CenterPoint Energy 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 CenterPoint Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VA LU E

VISION

from

2012 ANNUAL REPORT

Table of contents

-

Page 1

VALUE VISION from 2012 A N N UA L R E PORT -

Page 2

... will benefit both pipelines and field services î¼ Continued to grow and expand our competitive energy services business Acquired a group of customers in Oklahoma and expanded sales in Choice programs, which allow residential and small commercial customers to choose their natural gas supplier... -

Page 3

Value from A Shared Commitment CenterPoint Energy's brand promise is Always There. It's a commitment that we strive to deliver across all of our businesses and services. We're a company built upon a strong foundation and proud history of service. -

Page 4

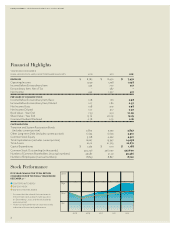

...POI N T EN ERGY 2012 A N N UA L R EPORT Financial Highlights YEAR ENDED DECEMBEr 31 In mIllIons of dollars, except per share amounts Revenues 2010 2011 2012 $ 8,785 $ operating Income Income before extraordinary Item extraordinary Item, net of tax net Income PeR shaRe of Common stoCk 1,249 442... -

Page 5

... season and reduced gas use, our natural gas distribution business matched its excellent 2011 results. core operating income for the year was $226 million, identical to last year's total. We added more than 22,000 customers, primarily in houston and minneapolis. our rate design strategy remains... -

Page 6

... in North Dakota, Oklahoma, Louisiana and Texas, offer opportunities to expand our field services footprint. Finally, no company can promise that it is invulnerable. We must acknowledge the threat to critical energy infrastructure by cyber-attack or other sabotage. All of us at CenterPoint Energy... -

Page 7

... in 2012. Electric operations recorded its safest year in history in terms of its three core safety metrics. We also achieved company bests in two out of three safety goals in our natural gas business, while meeting the target on the third measurement. In 2011, our midstream business' safety... -

Page 8

.... Today we're responding to power outages faster, reading natural gas meters more efficiently and accurately and receiving near real-time reports on pipeline availability. Innovating our energy delivery infrastructure and offering new tools and services to customers continues to position us as one... -

Page 9

Value from 7 -

Page 10

VALUE from VISION // CEN TER POI N T EN ERGY 2012 A N N UA L R EPORT Always There Value from Being 8 00 -

Page 11

... As a leading energy delivery company, we are committed to providing smart, long-lasting solutions for our customers. By building an intelligent grid and implementing our strategy to improve the experience of our customers, we are making meaningful advancements to serve generations to come. Now... -

Page 12

... our Houston-area service territory, making CenterPoint Energy one of the first large American utilities to complete its advanced metering system. Smart meters have allowed us to automate millions of service orders and monthly meter readings, vastly reducing field visits and the related vehicle... -

Page 13

... provide energy usage advice and conservation improvement program rebates in Arkansas, Minnesota and Oklahoma. These types of efforts helped us achieve first-quartile rankings in both the Midwest and South regions in the J.D. Power and Associates annual gas utility residential customer satisfaction... -

Page 14

... Mississippi River Transmission pipeline request for an increase in rates is expected to be finalized in the third quarter of 2013. CenterPoint Energy Gas Transmission (CEGT) pipeline is in pre-filing discussions with customers about a new rate structure. We worked to shape legislation as a company... -

Page 15

... the benefits of natural gas and the important role of natural gas pipelines. provide a foundation for more growth? A We are strategically positioned as a key gathering, processing and transportation service provider in East Texas and northwest Louisiana. We now own 100 percent of Waskom with... -

Page 16

... and industrial markets as well as Choice programs in the central united States. Value through Technology We launched new services to help consumers receive greater value and use energy more wisely. TrueCost, a free, easy-to-use shopping website for electric plans, offers Houston-area residential... -

Page 17

... Chief Executive Officer, CenterPoint Energy President and Chief Executive Officer, J&A Group, LLC, a management and business consulting company President and Chief Executive Officer, Anadarko Petroleum Corporation Former Executive Vice President and Chief Operating Officer, Health Care Service... -

Page 18

...Deputy General Counsel C. DEAN WOODS, 61 Division Senior Vice President and Chief Commercial Officer, Pipelines TRACY B. BRIDGE, 54* Vice President, Human Resources Senior Vice President and Division President, Electric Operations Vice President, Government Relations JAMES M. DUMLER, 52 Company... -

