CenterPoint Energy 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 CenterPoint Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our risk control policy, which is overseen by our Risk Oversight Committee, defines authorized and prohibited trading instruments and

trading limits. CES is a physical marketer of natural gas and uses a variety of tools, including pipeline and storage capacity, financial instruments

and physical commodity purchase contracts, to support its sales. The CES business optimizes its use of these various tools to minimize its supply

costs and does not engage in proprietary or speculative commodity trading. The VaR limit within which CES currently operates, a $4 million

maximum, is consistent with CES’

operational objective of matching its aggregate sales obligations (including the swing associated with load

following services) with its supply portfolio in a manner that minimizes its total cost of supply. In 2014, CES’

VaR averaged $0.3 million with a

high of $1.7 million.

Assets

CEIP owns and operates over 200 miles of intrastate pipeline in Louisiana and Texas. In addition, CES leases transportation capacity on

various interstate and intrastate pipelines and storage to service its shippers and end-users.

Competition

CES competes with regional and national wholesale and retail gas marketers, including the marketing divisions of natural gas producers and

utilities. In addition, CES competes with intrastate pipelines for customers and services in its market areas.

Midstream Investments

On March 14, 2013, we entered into a Master Formation Agreement (MFA) with OGE Energy Corp. (OGE) and affiliates of ArcLight

Capital Partners, LLC (ArcLight), pursuant to which we, OGE and ArcLight agreed to form Enable, initially a private limited partnership. On

May 1, 2013, the parties closed on the formation of Enable pursuant to which Enable became the owner of substantially all of (i) CERC Corp.’

s

former Interstate Pipelines and Field Services businesses and (ii) Enogex LLC’

s midstream assets, which were contributed by OGE and

ArcLight.

On April 16, 2014, Enable completed its initial public offering (IPO) of 28,750,000 common units at a price of $20.00 per unit, which

included 3,750,000 common units sold by ArcLight pursuant to an over-

allotment option that was fully exercised by the underwriters. Enable

received $464 million in net proceeds from the sale of the units, after deducting underwriting fees, structuring fees and other offering costs. In

connection with Enable’

s IPO, a portion of our common units were converted into subordinated units. As of December 31, 2014, CERC Corp.

held an approximate 55.4% limited partner interest in Enable (consisting of 94,126,366 common units and 139,704,916 subordinated units) and

OGE held an approximate 26.3% limited partner interest in Enable (consisting of 42,832,291 common units and 68,150,514 subordinated units).

Sales of more than 5% of our limited partner interest in Enable or sales by OGE of more than 5% of its limited partner interest in Enable are

subject to mutual rights of first offer and first refusal.

Enable is controlled jointly by CERC Corp. and OGE as each own 50% of the management rights in the general partner of Enable. Sale of

our ownership interests in Enable’s general partner to anyone other than an affiliate prior to May 1, 2016 is prohibited by Enable’

s general

partner’s limited liability company agreement. Sale of our or OGE’s ownership interests in Enable’

s general partner to a third party is subject to

mutual rights of first offer and first refusal, and we are not permitted to dispose of less than all of our interest in Enable’s general partner.

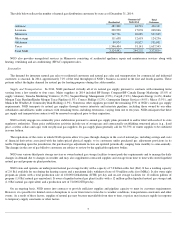

As of December 31, 2014, CERC Corp. and OGE also own a 40% and 60% interest, respectively, in the incentive distribution rights held by

the general partner of Enable. Enable is expected to pay a minimum quarterly distribution of $0.2875 per unit on its outstanding units to the

extent it has sufficient cash from operations after establishment of cash reserves and payment of fees and expenses, including payments to its

general partner and its affiliates, within 45 days after the end of each quarter. If cash distributions to Enable’

s unitholders exceed $0.330625 per

unit in any quarter, the general partner will receive increasing percentages or incentive distributions rights, up to 50%, of the cash Enable

distributes in excess of that amount. In certain circumstances the general partner of Enable will have the right to reset the minimum quarterly

distribution and the target distribution levels at which the incentive distributions receive increasing percentages to higher levels based on

Enable’s cash distributions at the time of the exercise of this reset election.

Our investment in Enable and our 0.1% interest in Southeast Supply Header, LLC (SESH) are accounted for on an equity basis. Equity

earnings associated with our interest in Enable and SESH are reported under the Midstream Investments segment.

Enable.

Enable was formed to own, operate and develop strategically located natural gas and crude oil infrastructure assets. Enable serves

current and emerging production areas in the United States, including several unconventional shale resource plays and local and regional end-

user markets in the United States. Enable’

s assets and operations are organized into two reportable segments: (i) gathering and processing, which

primarily provides natural gas gathering, processing and fractionation services and

7