CenterPoint Energy 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 CenterPoint Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STAYING

FOCUSED

2008 ANNUAL REPORT

Table of contents

-

Page 1

STAYING FOCUSED 2008 ANNUAl REpORT -

Page 2

... RIGHT STRATEGY. RIGHT ASSETS. RIGHT pEOplE. CenterPoint Energy's solid performance is achieved by staying focused on our portfolio of electric and natural gas delivery businesses. As we continue to build and operate energy delivery systems to serve our customers today and tomorrow, we will strive... -

Page 3

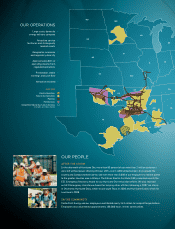

... Gas Distribution 3.2 Million Customers In Arkansas, Louisiana, Minnesota, Mississippi, Oklahoma And Texas THE STRENGTH OF A BAlANCED pORTFOlIO $215 Million Operating Income FiElD sErvicEs 3,600 Miles Of Gathering Lines Gathered 421 Billion Cubic Feet Of Natural Gas In 2008 $147 Million Operating... -

Page 4

... and cash ï¬,ow Attractive dividend map KEY Electric Operations Natural Gas Operations Pipelines Field Services Competitive Natural Gas Sales & Services (includes all states shown) OK KS MO IL IN AR TN MS AL TX LA OUR pEOplE AFTER THE STORM In the aftermath of Hurricane Ike, more than 90... -

Page 5

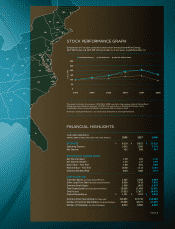

... 2008 GA The graph illustrates the value on 12/31/08 of $100 invested in the common stock of CenterPoint Energy and each reference group on 12/31/03. The calculation of CenterPoint Energy's total shareholder return assumes dividends were reinvested in company stock. Historical stock performance... -

Page 6

OUR BUSINESSES CONTINUE TO pERFORM wEll UNDER A vARIETY OF MARkET CONDITIONS [left to right] Milton Carroll Chairman David M. McClanahan president and CEO -

Page 7

... for what lies ahead. Our electric transmission and distribution business, which serves more than 2 million customers in the Houston area, overcame the impact of Hurricane Ike and increased core operating income from transmission and distribution operations, reporting $407 million compared to $400... -

Page 8

... income represented a decrease from $75 million in 2007. The timing of mark-to-market losses and inventory write-downs offset improved operating margins, increased natural gas throughput, and signiï¬cant growth in revenues and customer count. MEETING THE NATION'S CHANGING ENERGY DEMANDS With a new... -

Page 9

...our electric and gas utilities service territories is expected to be modest, at best, in 2009. Energy markets are also being impacted, creating uncertainty about the timing of some projects. The steep decline in the stock market last year took its toll on the value of the assets in our pension plans... -

Page 10

... transition charge. In 2008, we added nearly 31,000 customers, and we invested more than $330 million in new infrastructure to serve both our new and existing customers. We overcame the largest power outage in Texas history when Hurricane Ike hit the Houston-Galveston area in September. Our electric... -

Page 11

... inCoMe ELECTRIC TRANSMISSION AND DISTRIBUTION OPERATIONS COMPETITION TRANSITION CHARGE TRANSITION BOND COMPANIES with less than 1 percent of our poles destroyed or needing to be replaced. Uprooted trees and ï¬,ying debris, however, damaged or severed power lines throughout our service territory... -

Page 12

OKLAHOMA 105,000 nuMBer of CustoMers Per state at year enD LOUISIANA 251,000 ARKANSAS 445,000 MISSISSIPPI 122,000 MINNESOTA 798,000 TEXAS 1.5 MILLION -

Page 13

...weather adjustment rate mechanism in Oklahoma. We continue to focus on increasing productivity and deploying new technologies to help us control costs and improve customer service. Finally, customers ranked us ï¬rst in the Midwest Region in the J.D. Power and Associates 2008 Gas Utility Residential... -

Page 14

... we anticipate benefiting from improved planning and scheduling processes. We increased our ability to serve off-system customers located on the east side of our system, added new transportation and pooling services and are securing regulatory approvals while assessing customer interest for future... -

Page 15

1,538 BCF 2008 1,216 BCF 2007 939 BCF 2006 annual throughPut pAGE 13 -

Page 16

annual throughPut 375 BCF 2006 398 BCF 2007 fielD serviCes RECORD pERFORMANCE; pOSITIONED FOR GROwTH -

Page 17

421 BCF 2008 For the sixth consecutive year, Field Services had record performance with operating income of $147 million plus equity income of $15 million from a jointly owned natural gas processing plant. As a midstream natural gas gathering and processing provider, we added more than 475 new well... -