Page 19

... File Number 1-31447 _____ CenterPoint Energy, Inc. (Exact name of registrant as specified in its charter) Texas (State or other jurisdiction of incorporation or organization) 1111 Louisiana Houston, Texas 77002 (Address and zip code of principal executive offices) 74-0694415 (I.R.S. Employer... -

Page 20

THIS PAGE LEFT INTENTIONALLY BLANK -

Page 21

... Market Risk ...Financial Statements and Supplementary Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...Controls and Procedures...Other Information...PART III Directors, Executive Officers and Corporate Governance...Executive Compensation...Security... -

Page 22

... 1A and "Management's Discussion and Analysis of Financial Condition and Results of Operations - Certain Factors Affecting Future Earnings" and " - Liquidity and Capital Resources - Other Factors That Could Affect Cash Requirements" in Item 7 of this report, which discussions are incorporated herein... -

Page 23

...principal executive offices are located at 1111 Louisiana, Houston, Texas 77002 (telephone number: 713-207-1111). We make available free of charge on our Internet website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed... -

Page 24

... generation and retail electric sales are unregulated, but services provided by transmission and distribution companies, such as CenterPoint Houston, are regulated by the Texas Utility Commission. ERCOT serves as the regional reliability coordinating council for member electric power systems... -

Page 25

... 2011, the Texas Utility Commission also issued a financing order (the Financing Order) that authorized the issuance of transition bonds by CenterPoint Houston to securitize the Recoverable True-Up Balance. In January 2012, CenterPoint Energy Transition Bond Company IV, LLC (Bond Company IV), a new... -

Page 26

... revenues generally being higher during the warmer months. Properties All of CenterPoint Houston's properties are located in Texas. Its properties consist primarily of high-voltage electric transmission lines and poles, distribution lines, substations, service centers, service wires and meters. Most... -

Page 27

... industrial customers in Arkansas, Louisiana, Minnesota, Mississippi, Oklahoma and Texas. The largest metropolitan areas served in each state by Gas Operations are Houston, Texas; Minneapolis, Minnesota; Little Rock, Arkansas; Shreveport, Louisiana; Biloxi, Mississippi; and Lawton, Oklahoma. In 2012... -

Page 28

... of natural gas distribution mains, varying in size from one-half inch to 24 inches in diameter. Generally, in each of the cities, towns and rural areas served by Gas Operations, it owns the underground gas mains and service lines, metering and regulating equipment located on customers' premises... -

Page 29

... and industrial customers and electric and gas utilities through CenterPoint Energy Services, Inc. (CES) and its subsidiary, CenterPoint Energy Intrastate Pipelines, LLC (CEIP). In 2012, CES marketed approximately 562 Bcf of natural gas, related energy services and transportation to approximately... -

Page 30

..., which CEGT operates as a separate line with a fixed fuel rate; and CenterPoint Energy-Mississippi River Transmission, LLC (MRT) is an interstate pipeline that provides natural gas transportation, natural gas storage and pipeline services to customers principally in Arkansas, Illinois and Missouri... -

Page 31

... Company (Waskom), a Texas general partnership, which owns and operates a natural gas processing plant and natural gas gathering assets in east Texas. On July 31, 2012, CenterPoint Energy purchased the 50% interest that it did not already own in Waskom, as well as other gathering and related... -

Page 32

... FERC. CERC's natural gas pipeline subsidiaries may periodically file applications with the FERC for changes in their generally available maximum rates and charges designed to allow them to recover their costs of providing service to customers (to the extent allowed by prevailing market conditions... -

Page 33

.... All distribution companies in ERCOT pay CenterPoint Houston the same rates and other charges for transmission services. Resolution of True-Up Appeal. For a discussion of CenterPoint Houston's true-up proceedings, see "- Our Business - Electric Transmission & Distribution - Resolution of True-Up... -

Page 34

... pipelines and field services businesses. • • • In order to comply with these requirements, we may need to spend substantial amounts and devote other resources from time to time to construct or acquire new equipment; acquire permits for facility operations; modify, upgrade or replace... -

Page 35

... through lower gas sales, and our gas transmission and field services businesses could experience lower revenues. On the other hand, warmer temperatures in our electric service territory may increase our revenues from transmission and distribution through increased demand for electricity for cooling... -

