CenterPoint Energy 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 CenterPoint Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2012 marked another solid year, with each of CenterPoint Energy’s

businesses delivering strong performances.

The year also marked our 10th anniversary as a stand-alone company.

The past decade held many challenges. We experienced the collapse

of credit markets for energy companies. Our service territory took

direct strikes from hurricanes Katrina and Rita in 2005, and again in

2008 from Hurricane Ike. We saw natural gas prices fluctuate between

$15.40 in December 2005 and $2 in April 2012. We navigated through

the Great Recession, which slowed economic activity and energy

consumption. And our electric true-up case, which we hoped could

be resolved in 2004, slowly worked its way through the Texas courts

before it was successfully concluded in 2011. The favorable outcome

allowed us to reduce our debt and restructure our balance sheet.

We overcame these challenges by staying true to the vision, values and

strategy that have defined us. As a result, your company has been one

of the best performing investor-owned utilities over the past 10years.

It’s a remarkable achievement accomplished by remarkable employees.

2012 Overview

Led by the performance of our regulated utilities and field services

business, we reported net income of $417 million for 2012. Though at

first glance this number appears to compare unfavorably with our 2011

net income of $1.4 billion, both 2011 and 2012 included some significant,

unusual items. In 2011, our results included net income of $811 million

from our true-up case. Likewise, our 2012 results included two unusual,

non-cash items: a $252 million goodwill impairment charge associated

with our competitive energy services business and a $136 million pre-tax

gain from our purchase of the remaining 50 percent interest in a gathering

and processing joint venture. When you exclude these items, our 2012

net income would have been $581 million, compared with $546million

in 2011.

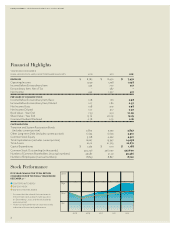

In January 2012, we raised our quarterly dividend from 19.75 cents per

share to 20.25 cents per share. We raised it again in January 2013 to

20.75 cents per share, making this the eighth consecutive year of

dividend increases. Nevertheless, for utility stock investors 2012 was

anup and down year due to the uncertainty over the economy and

thefuture dividend tax rate. Total shareholder return last year, which

included stock price appreciation and annual dividends, was essentially

flat, with a loss of less than 0.2 percent. This lagged the S&P 500

Utilities Index, which returned 1.3 percent, and the broader market,

asmeasured by the S&P 500 Index, which returned 16.0 percent.

Overall, our shareholder returns have been outstanding. Since 2002,

our cumulative total shareholder return has been 278.1 percent,

compared with 182.1 percent for the S&P 500 Utilities average and

115.2percent for the S&P 500 average.

Business Segment Results

Our electric transmission and distribution business had a great year,

nearly matching its record performance in 2011. Core operating income

was $492 million, compared with $496 million in 2011. The Houston

economy was strong, and we added more than 44,000 customers.

Considering the full-year impact of our 2011 rate case results and the

return of normal weather following record heat, weare very pleased.

Despite a mild heating season and reduced gas use, our natural

gasdistribution business matched its excellent 2011 results. Core

operating income for the year was $226 million, identical to last year’s

total. We added more than 22,000 customers, primarily inHouston

and Minneapolis. Our rate design strategy remains focused on ensuring

timely cost recovery to give us an opportunity to earn at or near our

authorized rates of return.

Dear

Shareholder,

The Value of Vision

3