Page 18

...Bcf/day of ï¬rm transportation capacity and approximately 11 Bcf of underground storage capacity. We are accessing some of the most proliï¬c shale production areas in the country to provide our customers with lower energy costs. BIO-FUEL AND AGRICULTURAL HEALTH CARE GOVERNMENT AND INSTITUTIONAL... -

Page 19

FORM 10-K -

Page 20

... 1111 Louisiana Houston, Texas 77002 (Address and zip code of principal executive offices) 74-0694415 (I.R.S. Employer Identification No.) (713) 207-1111 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock... -

Page 21

... with Accountants on Accounting and Financial Disclosure ...104 Controls and Procedures ...104 PART III Directors, Executive Officers and Corporate Governance ...105 Executive Compensation ...105 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters... -

Page 22

... make statements concerning our expectations, beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are not historical facts. These statements are ―forward-looking statementsâ€- within the meaning of the Private Securities... -

Page 23

... principal executive offices are located at 1111 Louisiana, Houston, Texas 77002 (telephone number: 713207-1111). We make available free of charge on our Internet website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed... -

Page 24

... another and to retail electric customers taking power at or above 69 kilovolts (kV) in locations throughout CenterPoint Houston's certificated service territory. CenterPoint Houston provides transmission services under tariffs approved by the Texas Utility Commission. Electric Distribution In ERCOT... -

Page 25

...the load-serving substations it owns, primarily within its certificated area. CenterPoint Houston participates with the ERCOT ISO and other ERCOT utilities to plan, design, obtain regulatory approval for and construct new transmission lines necessary to increase bulk power transfer capability and to... -

Page 26

... 31, 2008. In the True-Up Order, the Texas Utility Commission reduced CenterPoint Houston's stranded cost recovery by approximately $146 million, which was included in the extraordinary loss discussed above, for the present value of certain deferred tax benefits associated with its former electric... -

Page 27

... Houston received an order from the Texas Utility Commission allowing it to implement a CTC designed to collect the remaining $596 million from the True-Up Order over 14 years plus interest at an annual rate of 11.075% (CTC Order). The CTC Order authorized CenterPoint Houston to impose a charge... -

Page 28

... electric delivery facilities damaged as a result of Hurricane Ike will be in the range of $600 million to $650 million. As is common with electric utilities serving coastal regions, the poles, towers, wires, street lights and pole mounted equipment that comprise CenterPoint Houston's transmission... -

Page 29

... customers. It operates on a continuous billing cycle, with meter readings being conducted and invoices being distributed to REPs each business day. Advanced Metering System and Distribution Automation (Intelligent Grid) In December 2008, CenterPoint Houston received approval from the Texas Utility... -

Page 30

... territory. In exchange for the payment of fees, these franchises give CenterPoint Houston the right to use the streets and public rights-of way of these municipalities to construct, operate and maintain its transmission and distribution system and to use that system to conduct its electric delivery... -

Page 31

..., the purchased gas adjustment factors are updated periodically, ranging from monthly to semi-annually, using estimated gas costs. The changes in the cost of gas billed to customers are subject to review by the applicable regulatory bodies. Gas Operations uses various third-party storage services or... -

Page 32

...). CES customers vary in size from small commercial customers to large utility companies in the central and eastern regions of the United States, and are served from offices located in Arkansas, Illinois, Indiana, Louisiana, Minnesota, Missouri, Pennsylvania, Texas and Wisconsin. The business has... -

Page 33

... Arkansas, Illinois, Louisiana, Missouri, Oklahoma and Texas. CERC's interstate pipeline operations are primarily conducted by two wholly owned subsidiaries that provide gas transportation and storage services primarily to industrial customers and local distribution companies: • CenterPoint Energy... -

Page 34

...625 million. Assets Our interstate pipelines business currently owns and operates approximately 8,000 miles of natural gas transmission lines primarily located in Arkansas, Illinois, Louisiana, Missouri, Oklahoma and Texas. We also own and operate six natural gas storage fields with a combined daily... -

Page 35

... pursuant to blanket authority granted by the FERC. Our natural gas pipeline subsidiaries may periodically file applications with the FERC for changes in their generally available maximum rates and charges designed to allow them to recover their costs of providing service to customers (to the extent... -

Page 36

.... All distribution companies in ERCOT pay CenterPoint Houston the same rates and other charges for transmission services. This regulated delivery charge includes the transmission and distribution rate (which includes municipal franchise fees), a system benefit fund fee imposed by the Texas electric... -