Page 36

... referred to as the RICE MACT rule), the most recent being January 14, 2013. Compressors and back up electrical generators used by our Interstate Pipelines, Field Services and Natural Gas Distribution segments are generally compliant. Additional rules are expected to be proposed by the EPA this year... -

Page 37

...The Minnesota Public Utilities Commission includes approximately $285,000 annually in rates to fund normal on-going remediation costs. As of December 31, 2012, CERC had collected $5.8 million from insurance companies to be used for future environmental remediation. In addition to the Minnesota sites... -

Page 38

... Counsel and Corporate Secretary Executive Vice President and Group President, Corporate and Energy Services Executive Vice President and Chief Financial Officer Senior Vice President and Division President, Electric Operations Senior Vice President and Division Group President, Pipelines and Field... -

Page 39

... Southern Gas Association. C. Gregory Harper has served as Senior Vice President and Group President, Pipelines and Field Services since December 2008. Before joining CenterPoint Energy in 2008, Mr. Harper served as President, Chief Executive Officer and as a Director of Spectra Energy Partners, LP... -

Page 40

... of transmission and distribution services. CenterPoint Houston transmits and distributes to customers of REPs electric power that the REPs obtain from power generation facilities owned by third parties. CenterPoint Houston does not own or operate any power generation facilities. If power generation... -

Page 41

... must compete with alternate energy sources, which could result in CERC marketing less natural gas, and its interstate pipelines and field services businesses must compete directly with others in the transportation, storage, gathering, treating and processing of natural gas, which could lead to... -

Page 42

...rules governing the use of hydraulic fracturing, a process used in the extraction of natural gas from shale reservoir formations, and the use of water in that process. Because of these factors, even if new natural gas reserves are discovered in areas served by our assets, producers may choose not to... -

Page 43

... and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources - Future Sources and Uses of Cash - Impact on Liquidity of a Downgrade in Credit Ratings" in Item 7 of Part II of this report. These credit ratings may not remain in effect for any given period of time... -

Page 44

... to stringent and complex laws and regulations pertaining to health, safety and the environment. As an owner or operator of natural gas pipelines and distribution systems, gas gathering and processing systems, and electric transmission and distribution systems, we must comply with these laws and... -

Page 45

... the loss or damage without negative impact on our results of operations, financial condition and cash flows. In common with other companies in its line of business that serve coastal regions, CenterPoint Houston does not have insurance covering its transmission and distribution system, other than... -

Page 46

... of natural gas in California and other markets. Although these matters relate to the business and operations of GenOn, claims against Reliant Energy have been made on grounds that include liability of Reliant Energy as a controlling shareholder of GenOn's predecessor. We, CenterPoint Houston or... -

Page 47

... any of which could have a material adverse affect on our results of operations, financial condition and cash flows. In addition, our electrical distribution and transmission facilities and gas distribution and pipeline systems may be targets of terrorist activities that could disrupt our ability to... -

Page 48

... could increase our costs to repair damaged facilities and restore service to our customers. When we cannot deliver electricity or natural gas to customers or our customers cannot receive our services, our financial results can be impacted by lost revenues, and we generally must seek approval from... -

Page 49

...- Electric Transmission & Distribution - Properties" in Item 1 of this report, which information is incorporated herein by reference. Natural Gas Distribution For information regarding the properties of our Natural Gas Distribution business segment, please read "Business - Our Business - Natural Gas... -

Page 50

...closing prices of the common stock of CenterPoint Energy on the New York Stock Exchange composite tape during the periods indicated, as reported by Bloomberg, and the cash dividends declared in these periods. Dividend Declared Low Per Share Market Price High 2011 First Quarter ...March 17 ...March... -

Page 51

... of new accounting guidance as of January 1, 2009 for convertible debt instruments that may be settled in cash upon conversion. 2011 Income before Extraordinary Item includes a $224 million after-tax ($0.53 and $0.52 per basic and diluted share, respectively) return on true-up balance related to... -

Page 52

... of REPs, CenterPoint Houston delivers electricity from power plants to substations, from one substation to another and to retail electric customers in locations throughout CenterPoint Houston's certificated service territory. The Electric Reliability Council of Texas, Inc. (ERCOT) serves as the... -

