CenturyLink 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

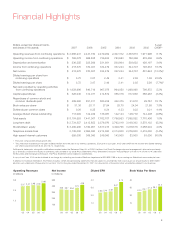

Our consistently strong financial

performance demonstrates our firm

commitment to driving shareholder value

through investments in our network,

systems and employees; through strategic

acquisitions and technology investments;

as well as through dividends and share

repurchase programs.

Keeping Watch on

Market-Driving Forces

We closely monitor evolving customer

needs, changing technologies, increasing

competitive pressures and industry chal-

lenges, all of which are key factors that

impact our long-term strategic outlook.

Currently, we foresee:

Significant Growth in

Demand for Bandwidth

Customers are growing more sophisticated

in their use of broadband capabilities. They

are demanding higher quality, instant avail-

ability and greater control. We expect

emerging media-rich applications, such

as video on demand and video anytime/

anywhere, to drive significant growth in both

Internet traffic and bandwidth demand.

Multiple Technologies

and Market Opportunities

We see technological evolution on multiple

fronts driving significant opportunities for

growth. We believe video-enabling tech-

nologies will be increasingly important as

a new generation of Internet-based video

services further integrates personal com-

puters and televisions into one IP-driven

appliance. We expect home networking

to continue to proliferate, driving demand

for services and bandwidth.

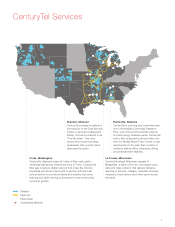

Wireless services continue to be

in great demand by consumers. At year-

end 2007 we had 26 WiFi Hot Spots in

service and expect to build 30 to 35 addi-

tional Hot Spots in the coming year in our

markets across the country. We anticipate

further investments in wireless technolo-

gies that can help us provide a full array

of communications services to our cus-

tomers over time.

Ongoing Competitive Pressure

Competitive pressure continues for broad-

band and voice services. Since year-end

2004, cable modem availability in our wire-

line territories has increased from about

49 percent to approximately 60 percent.

Availability of voice services from cable

operators has grown from approximately

two percent at year-end 2004 to more

than 40 percent at year-end 2007.

We expect competition for both voice

and broadband services to continue to

increase. We are preparing for competition

by enabling more competitive service

offerings, providing more compelling value

propositions and delivering excellent

customer service. Our efforts are driving

positive results. We generally find that after

the expected loss of some customers

shortly after the initial roll out of a competi-

tor’s service, our customer losses slow

significantly, and we begin to see success

in our win-back efforts.

Industry Challenges

Given the rapid changes in customer

demand, technologies and competition,

our industry faces a number of key chal-

lenges. Growing revenues and earnings,

maintaining market share, balancing invest-

ment requirements in different technologies

and managing regulatory uncertainty each

present a significant challenge for telecom-

munications providers. We respond to

these uncertainties by focusing on the

following areas:

• Weexpecttodriverevenueand

earnings growth by offering compelling

broadband service bundles to our resi-

dential and business customers. We are

leveraging our LightCore fiber network

to provide differentiated solutions to our

wholesale and enterprise customers

and lower our internal transport costs.

We also continually evaluate strategic

opportunities, such as the Madison

River acquisition, which provide imme-

diate revenue growth and the ability to

realize future synergies.

2 CENTURYTEL PERSONAL TOUCH | ADVANCED COMMUNICATIONS

2007 REVIEW AND CHAIRMAN’S MESSAGE

“We expect emerging media-rich applications,

such as video on demand and video anytime/any-

where, to drive significant growth in both Internet

traffic and bandwidth demand.”

Broadband Deployment

% of total access lines

63

03

71

04

75

05

79

06

84

07

20

40

60

80

100