Page 37

...have retained original jurisdiction. In March 2008, Gas Operations filed a request to change its rates with the Railroad Commission and the 47 cities in its Texas Coast service territory, an area consisting of approximately 230,000 customers in cities and communities on the outskirts of Houston. The... -

Page 38

... of increased costs related to conservation improvement programs and provide a return for the additional capital invested to serve its customers. In addition, Gas Operations is seeking an adjustment mechanism that would annually adjust rates to reflect changes in use per customer. In December 2008... -

Page 39

... consumption of natural gas if ultimately adopted. Our electric transmission and distribution business, unlike most electric utilities, does not generate electricity and thus is not directly exposed to the risk of high capital costs and regulatory uncertainties that face electric utilities that are... -

Page 40

... of the original conduct, on certain classes of persons responsible for the release of hazardous substances into the environment. Such classes of persons include the current and past owners or operators of sites where a hazardous substance was released and companies that disposed or arranged for the... -

Page 41

...most of these claims relate, to Texas Genco LLC, which is now known as NRG Texas LP. Under the terms of the arrangements regarding separation of the generating business from us and our sale to NRG Texas LP, ultimate financial responsibility for uninsured losses from claims relating to the generating... -

Page 42

... Scott E. Rozzell ...59 Executive Vice President, General Counsel and Corporate Secretary Gary L. Whitlock ...59 Executive Vice President and Chief Financial Officer C. Gregory Harper ...44 Senior Vice President and Group President, CenterPoint Energy Pipelines and Field Services Thomas R. Standish... -

Page 43

... has served as Senior Vice President and Group President of CenterPoint Energy Pipelines and Field Services since December 2008. Before joining CenterPoint Energy in 2008, Mr. Harper served as President, Chief Executive Officer and as a Director of Spectra Energy Partners, LP from March 2007 to... -

Page 44

... 31, 2008. In the True-Up Order, the Texas Utility Commission reduced CenterPoint Houston's stranded cost recovery by approximately $146 million, which was included in the extraordinary loss discussed above, for the present value of certain deferred tax benefits associated with its former electric... -

Page 45

... payments. In 2008, seven REPs selling power within CenterPoint Houston's service territory ceased to operate, and their customers were transferred to the provider of last resort or to other REPs. CenterPoint Houston depends on these REPs to remit payments on a timely basis. Applicable regulatory... -

Page 46

... retail rate relief. For more information on the Stipulation and Settlement Agreement, please read ―Business - Regulation - State and Local Regulation - Electric Transmission & Distribution - CenterPoint Houston Rate Agreementâ€- in Item 1 of this report. Disruptions at power generation facilities... -

Page 47

... must compete with alternate energy sources, which could result in CERC marketing less natural gas, and its interstate pipelines and field services businesses must compete directly with others in the transportation, storage, gathering, treating and processing of natural gas, which could lead... -

Page 48

... of capital, which may exceed CERC 's estimates. These projects may not be completed at the planned cost, on schedule or at all. The construction of new pipeline or compression facilities is subject to construction cost overruns due to labor costs, costs of equipment and materials such as steel and... -

Page 49

... obtained to date; • CenterPoint Houston's recovery of costs arising from Hurricane Ike; • general economic and capital market conditions; • credit availability from financial institutions and other lenders; • investor confidence in us and the markets in which we operate; • maintenance of... -

Page 50

... and the environment as described in ―Business - Environmental Mattersâ€- in Item 1 of this Form 10-K. As an owner or operator of natural gas pipelines and distribution systems, gas gathering and processing systems, and electric transmission and distribution systems, we must comply with these... -

Page 51

... and distribution properties following Hurricane Ike, or any such costs sustained in the future, through a change in its regulated rates, and any such recovery may not be timely granted. Therefore, CenterPoint Houston may not be able to restore any loss of, or damage to, any of its transmission and... -

Page 52

... electric generation assets Reliant Energy transferred to it. Texas Genco also agreed to indemnify, and cause the applicable transferee subsidiaries to indemnify, us and our subsidiaries, including CenterPoint Houston, with respect to liabilities associated with the transferred assets and businesses... -

Page 53

...and gas mains are located, pursuant to easements and other rights, on public roads or on land owned by others. Electric Transmission & Distribution For information regarding the properties of our Electric Transmission & Distribution business segment, please read ―Business - Our Business - Electric... -

Page 54

... For information regarding the properties of our Field Services business segment, please read ―Business - Our Business - Field Services - Assetsâ€- in Item 1 of this report, which information is incorporated herein by reference. Other Operations For information regarding the properties of our... -

Page 55

... and Chicago Stock Exchanges and is traded under the symbol ―CNP.â€- The following table sets forth the high and low closing prices of the common stock of CenterPoint Energy on the New York Stock Exchange composite tape during the periods indicated, as reported by Bloomberg, and the cash dividends... -