Page 53

... natural gas primarily from three regions located in major producing fields in Arkansas, Louisiana, Oklahoma and Texas. Other Operations Our other operations business segment includes office buildings and other real estate used in our business operations and other corporate operations which support... -

Page 54

... Electric Transmission & Distribution business segment and our Gas Operations in Texas. Significant Events Acquisition On July 31, 2012, we purchased the 50% interest that we did not already own in Waskom Gas Processing Company (Waskom), a Texas general partnership, which owns and operates a natural... -

Page 55

..., among others, energy deregulation or re-regulation, pipeline integrity and safety, health care reform, financial reform, tax legislation and actions regarding the rates charged by our regulated businesses; state and federal legislative and regulatory actions or developments relating to the... -

Page 56

... in the debt capital markets; actions by credit rating agencies; effectiveness of our risk management activities; inability of various counterparties to meet their obligations to us; non-payment for our services due to financial distress of our customers; the ability of GenOn Energy, Inc. (GenOn... -

Page 57

... amounts. Year Ended December 31, 2010 2011 2012 Revenues ...$ Expenses...Operating Income...Gain on Marketable Securities ...Gain (Loss) on Indexed Debt Securities ...Interest and Other Finance Charges ...Interest on Transition and System Restoration Bonds ...Equity in Earnings of Unconsolidated... -

Page 58

... is, at current market prices. Operating Income (Loss) by Business Segment Year Ended December 31, 2010 2011 2012 Electric Transmission & Distribution ...$ Natural Gas Distribution ...Competitive Natural Gas Sales and Services ...Interstate Pipelines ...Field Services ...Other Operations ...Total... -

Page 59

... segment, CenterPoint Houston, for 2010, 2011 and 2012 (in millions, except throughput and customer data): Year Ended December 31, 2010 2011 2012 Revenues: Electric transmission and distribution utility...$ Transition and system restoration bond companies...Total revenues...Expenses: Operation and... -

Page 60

... data of our Natural Gas Distribution business segment for 2010, 2011 and 2012 (in millions, except throughput and customer data): Year Ended December 31, 2010 2011 2012 Revenues ...$ Expenses: Natural gas ...Operation and maintenance ...Depreciation and amortization...Taxes other than income... -

Page 61

... include approximately 12,700 natural gas customers as of December 31, 2012 that are under residential and small commercial choice programs invoiced by their host utility. 2012 Compared to 2011. Our Competitive Natural Gas Sales and Services business segment reported operating income, excluding the... -

Page 62

...segment reported operating income of $248 million for 2011 compared to $270 million for 2010. Operating income decreased $22 million primarily due to a backhaul contract that expired in 2011 ($22 million), as well as the effects of the restructured 10-year agreement with our natural gas distribution... -

Page 63

... data of our Field Services business segment for 2010, 2011 and 2012 (in millions, except throughput data): Year Ended December 31, 2010 2011 2012 Revenues ...$ Expenses: Natural gas ...Operation and maintenance ...Depreciation and amortization...Taxes other than income taxes...Total expenses... -

Page 64

... ($18 million). Net cash provided by operating activities increased $502 million in 2011 compared to 2010 primarily due to increased tax refunds ($412 million), increased cash related to gas storage inventory ($41 million), decreased net margin deposits ($27 million) and increased cash provided... -

Page 65

... identified or planned projects for 2013 through 2017 (in millions): 2012 2013 2014 2015 2016 2017 Electric Transmission & Distribution...$ Natural Gas Distribution ...Competitive Natural Gas Sales and Services ...Interstate Pipelines ...Field Services ...Other Operations ...Total ...$ 599... -

Page 66

..., we used interest rates in place as of December 31, 2012. We typically expect to settle such interest payments with cash flows from operations and short-term borrowings. For a discussion of operating leases, please read Note 13(c) to our consolidated financial statements. In 2013, we expect to make... -

Page 67

... in its requested performance bonus amount. The rates took effect with the commencement of CenterPoint Houston's January 2013 billing month. Gas Operations Beaumont/East Texas Rate Case. In July 2012, the natural gas distribution business of CERC (Gas Operations) filed a general rate case with the... -

Page 68

...-Mississippi River Transmission, LLC Rate Filing. In August 2012, our subsidiary, CenterPoint EnergyMississippi River Transmission, LLC (MRT), an interstate pipeline that provides natural gas transportation, natural gas storage and pipeline services to customers principally in Arkansas, Illinois... -

