Carnival Cruises 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

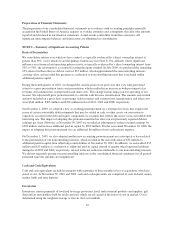

NOTE 5 – Debt

Long-term debt and short-term borrowings consisted of the following (in millions):

November 30,

2010 (a) 2009 (a)

SECURED LONG-TERM DEBT

Fixed rate export credit facilities, collateralized by two ships, bearing interest at 5.4% and

5.5%, due through 2016 ...................................................... $ 328 $ 375

Floating rate export credit facilities collateralized by three ships, bearing interest at LIBOR

plus 1.1% to 1.3% (1.7% to 2.6%), repaid or collateral released in 2010 ................ - 325

Other ....................................................................... 3 3

Total Secured Long-term Debt ............................................. 331 703

UNSECURED LONG-TERM DEBT

Export Credit Facilities

Fixed rate export credit facilities, bearing interest at 4.2% to 5.0%, due through 2020 (b) ..... 2,339 2,603

Euro fixed rate export credit facilities, bearing interest at 3.8% to 4.5%, due through

2025 (b)(c) ................................................................ 503 299

Floating rate export credit facilities, bearing interest at LIBOR plus 1.3% to 1.6% (1.9% to

2.0%), due through 2022 (d)(e) ................................................ 688 83

Euro floating rate export credit facilities, bearing interest at EURIBOR plus 0.2% to 0.5%

(1.1% to 1.6%), due through 2022 (f)(g) ......................................... 824 1,111

Bank Loans

Fixed rate bank loans, bearing interest at 3.5% to 4.5%, due through 2015 (b)(h)(i) ......... 851 850

Euro fixed rate bank loans, bearing interest at 3.9% to 4.7%, due through 2021 (b) .......... 406 524

Floating rate bank loans, bearing interest at LIBOR plus 1.9% (2.2%), due in 2013 (i)(j) ..... 150 200

Euro floating rate bank loans, bearing interest at EURIBOR plus 0.6% to 1.3% (1.6% to

2.3%), due in 2014 (b)(k) ..................................................... 262 152

Revolver (i)(l)

Loans, bearing interest at LIBOR plus 0.2% (0.6%) .................................. 5 212

Euro loans, bearing interest at EURIBOR plus 0.2% (0.6%) ............................ - 52

Private Placement Notes

Fixed rate notes, bearing interest at 5.9% to 6.0%, due through 2016 ..................... 123 224

Euro fixed rate notes, bearing interest at 6.7% to 7.3%, due through 2018 (b) .............. 246 278

Publicly-Traded Notes

Fixed rate notes, bearing interest at 6.7% to 7.2%, due through 2028 ..................... 529 530

Euro fixed rate notes, bearing interest at 4.3%, due in 2013 ............................ 991 1,119

Sterling fixed rate notes, bearing interest at 5.6%, due in 2012 .......................... 322 339

Publicly-Traded Convertible Notes

Notes, bearing interest at 2%, repaid in 2010 ........................................ - 595

Notes, bearing interest at 1.75%, net of discount, due in 2013 .......................... 6 9

Other ...................................................................... 48 29

Total Unsecured Long-term Debt ........................................... 8,293 9,209

UNSECURED SHORT-TERM BORROWINGS

Commercial paper, with aggregate weighted-average interest rate of 0.5%, repaid in December

2010 (l) ................................................................... 696 96

Euro bank loans, with aggregate weighted-average interest rate of 1.2%, repaid in December

2010 ..................................................................... 44 39

Total Unsecured Short-term Borrowings ..................................... 740 135

Total Unsecured Debt ..................................................... 9,033 9,344

Total Debt .............................................................. 9,364 10,047

Less short-term borrowings ..................................................... (740) (135)

Less current portion of long-term debt ............................................. (613) (815)

Total Long-term Debt .................................................... $8,011 $ 9,097

(See next page for footnotes.)

16