Page 56

... of the final orders issued by the Texas Utility Commission. (3) Under the terms of the receivables facilities in place since October 2006, the provisions for sale accounting under Statement of Financial Accounting Standards No. 140, ―Accounting for Transfers and Servicing of Financial Assets and... -

Page 57

... 31, 2008 is set forth below: Electric Transmission & Distribution Our electric transmission and distribution operations provide electric transmission and distribution services to retail electric providers (REPs) serving over 2 million metered customers in a 5,000-square-mile area of the Texas Gulf... -

Page 58

... electric delivery facilities damaged as a result of Hurricane Ike will be in the range of $600 million to $650 million. As is common with electric utilities serving coastal regions, the poles, towers, wires, street lights and pole mounted equipment that comprise CenterPoint Houston's transmission... -

Page 59

... damage to its system in Houston, Texas and in other portions of its service territory across Texas and Louisiana. As of December 31, 2008, Gas Operations has deferred approximately $4 million of costs related to Hurricane Ike for recovery as part of future natural gas distribution rate proceedings... -

Page 60

... dividend reinvestment plan. Interstate Pipeline Expansion The Southeast Supply Header (SESH) pipeline project, a joint venture between CenterPoint Energy Gas Transmission, a wholly owned subsidiary of CERC Corp., and Spectra Energy Corp., was placed into commercial service on September 6, 2008... -

Page 61

... associated with Hurricane Ike; • timely and appropriate rate actions and increases, allowing recovery of costs and a reasonable return on investment; • cost overruns on major capital projects that cannot be recouped in prices; • industrial, commercial and residential growth in our service... -

Page 62

... from the 2007 effective tax rate of 32.8% primarily as a result of revisions to the Texas State Franchise Tax Law (Texas margin tax) which was reported as an operating expense prior to 2008 and is now being reported as an income tax for CenterPoint Houston and a Texas state tax examination in 2007... -

Page 63

... segment, CenterPoint Houston, for 2006, 2007 and 2008 (in millions, except throughput and customer data): Year Ended December 31, 2007 2006 2008 Revenues: Electric transmission and distribution utility ...$ 1,516 Transition bond companies ...265 Total revenues ...1,781 Expenses: Operation and... -

Page 64

...reported operating income of $545 million for 2008, consisting of $407 million from our regulated electric transmission and distribution utility operations (TDU), exclusive of an additional $5 million from the competition transition charge (CTC), and $133 million related to transition bond companies... -

Page 65

... the net impact of rate increases ($11 million), lower labor and benefits costs ($14 million), and customer growth from the addition of approximately 25,000 customers in 2008 ($6 million). 2007 Compared to 2006. Our Natural Gas Distribution business segment reported operating income of $218 million... -

Page 66

... gas costs) on the Carthage to Perryville pipeline that went into service in May 2007 ($51 million), increased transportation and ancillary services ($27 million), and a gain on the sale of two storage development projects ($18 million). These increases are partially offset by higher operation... -

Page 67

...with new assets and general cost increases, partially offset by a gain related to the sale of assets in 2008 ($7 million). 2007 Compared to 2006. Our Field Services business segment reported operating income of $99 million for 2007 compared to $89 million for 2006. Continued increased demand for gas... -

Page 68

... by operating activities in 2007 decreased $217 million compared to 2006 primarily due to the timing of fuel recovery ($204 million), increased tax payments ($10 million), increased interest payments ($40 million), increased gas storage inventory ($36 million) and decreased net accounts receivable... -

Page 69

... requirements for 2009 through 2013 (in millions): 2008 2009 2010 2011 2012 2013 Electric Transmission & Distribution ...Natural Gas Distribution ...Competitive Natural Gas Sales and Services ...Interstate Pipelines ...Field Services ...Other Operations ...Total ... $ 481 $ 422 $ 591 $ 579 $ 504... -

Page 70

...Utility Commission in September 2007, in February 2008 a subsidiary of CenterPoint Houston issued approximately $488 million in transition bonds in two tranches with interest rates of 4.192% and 5.234% and final maturity dates in February 2020 and February 2023, respectively. Scheduled final payment... -

Page 71

... in our enhanced dividend reinvestment plan. Credit and Receivables Facilities. In November 2008, CenterPoint Houston entered into a $600 million 364-day credit facility. The credit facility will terminate if bonds are issued to securitize the costs incurred as a result of Hurricane Ike and if those... -

Page 72

...(in millions): Amount Utilized at February 13, 2009 Date Executed Company Type of Facility Size of Facility June 29, 2007 June 29, 2007 June 29, 2007 November 25, 2008 November 25, 2008 CenterPoint Energy CenterPoint Houston CERC Corp. CERC Corp. CenterPoint Houston Revolver Revolver Revolver... -