Page 69

... restoration bonds) to EBITDA covenant (as those terms are defined in the facility). The facility allows for a temporary increase of the permitted ratio in the financial covenant from 5 times to 5.5 times if CenterPoint Houston experiences damage from a natural disaster in its service territory and... -

Page 70

.... CenterPoint Energy Services, Inc. (CES), a wholly owned subsidiary of CERC Corp. operating in our Competitive Natural Gas Sales and Services business segment, provides comprehensive natural gas sales and services primarily to commercial and industrial customers and electric and gas utilities... -

Page 71

...outflow when the taxes are paid as a result of the retirement of the ZENS notes. If all ZENS notes had been exchanged for cash on December 31, 2012, deferred taxes of approximately $405 million would have been payable in 2012. Cross Defaults. Under our revolving credit facility, a payment default on... -

Page 72

... service and if the competitive environment makes it probable that such rates can be charged and collected. Our Electric Transmission & Distribution business segment, our Natural Gas Distribution business segment and portions of our Interstate Pipelines business segment apply this accounting... -

Page 73

...valuation techniques. Unbilled Energy Revenues Revenues related to electricity delivery and natural gas sales and services are generally recognized upon delivery to customers. However, the determination of deliveries to individual customers is based on the reading of their meters, which is performed... -

Page 74

... rates or the market values of the securities held by the plan during 2013 could materially, positively or negatively, change our funded status and affect the level of pension expense and required contributions. Pension cost was $86 million, $78 million and $82 million for 2010, 2011 and 2012... -

Page 75

... and obligations under our ZENS that subject us to the risk of loss associated with movements in market interest rates. We have no material floating rate obligations. As of December 31, 2011 and 2012, we had outstanding fixed-rate debt (excluding indexed debt securities) aggregating $8.7 billion and... -

Page 76

... is related to our Competitive Natural Gas Sales and Services business segment. An increase of 10% in the market prices of energy commodities from their December 31, 2012 levels would have decreased the fair value of our non-trading energy derivatives net asset by $1 million. The above analysis of... -

Page 77

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the accompanying consolidated balance sheets of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2012 and 2011, and the related statements... -

Page 78

...OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the internal control over financial reporting of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2012, based on criteria... -

Page 79

... accounting firm, has issued an attestation report on the effectiveness of our internal control over financial reporting as of December 31, 2012 which is included herein on page 56. /s/ DAVID M. MCCLANAHAN President and Chief Executive Officer /s/ GARY L. WHITLOCK Executive Vice President and Chief... -

Page 80

CENTERPOINT ENERGY, INC. AND SUBSIDIARIES STATEMENTS OF CONSOLIDATED INCOME Year Ended December 31, 2010 2011 2012 (in millions, except per share amounts) Revenues ...$ Expenses: Natural gas ...Operation and maintenance ...Depreciation and amortization...Taxes other than income taxes...Goodwill ... -

Page 81

CENTERPOINT ENERGY, INC. AND SUBSIDIARIES STATEMENTS OF CONSOLIDATED COMPREHENSIVE INCOME Year Ended December 31, 2010 2011 (in millions) 2012 Net income ...$ Other comprehensive income (loss): Adjustment to pension and other postretirement plans (net of tax of $5, $7 and $2)...Reclassification of ... -

Page 82

CENTERPOINT ENERGY, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, 2011 December 31, 2012 (in millions) ASSETS Current Assets: Cash and cash equivalents ($220 and $266 related to VIEs at December 31, 2011 and 2012, respectively) ...$ Investment in marketable securities ...Accounts ... -

Page 83

... of tax...Return on true-up balance ...Goodwill impairment ...Step acquisition gain ...Unrealized gain on marketable securities...Unrealized loss (gain) on indexed debt securities ...Write-down of natural gas inventory...Equity in earnings of unconsolidated affiliates, net of distributions...Pension... -

Page 84

... of year ...Issuances related to benefit and investment plans ...Issuances related to public offerings, net of issuance costs ...Balance, end of year...Retained Earnings (Accumulated Deficit) Balance, beginning of year ...Net income ...Common stock dividends...Balance, end of year...Accumulated... -

