Carphone Warehouse 2003 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2003 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

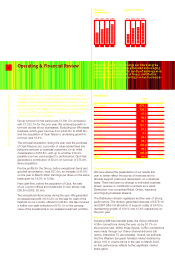

30.6 49.6 46.8 57.0

02 030100

Headline profit

before tax

(£m)

3.7 5.0 4.4 5.3

02 030100

Headline earnings

per share

(pence)

02 030100

824 1,059 1,104 1,140

Stores

(number)

3,756 5,445 6,992 8,133

02 030100

Employees

(number)

The Group has successfully continued to pursue

its strategy of developing its recurring revenue

streams, both in the existing mobile business and,

with the acquisition of Opal Telecom, through our

move into fixed line services. We are delighted to be

recommending a maiden dividend, reflecting strong

cash generation and confidence in our prospects.

I am pleased to report on a successful year for The

Carphone Warehouse. In the year to March 2003, we

achieved organic growth in turnover of 18.4% in our core

Distribution and Telecoms Services businesses. Profit

before tax, exceptional items and goodwill increased by

21.8% to £57.0m, and earnings per share on the same

basis increased by 19.0% to 5.25p.

The Group continued to gain market share in the year

as a result of our superior retail and service offering, our

independence, and the withdrawal of further capacity from the

retail market. After nearly two years of deteriorating handset

sales, most of the markets in which we operate have returned

to growth, giving improving visibility for the current year.

In November 2002 we acquired Opal Telecom plc, a provider

of value-added fixed line telecoms services to business

customers. The core Opal business has continued to deliver

strong and profitable growth since it became part of the

Group, and in February we launched our own residential fixed

line service, talktalk™, using the Opal network and leveraging

our retail asset. We have been very pleased with the initial

levels of customer interest.

We continue to pursue our strategy of generating recurring

revenues and profits from our customers beyond the point

of sale as our business becomes more closely aligned with

that of our network partners. The acquisition of Opal has

further developed these revenue streams so that in the

forthcoming year we anticipate that over 50% of Group

contribution will be generated beyond the point of sale.

The Group generated an encouraging level of free cash

flow, maintaining a strong balance sheet. Our confidence in

the future has prompted us to propose a maiden dividend

of 1p per share, which we aim to increase in line with

earnings growth in the medium term.

We are quietly optimistic about the outlook for this year.

The product pipeline is strong and customers continue to be

interested in the latest technologies and handset styles. The

recent launch of the first third generation network operational

in the UK gives some indication of the range of new services

that is likely to be widely available in the coming years.

The Carphone Warehouse has been built on the foundations

of strong relationships with suppliers, customers and

employees. I would like to thank our suppliers and network

partners for their continued support during the year, our

customers for their loyalty, and most of all our employees

for their outstanding contribution.

Hans Roger Snook, Chairman

1

The Carphone Warehouse Group PLC Annual Report 2003

Chairman’s Statement