Page 73

... Rating S&P Outlook(2) Rating Fitch Outlook(3) CenterPoint Energy Senior Unsecured Debt ...Ba1 Stable BBBStable BBBStable CenterPoint Houston Senior Secured Debt (First Mortgage Bonds) ...Baa2 Stable BBB+ Stable AStable CenterPoint Houston Senior Secured Stable BBB+ Stable BBB+ Stable Debt (General... -

Page 74

CenterPoint Energy Services, Inc. (CES), a wholly owned subsidiary of CERC Corp. operating in our Competitive Natural Gas Sales and Services business segment, provides comprehensive natural gas sales and services primarily to commercial and industrial customers and electric and gas utilities ... -

Page 75

... the costs of providing the regulated service and if the competitive environment makes it probable that such rates can be charged and collected. Our Electric Transmission & Distribution business segment, our Natural Gas Distribution business segment and portions of our Interstate Pipelines business... -

Page 76

... ultimate cost associated with retiring the assets under SFAS No. 143 and FIN 47. For example, if the inflation adjustment increased 25 basis points, this would increase the balance for asset retirement obligations by approximately 3.0%. Similarly, an increase in the discount rate by 25 basis points... -

Page 77

Unbilled Energy Revenues Revenues related to electricity delivery and natural gas sales and services are generally recognized upon delivery to customers. However, the determination of deliveries to individual customers is based on the reading of their meters, which is performed on a systematic basis... -

Page 78

... rebalance plan assets as appropriate. As of December 31, 2008, the projected benefit obligation was calculated assuming a discount rate of 6.90%, which is a 0.50% increase from the 6.40% discount rate assumed in 2007. The discount rate was determined by reviewing yields on high-quality bonds that... -

Page 79

... in market interest rates (please read Note 8 to our consolidated financial statements). However, the fair value of these instruments would increase by approximately $310 million if interest rates were to decline by 10% from their levels at December 31, 2008. In general, such an increase in fair... -

Page 80

... commodities from their December 31, 2008 levels would have increased the fair value of our non-trading energy derivatives net liability by $118 million with all of the increase attributable to price stabilization activities related to our Natural Gas Distribution business segment. There would be no... -

Page 81

... Data REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the accompanying consolidated balance sheets of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2008... -

Page 82

... INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the internal control over financial reporting of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2008, based on criteria... -

Page 83

... accounting firm, has issued an attestation report on the effectiveness of our internal control over financial reporting as of December 31, 2008 which is included herein on page 60. /s/ DAVID M. MCCLANAHAN President and Chief Executive Officer /s/ GARY L. WHITLOCK Executive Vice President and Chief... -

Page 84

... taxes ...367 Total ...8,274 1,045 Operating Income ...Other Income (Expense): Gain (loss) on Time Warner investment ...94 Gain (loss) on indexed debt securities ...(80) Interest and other finance charges ...(470) Interest on transition bonds ...(130) Distribution from AOL Time Warner litigation... -

Page 85

CENTERPOINT ENERGY, INC. AND SUBSIDIARIES STATEMENTS OF CONSOLIDATED COMPREHENSIVE INCOME Year Ended December 31, 2006 2007 2008 (In millions) Net income ...Other comprehensive income (loss): Adjustment to pension and other postretirement plans (net of tax of $-0-, $28 and $32) ...Minimum pension ... -

Page 86

CENTERPOINT ENERGY, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, December 31, 2007 2008 (In millions) ASSETS Current Assets: Cash and cash equivalents ...$ Investment in Time Warner common stock ...Accounts receivable, net ...Accrued unbilled revenues ...Inventory ...Non-trading ... -

Page 87

... reductions related to ZENS and ACES settlement ...(107) Unrealized loss (gain) on Time Warner investment ...(94) Unrealized loss (gain) on indexed debt securities ...80 Write-down of natural gas inventory ...66 Equity in earnings of unconsolidated affiliates, net of distributions ...(5) Changes... -

Page 88

... related to benefit and investment plans ...- Balance, end of year ...- Accumulated Deficit Balance, beginning of year ...Net income ...Cumulative effect of uncertain tax positions standard ...Common stock dividends - $0.60 per share in 2006, $0.68 per share in 2007, and $0.73 per share in 2008... -

Page 89

... and treating facilities. As of December 31, 2008, the Company's indirect wholly owned subsidiaries included: • CenterPoint Energy Houston Electric, LLC (CenterPoint Houston), which engages in the electric transmission and distribution business in a 5,000-square mile area of the Texas Gulf Coast... -