Page 85

... natural gas gathering, processing and treating facilities. As of December 31, 2012, CenterPoint Energy's indirect wholly owned subsidiaries included: • CenterPoint Energy Houston Electric, LLC (CenterPoint Houston), which engages in the electric transmission and distribution business in the Texas... -

Page 86

bonds issued by these VIEs are payable only from and secured by transition and system restoration property and the bondholders have no recourse to the general credit of CenterPoint Energy. (c) Revenues CenterPoint Energy records revenue for electricity delivery and natural gas sales and services ... -

Page 87

... for use or sale in the normal course of business. CenterPoint Energy has a Risk Oversight Committee composed of corporate and business segment officers that oversees all commodity price, weather and credit risk activities, including CenterPoint Energy's marketing, risk management services and... -

Page 88

... 31, 2011 and 2012, respectively, that was held by CenterPoint Energy's transition and system restoration bond subsidiaries solely to support servicing the transition and system restoration bonds. (o) New Accounting Pronouncements Management believes the impact of recently issued standards, which... -

Page 89

... also determined that no impairment charge was required for any other reportable segment. Other intangibles were not material as of December 31, 2011 and 2012. CenterPoint Energy estimated the value of the Competitive Natural Gas Sales and Services reporting unit using an income approach. Under this... -

Page 90

...material as of December 31, 2011 and 2012. (b) Resolution of True-Up Appeal In March 2004, CenterPoint Houston filed a true-up application with the Texas Utility Commission requesting recovery of $3.7 billion, excluding interest, as allowed under the Texas Electric Choice Plan. In December 2004, the... -

Page 91

... 2011, the Texas Utility Commission also issued a financing order (the Financing Order) that authorized the issuance of transition bonds by CenterPoint Houston to securitize the Recoverable True-Up Balance. In January 2012, CenterPoint Energy Transition Bond Company IV, LLC (Bond Company IV), a new... -

Page 92

... using fair value and expected achievement levels on the grant date. For performance awards with operational goals, the achievement levels are revised as goals are evaluated. The fair value of awards granted to employees is based on the closing stock price of CenterPoint Energy's common stock... -

Page 93

... and Postretirement Benefits CenterPoint Energy maintains a non-contributory qualified defined benefit pension plan covering substantially all employees, with benefits determined using a cash balance formula. Under the cash balance formula, participants accumulate a retirement benefit based upon... -

Page 94

... 7 1 32 CenterPoint Energy used the following assumptions to determine net periodic cost relating to pension and postretirement benefits: Year Ended December 31, 2010 Pension Benefits Postretirement Benefits Pension Benefits 2011 Postretirement Benefits Pension Benefits 2012 Postretirement Benefits... -

Page 95

... for all defined benefit pension plans was $2,064 million and $2,283 million as of December 31, 2011 and 2012, respectively. The expected rate of return assumption was developed by a weighted-average return analysis of the targeted asset allocation of CenterPoint Energy's plans and the expected... -

Page 96

...periodic cost in 2013...$ 13 2 15 $ $ 1 1 2 The following table displays pension benefits related to CenterPoint Energy's pension plans that have accumulated benefit obligations in excess of plan assets: December 31, 2011 Pension Qualified Pension Non-qualified Pension Qualified 2012 Pension Non... -

Page 97

...level, within the fair value hierarchy (see Note 8), CenterPoint Energy's pension plan assets at fair value as of December 31, 2011 and 2012: Fair Value Measurements at December 31, 2011 (in millions) Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Observable Inputs (Level... -

Page 98

... over-the-counter financial instruments such as futures, interest rate options and swaps that were marked to market daily with the gains/losses settled in the cash accounts. The pension plan did not include any holdings of CenterPoint Energy common stock as of December 31, 2011 or 2012. The changes... -

Page 99

... Benefit Payments Medicare Subsidy Receipts 2013...$ 2014...2015...2016...2017...2018-2022 ...(c) Savings Plan 130 141 149 151 153 816 $ 34 36 37 39 40 222 $ (4) (4) (5) (5) (6) (39) CenterPoint Energy has a tax-qualified employee savings plan that includes a cash or deferred arrangement... -

Page 100

... compensation plans that provide benefits payable to directors, officers and certain key employees or their designated beneficiaries at specified future dates, upon termination, retirement or death. Benefit payments are made from the general assets of CenterPoint Energy. During 2010, 2011 and 2012... -

