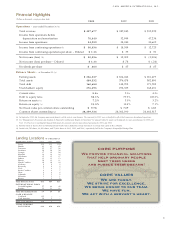

Cash America 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

In my previous role as President and current capacity as Chief

Executive Officer, I have penned the last fifteen annual Letters to

Shareholders appearing in Cash America’s Annual Reports.

Composing a celebratory and encouraging message for our

shareholders has been more difficult in some years than others.

During those fifteen years, we have enjoyed our share of good

fortune and endured a few periods of disappointing results, mostly

of our own making. For the most part, the market has viewed us

with respect and admiration, although I suspect a shareholder or

two along the way may have suggested a less appealing descriptor.

Regardless, as I sit here today to compose my sixteenth message, I

have never felt more comfortable blending the joy of a great year

just past with the excitement of the road ahead. And, I have been

doing this long enough to understand that both current

shareholders and potential new investors are

more interested in the view through the

windshield than the images captured in the

rearview mirror. Consequently, this message

will be more anticipatory than celebratory.

First, we must take a moment to celebrate

the good news of 2003. The crisp and precise

execution of the 3,800-member team at Cash

America is once again the cornerstone of a

record-breaking performance. Your Company

surpassed a number of significant milestones in

2003, including breaking the $400 million

revenue barrier, passing $30 million in

earnings, eclipsing a $1 per share in earnings,

and posting the highest year-ending share value in our history.

The other good news from 2003 is that we are now back in

the unit expansion game. Building on the cornerstone of

execution, we once again feel safe adding the building blocks of

new units in both the pawn and cash advance arenas. Following

five years of a relatively stable unit count, we invested

approximately $70 million to add 171 new units in 2003. The

August acquisition of Cashland, an Ohio-based consumer finance

business, provided 121 of these units. Following the acquisition,

Cashland opened 14 additional units offering short-term cash

advances, check cashing, money orders and money transfer

services. Our U.S. business added 8 pawnshops and 17 of their own

short-term cash advance units. The balance of the growth came

from our foreign lending segment.

The final piece of good news for our shareholders relating to

2003 is a confirmation that your management team is not

particularly enamored with its success. Our celebration of 2003

results ended quickly. Sure, we are proud of what has been

accomplished since adoption of our “back to basics” strategy in

2000. But we also recognize that the bar has been raised following

successive record years. In a recent internal newsletter distributed

to our entire workforce, I challenged everyone to elevate their

level of anxiety about our future by sharing a paraphrased quote

from the sixth-century Chinese philosopher Lao-Tzu who wrote,

“If you wish to stay out in front, then act like you’re behind.”

That quote is a perfect segue to the anticipatory part of

this message.

Gazing through the windshield, we find a panoramic view of

opportunities we could not have considered a few short years ago –

opportunities that now appear on the horizon as a result of the

burgeoning wants and needs of the working middle class coupled

with the continuing migration of mainstream financial institutions

toward mega-mergers and away from neighborhood lending. The

banks, thrifts, credit unions and large finance companies all have

sound business reasons for stepping away from a

business they simply can’t handle profitably – a

business that is labor intensive, risky and

dependent on attentive service. This retreat that

began about 20 years ago now finds the

mainstream lenders at a point where regulations

and thin margins have led to cultural and

structural changes that have rendered them

incapable of fully servicing households with

incomes below $50,000. I see no political will to

alter the regulatory environment for these

institutions, and I have seen little movement

toward altering the cultural bias against

developing relationships with the neighborhood

plumber, nurse, mechanic or third-grade teacher.

Consequently, I believe the opportunities for Cash America

will continue to grow regardless of the ebb and flow of GDP

growth and unemployment rates. Sure, factors we don’t control,

such as short-term interest rates, gold prices, currency rates and the

general state of the economy, will always influence near-term

results – sometimes positively and sometimes negatively. But I

believe the long-term prospects for our business are undeniable.

From our formation almost 20 years ago, we have been providing a

financial bridge helping ordinary people navigate the treacherous

waters of overdue bills, unexpected expenses and the discretionary

choice of providing an occasional treat for themselves or a loved

one. The segment of the population we serve is expanding at a

faster rate than the overall population, and the economic

bifurcation of society is growing more divisive. I believe the course

we have set will ultimately transform our role from a niche player

to a mainstream provider.

Today, our offerings provide our customers with the freedom of

choice to cross the bridge of secured pawn loans or the bridge of

unsecured cash advances. This double-barrel offering has allowed

To My Fellow Shareholders:

0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40