Page 90

... 2007 and 2008 is as follows (in millions): Natural Gas Distribution ...Interstate Pipelines ...Competitive Natural Gas Sales and Services ...Field Services ...Other Operations ...Total ...$ 746 579 335 25 11 $ 1,696 The Company performs its goodwill impairment tests at least annually and evaluates... -

Page 91

... of Financial Accounting Standards (SFAS) No. 71, ―Accounting for the Effects of Certain Types of Regulationâ€- (SFAS No. 71), to the Electric Transmission & Distribution business segment and the Natural Gas Distribution business segment and to portions of the Interstate Pipelines business segment... -

Page 92

... Company's Competitive Natural Gas Sales and Services business segment are also primarily valued at the lower of average cost or market. Natural gas inventories of the Company's Natural Gas Distribution business segment are primarily valued at weighted average cost. During 2007 and 2008, the Company... -

Page 93

.... As of December 31, 2007 and 2008, the Company held an investment in Time Warner Inc. (TW) common stock (TW Common), which was classified as a ―tradingâ€- security. For information regarding this investment, see Note 6. (m) Environmental Costs The Company expenses or capitalizes environmental... -

Page 94

...cash equivalents includes $128 million and $166 million at December 31, 2007 and 2008, respectively, that is held by the Company's transition bond subsidiaries solely to support servicing the transition bonds. (o) New Accounting Pronouncements In April 2007, the FASB issued Staff Position No. FIN 39... -

Page 95

... shares and the stock awards are issued to the participants along with the value of dividend equivalents earned over the performance cycle or vesting period. The Company issues new shares in order to satisfy share-based payments related to LICPs. Option awards are generally granted with an exercise... -

Page 96

...the Company's LICP activity for 2008: Stock Options Outstanding Options Year Ended December 31, 2008 Remaining...weighted-average grant-date fair values of awards granted were as follows for 2006, 2007 and 2008: 2006 Year Ended December 31, 2007 2008 Performance shares ...$ 13.05 $ 18.20 Stock awards ... -

Page 97

... retirement, as defined in the plans. Under plan amendments, effective in early 1999, healthcare benefits for future retirees were changed to limit employer contributions for medical coverage. Such benefit costs are accrued over the active service period of employees. The net unrecognized transition... -

Page 98

... relating to pension and postretirement benefits: 2006 Postretirement Benefits December 31, 2007 Pension Postretirement Benefits Benefits 2008 Postretirement Benefits Pension Benefits Pension Benefits Discount rate ...5.70% Expected return on plan assets ...8.50 Rate of increase in compensation... -

Page 99

... and 2008, respectively. The expected rate of return assumption was developed by reviewing the targeted asset allocations and historical index performance of the applicable asset classes over a 15-year period, adjusted for investment fees and diversification effects. The discount rate was determined... -

Page 100

...Debt securities ...34-44% 60-70% Real estate ...0-5% - Cash ...0-2% 0-2% The pension plan did not include any holdings of CenterPoint Energy common stock as of December 31, 2007 or 2008. The Company contributed $8 million and $20 million to its non-qualified pension and postretirement benefits plans... -

Page 101

... times. Participating employees may elect to invest all or a portion of their contributions to the plan in CenterPoint Energy common stock, to have dividends reinvested in additional shares or to receive dividend payments in cash on any investment in CenterPoint Energy common stock, and to transfer... -

Page 102

... electric delivery facilities damaged as a result of Hurricane Ike will be in the range of $600 million to $650 million. As is common with electric utilities serving coastal regions, the poles, towers, wires, street lights and pole mounted equipment that comprise CenterPoint Houston's transmission... -

Page 103

Gas Operations has deferred approximately $4 million of costs related to Hurricane Ike for recovery as part of future natural gas distribution rate proceedings. (b) Recovery of True-Up Balance In March 2004, CenterPoint Houston filed its true-up application with the Texas Utility Commission, ... -

Page 104

... 31, 2008. In the True-Up Order, the Texas Utility Commission reduced CenterPoint Houston's stranded cost recovery by approximately $146 million, which was included in the extraordinary loss discussed above, for the present value of certain deferred tax benefits associated with its former electric... -

Page 105

... Houston received an order from the Texas Utility Commission allowing it to implement a CTC designed to collect the remaining $596 million from the True-Up Order over 14 years plus interest at an annual rate of 11.075% (CTC Order). The CTC Order authorized CenterPoint Houston to impose a charge... -

Page 106

... Texas Utility Commission approved CenterPoint Houston's request. The interim rates became effective for service on and after November 5, 2008. Minnesota. In November 2006, the Minnesota Public Utilities Commission (MPUC) denied a request filed by Gas Operations for a waiver of MPUC rules in order... -

