8,184,553 7,441,007 7,762,707 7,796,953 7,895,852 7,770,408 1.0%

Long-term debt $ 2,734,357 2,412,852 2,376,070 2,762,019 3,109,302 3,578,132 (5.2%)

Stockholders’ equity $ 3,409,205 3,190,951 3,617,273 3,409,765 3,478,516 3,088,004 2.0%

Telephone access lines 2,135,000 2,094,000 2,214,000 2,314,000 2,376,000 2,415,000 (2.4%)

High-speed Internet customers 555,000 369,000 249,000 143,000 83,000 53,000 60.0%

(1) Five-year compounded annual growth rate

(2) This year 2002 included a pre-tax gain of $803.9 million from the sale of our wireless operations. Exclusive of such gain, the 5-year CAGR for net income and diluted earnings

per share would have been 8.2% and 13.7%, respectively.

Full financial statements, along with certifications required under the Sarbanes-Oxley Act of 2002, the New York Stock Exchange rules and management’s discussion and analy-

sis of financial condition and results of operations, are provided in our 2008 Proxy Statement (“Proxy Statement”) and 2007 Annual Report on Form 10-K (“Form 10-K”) filed with

the Securities and Exchange Commission. The Proxy Statement will be mailed to shareholders.

A copy of our Form 10-K can be obtained at no charge by contacting our Investor Relations department at 800.833.1188 or by accessing our Website at www.centurytel.com.

In addition to historical information, this Review includes certain forward-looking statements that are subject to uncertainties that could cause our actual results to differ materi-

ally from such statements. Please refer to our Form 10-K for the year ended December 31, 2007 for a description of these and other uncertainties related to our business.

5

Financial Highlights

Operating Revenues

in billions

2.37

03

2.41

04

2.48

05

2.45

06

2.66

07

1.0

2.0

3.0

Book Value Per Share

24.0

03

25.7

04

27.5

05

28.1

06

31.4

07

30

20

10

40

Net Income

in millions

345

03

337

04

334

05

370

06

418

07

100

400

300

200

500

Diluted EPS

2.35

03

2.41

04

2.49

05

3.07

06

3.72

07

3.0

2.0

1.0

4.0