Page 101

... decreased natural gas expense from unrealized net gains of $52 million, a net unrealized loss of $16 million. Weather Hedges. CenterPoint Energy has weather normalization or other rate mechanisms that mitigate the impact of weather on its gas operations in Arkansas, Louisiana, Mississippi, Oklahoma... -

Page 102

...costs in 2011 and 2012, respectively, associated with price stabilization activities of the Natural Gas Distribution business segment that will be ultimately recovered through purchased gas adjustments. (c) Credit Risk Contingent Features CenterPoint Energy enters into financial derivative contracts... -

Page 103

... using publicly available credit ratings and considering credit support (including parent company guaranties) and collateral (including cash and standby letters of credit). For unrated counterparties, CenterPoint Energy determines a synthetic credit rating by performing financial statement analysis... -

Page 104

... utilized by CenterPoint Energy to determine such fair value. Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) (in millions) Netting (1) Adjustments Balance at December 31, 2011 Assets Corporate... -

Page 105

... Fair Value December 31, 2012 Carrying Amount (in millions) Fair Value Financial liabilities: Long-term debt...$ (9) 8,994 $ 10,049 $ 9,619 $ 10,807 Indexed Debt Securities (ZENS) and Time Warner Securities (a) Investment in Time Warner Securities In 1995, CenterPoint Energy sold a cable... -

Page 106

... are adjusted for certain corporate events. As of December 31, 2012, the reference shares for each ZENS note consisted of 0.5 share of TW Common, 0.125505 share of TWC Common and 0.045455 share of AOL Common. CenterPoint Energy pays interest on the ZENS at an annual rate of 2% plus the amount of any... -

Page 107

... first mortgage bonds of CenterPoint Houston. (4) $218 million and $118 million of these series of debt were secured by general mortgage bonds of CenterPoint Houston at December 31, 2011 and 2012, respectively. (5) These series of debt are secured by general mortgage bonds of CenterPoint Houston. 85 -

Page 108

... restoration bonds are payable only through the imposition and collection of "transition" or "system restoration" charges, as defined in the Texas Public Utility Regulatory Act, which are irrevocable, non-bypassable charges payable by most of CenterPoint Houston's retail electric customers in order... -

Page 109

...The facility allows for a temporary increase of the permitted ratio in the financial covenant from 5 times to 5.5 times if CenterPoint Houston experiences damage from a natural disaster in its service territory and CenterPoint Energy certifies to the administrative agent that CenterPoint Houston has... -

Page 110

(12) Income Taxes The components of CenterPoint Energy's income tax expense were as follows: Year Ended December 31, 2010 2011 (in millions) 2012 Current income tax expense (benefit): Federal ...$ State ...Total current expense (benefit) ...Deferred income tax expense (benefit): Federal ...State ... -

Page 111

... net operating loss carryforwards which expire in various years between 2013 and 2032. CenterPoint Energy has approximately $7 million of federal capital loss carryforwards, $15 million of federal charitable contribution carryforwards and $2 million of general business credit carryforwards which... -

Page 112

... 31, 2013 to materially impact the financial position of CenterPoint Energy. CenterPoint Energy has approximately $17 million, $21 million and $(3) million of unrecognized tax benefits (expenses) that, if recognized, would affect the effective income tax rate for 2010, 2011 and 2012, respectively... -

Page 113

... Agreements Gas Operations has asset management agreements associated with its utility distribution service in Arkansas, Louisiana, Mississippi, Oklahoma and Texas. Generally, these asset management agreements are contracts between Gas Operations and an asset manager that are intended to transfer... -

Page 114

... arrangements for certain GenOn gas transportation contracts discussed below. A large number of lawsuits were filed against numerous gas market participants in a number of federal and western state courts in connection with the operation of the natural gas markets in 2000-2002. CenterPoint Energy... -

Page 115

... lawsuits filed by a number of individuals who claim injury due to exposure to asbestos. Some of the claimants have worked at locations owned by subsidiaries of CenterPoint Energy, but most existing claims relate to facilities previously owned by CenterPoint Energy's subsidiaries. CenterPoint Energy... -

Page 116

...31, 2010 2011 2012 (in millions, except per share and share amounts) Income before extraordinary item ...$ Extraordinary item, net of tax...Net income...$ Basic weighted average shares outstanding ...Plus: Incremental shares from assumed conversions: Stock options (1) ...Restricted stock ...Diluted... -