Page 107

... million. Weather Derivatives. The Company has weather normalization or other rate mechanisms that mitigate the impact of weather in Arkansas, Louisiana, Oklahoma and a portion of Texas. The remaining Gas Operations jurisdictions, Minnesota, Mississippi and most of Texas, do not have such mechanisms... -

Page 108

..., to create a synthetic credit rating. (2) Retail end users represent commercial and industrial customers who have contracted to fix the price of a portion of their physical gas requirements for future periods. (5) Fair Value Measurements Effective January 1, 2008, the Company adopted SFAS No. 157... -

Page 109

... utilized by the Company to determine such fair value. Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) (in millions) Balance as of December 31, 2008 Netting Adjustments (1) Assets Corporate... -

Page 110

...change in unrealized gains or losses relating to assets still held at the reporting date ...$ (6) Indexed Debt Securities (ZENS) and Time Warner Securities (a) Original Investment in Time Warner Securities (3) (10) (11) (41) 6 1 (58) 7 In 1995, the Company sold a cable television subsidiary to TW... -

Page 111

... of ZENS ...- 2% interest paid ...- Gain on indexed debt securities...- Loss on TW Common ...(139) Balance at December 31, 2008 ...$ 218 $ (7) Equity (a) Capital Stock 109 19 (17) - - 111 20 (17) - - 114 20 (17) - - 117 $ 292 - - 80 - 372 - - (111) - 261 - - (128) - $ 133 CenterPoint Energy has... -

Page 112

... the Company's 3.75% convertible senior notes were submitted for conversion in 2008, as described in Note 8(b), ―Long-term Debt - Convertible Debt.â€- (4) These series of debt are secured by first mortgage bonds of CenterPoint Houston. (5) $527 million of these series of debt is secured by general... -

Page 113

... associated with Hurricane Ike. Revolving Credit Facilities. The Company's $1.2 billion credit facility has a first-drawn cost of LIBOR plus 55 basis points based on the Company's current credit ratings. The facility contains a debt (excluding transition bonds) to earnings before interest, taxes... -

Page 114

...or CERC Corp.'s $950 million credit facility at December 31, 2007 and 2008. The Company, CenterPoint Houston and CERC Corp. were in compliance with all debt covenants as of December 31, 2008. Transition Bonds. Pursuant to a financing order issued by the Texas Utility Commission in September 2007, in... -

Page 115

.... As of December 31, 2008, CenterPoint Houston's assets were also subject to liens securing approximately $2.6 billion of general mortgage bonds which are junior to the liens of the first mortgage bonds. (9) Income Taxes The components of the Company's income tax expense (benefit) were as follows... -

Page 116

... in the Texas State Franchise Tax Law (Texas margin tax) resulted in classifying Texas margin tax of approximately $8 million, net of federal income tax effect, as income tax expense in 2008 for CenterPoint Houston. The 2007 state income tax benefit of $10 million includes a benefit of approximately... -

Page 117

... tax expense for 2006 of approximately $26 million. (10) Commitments and Contingencies (a) Natural Gas Supply Commitments Natural gas supply commitments include natural gas contracts related to the Company 's Natural Gas Distribution and Competitive Natural Gas Sales and Services business segments... -

Page 118

...Gas Transmission at Union Church, Mississippi. CEGT filed with FERC on December 5, 2008 to increase the Carthage to Perryville capacity to approximately 1.9 Bcf per day. The expansion includes a new compressor unit at two of CEGT's existing stations and is currently projected to be placed in service... -

Page 119

... defendants in two mismeasurement lawsuits brought against approximately 245 pipeline companies and their affiliates pending in state court in Stevens County, Kansas. In one case (originally filed in May 1999 and amended four times), the plaintiffs purport to represent a class of royalty owners who... -

Page 120

... Company (CEGT), CenterPoint Energy Field Services (CEFS), CEPS, Mississippi River Transmission Corp. (MRT) and various non-affiliated companies alleging fraud, unjust enrichment and civil conspiracy with respect to rates charged to certain consumers of natural gas in Arkansas, Louisiana, Minnesota... -

Page 121

... owned or operated by CERC or may have been owned by one of its former affiliates. CERC has been named as a defendant in a lawsuit filed in the United States District Court, District of Maine, under which contribution is sought by private parties for the cost to remediate former MGP sites based on... -

Page 122

... most of these claims relate, to Texas Genco LLC, which is now known as NRG Texas LP. Under the terms of the arrangements regarding separation of the generating business from the Company and its sale to NRG Texas LP, ultimate financial responsibility for uninsured losses from claims relating to the... -

Page 123

... guaranties as calculated under the new agreement if and to the extent changes in market conditions exposed CERC to a risk of loss on those guaranties. The potential exposure to CERC under the guaranties relates to payment of demand charges related to transportation contracts. The present value of... -

Page 124

... of reportable business segments considers the strategic operating units under which the Company manages sales, allocates resources and assesses performance of various products and services to wholesale or retail customers in differing regulatory environments. The accounting policies of the business... -

Page 125

... & Distribution, Natural Gas Distribution, Competitive Natural Gas Sales and Services, Interstate Pipelines, Field Services and Other Operations. The rate-regulated electric transmission and distribution function (CenterPoint Houston) is reported in the Electric Transmission & Distribution business... -

Page 126

... Transmission & Distribution is $145 million related to Hurricane Ike. Revenues by Products and Services: Year Ended December 31, 2006 2007 2008 (In millions) Electric delivery sales...$ 1,781 $ 1,837 Retail gas sales ...4,546 4,941 Wholesale gas sales ...2,331 2,196 Gas transport ...550 532 Energy... -

Page 127

... III Item 10. Directors, Executive Officers and Corporate Governance The information called for by Item 10, to the extent not set forth in ―Executive Officersâ€- in Item 1, will be set forth in the definitive proxy statement relating to CenterPoint Energy 's 2009 annual meeting of shareholders... -

Page 128

... is included in the financial statements: III, IV and V. (a)(3) Exhibits. See Index of Exhibits in the Company's Annual Report on Form 10 -K for the year ended December 31, 2008 filed with the Securities and Exchange Commission on February 25, 2009, which can be found on the Company's website at www... -

Page 129

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the consolidated financial statements of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2008 and 2007, and for ... -

Page 130

CENTERPOINT ENERGY, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) STATEMENTS OF INCOME For the Year Ended December 31, 2006 2007 2008 (In millions) Expenses: Operation and Maintenance Expenses ...$ (19) $ Taxes Other than Income ...(2) Total ...(21) ... -

Page 131

CENTERPOINT ENERGY, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) BALANCE SHEETS December 31, 2007 2008 (In millions) ASSETS Current Assets: Cash and cash equivalents ...$ - $ - Notes receivable - subsidiaries ...216 82 Accounts receivable - ... -

Page 132

... related to ZENS and ACES settlement ...Amortization of debt issuance costs ...Loss (gain) on indexed debt securities ...Changes in working capital: Accounts receivable/(payable) from subsidiaries, net ...Accounts payable ...Other current assets ...Other current liabilities ...Common stock dividends... -

Page 133

...CenterPoint Houston 's issuance of bonds to securitize the costs incurred as a result of Hurricane Ike, after which time the permitted ratio would revert to the level that existed prior to the November 2008 modification. Under the Company's $1.2 billion credit facility, an additional utilization fee... -

Page 134

... Services, Inc. (CES) provides comprehensive natural gas sales and services to industrial and commercial customers. In order to hedge their exposure to natural gas prices, CES has entered standard purchase and sale agreements with various counterparties. CenterPoint Energy has guaranteed the payment... -

Page 135

...21 1 - - 22 _____ (1) The 2008 change to the deferred tax asset valuation allowance charged to other accounts represents a reduction equal to the related deferred tax asset reduction in 2008 for re-measurement of state tax attributes, net of federal tax benefit. A full valuation allowance for this... -

Page 136

... City of Houston, the State of Texas, on the 25th day of February, 2009. CENTERPOINT ENERGY, INC. (Registrant) By: /s/ David M. McClanahan David M. McClanahan President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below... -

Page 137

Exhibit 12 CENTERPOINT ENERGY, INC. AND SUBSIDIARIES COMPUTATION OF RATIOS OF EARNINGS TO FIXED CHARGES (Millions of Dollars) 2004 2005 2006 2007 (1) 2008 (1) Income from continuing operations...$ Income taxes for continuing operations ...Capitalized interest ... 205 139 (4) 340 $ 225 153 (4) ... -

Page 138

..., 59 President and Chief Executive Officer cOmpAny LEADERShip C. GREGORY HARPER , 44 Senior Vice President and Group President Pipelines and Field Services SCOTT E. ROZZELL , 59 Executive Vice President General Counsel and Corporate Secretary THOMAS R. STANDISH , 59 Senior Vice President and Group... -

Page 139

... Services serves as transfer agent, registrar and dividend disbursing agent for CenterPoint Energy common stock. inforMation requests Call (888) 468-3020 toll free for additional copies of: 2008 Annual Report and Form 10-K 2009 Proxy Statement DiviDenD PayMents Common stock dividends are generally... -

Page 140

1111 lOUISIANA STREET HOUSTON, TX 77002