Page 117

... uses operating income as the measure of profit or loss for its business segments. CenterPoint Energy's reportable business segments include the following: Electric Transmission & Distribution, Natural Gas Distribution, Competitive Natural Gas Sales and Services, Interstate Pipelines, Field Services... -

Page 118

... interstate natural gas pipeline operations. The Field Services business segment includes the non-rate regulated natural gas gathering, processing and treating operations. Other Operations consists primarily of other corporate operations which support all of CenterPoint Energy's business operations... -

Page 119

...postemployment related regulatory assets of $704 million, $796 million and $832 million, respectively. Year Ended December 31, 2011 (in millions) Revenues by Products and Services: 2010 2012 Electric delivery...Retail gas sales ...Wholesale gas sales ...Gas transportation and processing...Energy... -

Page 120

... are incorporated herein by reference pursuant to Instruction G to Form 10-K. Item 11. Executive Compensation The information called for by Item 11 will be set forth in the definitive proxy statement relating to CenterPoint Energy's 2013 annual meeting of shareholders pursuant to SEC Regulation 14A... -

Page 121

...in the financial statements: III, IV and V. (a)(3) Exhibits. See Index of Exhibits in CenterPoint Energy's Annual Report on Form 10-K for the year ended December 31, 2012 filed with the Securities and Exchange Commission on February 27, 2013, which can be found on CenterPoint Energy's website at www... -

Page 122

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the consolidated financial statements of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2012 and 2011, and for ... -

Page 123

CENTERPOINT ENERGY, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) STATEMENTS OF INCOME For the Year Ended December 31, 2010 2011 (in millions) 2012 Expenses: Operation and Maintenance Expenses ...$ Total...Other Income (Expense): Interest Income from... -

Page 124

.... SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) STATEMENTS OF COMPREHENSIVE INCOME Year Ended December 31, 2010 2011 (in millions) 2012 Net income ...$ Other comprehensive income (loss): Adjustment to pension and other postretirement plans (net of tax of... -

Page 125

CENTERPOINT ENERGY, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) BALANCE SHEETS December 31, 2011 (in millions) 2012 ASSETS Current Assets: Cash and cash equivalents...Notes receivable - subsidiaries ...Accounts receivable - subsidiaries ...Other ... -

Page 126

...CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) STATEMENTS OF CASH FLOWS For the Year Ended December 31, 2010 2011 (in millions) 2012 Operating Activities: Net income...$ Non-cash items included in net income: Equity income of subsidiaries ...Deferred income tax expense... -

Page 127

...parent company financial statements and notes of CenterPoint Energy, Inc. (CenterPoint Energy) should be read in conjunction with the consolidated financial statements and notes of CenterPoint Energy, Inc. and subsidiaries appearing in the Annual Report on Form 10-K. Credit facilities at CenterPoint... -

Page 128

CENTERPOINT ENERGY, INC. SCHEDULE II -VALUATION AND QUALIFYING ACCOUNTS For the Three Years Ended December 31, 2012 Column A Column B Balance at Beginning of Period Description Column C Additions Charged to Income Charged to Other Accounts (in millions) Deductions From Reserves (1) Balance at End of... -

Page 129

...in the City of Houston, the State of Texas, on the 27th day of February, 2013. CENTERPOINT ENERGY, INC. (Registrant) By: /s/ David M. McClanahan David M. McClanahan President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed... -

Page 130

Exhibit 12 CENTERPOINT ENERGY, INC. AND SUBSIDIARIES COMPUTATION OF RATIOS OF EARNINGS TO FIXED CHARGES (Millions of Dollars) 2008 (1) 2009 (1) 2010 (1) 2011 (1) 2012 (1) Income before extraordinary item...$ Equity in earnings of unconsolidated affiliates, net of distributions...Income taxes ...... -

Page 131

... CenterPoint Energy, Inc. 1111 Louisiana Street Houston, Texas 77002 Mailing Address P.O. Box 4567 Houston, Texas 77210-4567 Telephone: (713) 207-1111 Website Address CenterPointEnergy.com Information Requests Call (888) 468-3020 toll free for additional copies of: 2012 Annual Report and Form... -

Page 132

1111 Louisiana Street // Houston, TX 77002 // CenterPointEnergy.com