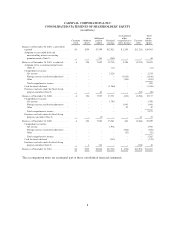

Carnival Cruises 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Preparation of Financial Statements

The preparation of our consolidated financial statements in accordance with accounting principles generally

accepted in the United States of America requires us to make estimates and assumptions that affect the amounts

reported and disclosed in our financial statements. Actual results could differ from these estimates. All

significant intercompany balances and transactions are eliminated in consolidation.

NOTE 2 – Summary of Significant Accounting Policies

Basis of Presentation

We consolidate entities over which we have control, as typically evidenced by a direct ownership interest of

greater than 50%, or for which we are the primary beneficiary (see Note 3). For affiliates where significant

influence over financial and operating policies exists, as typically evidenced by a direct ownership interest from

20% to 50%, the investment is accounted for using the equity method. In July 2009, we purchased the remaining

25% interest in Ibero that we did not own for $33 million, which approximated this noncontrolling interests’

carrying value, and recorded this payment as a reduction to noncontrolling interests that is included within

additional paid-in capital.

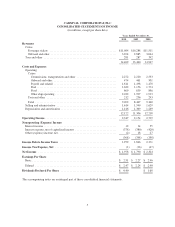

During the fourth quarter of 2010, we changed the classification of our port costs that vary with guest head

counts to a gross presentation from a net presentation, which resulted in an increase in both passenger ticket

revenues and commissions, transportation and other costs. This change had no impact on our operating or net

income. We adjusted all prior period amounts to conform with this new classification. The amounts reclassified

and now included on a gross basis in passenger ticket revenues and commissions, transportation and other costs

were $346 million, $303 million and $301 million in fiscal 2010, 2009 and 2008, respectively.

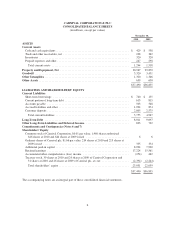

On December 1, 2009, we adopted a new accounting pronouncement on a retrospective basis that requires the

issuer of certain convertible debt instruments that may be settled in cash, or other assets, on conversion to

separately account for the debt and equity components in a manner that reflects the issuer’s non-convertible debt

borrowing rate. The impact of adopting this pronouncement had no effect on our previously reported diluted

earnings per share. However, at November 30, 2007 we recorded an adjustment to reduce retained earnings by

$203 million and increase additional paid-in capital by $209 million. For the year ended November 30, 2008, the

impact of adopting this pronouncement was an additional $6 million of non-cash interest expense.

On December 1, 2009, we also adopted another new accounting pronouncement on a retrospective basis related

to the presentation of our noncontrolling interests, which resulted in the reclassification of $54 million to

additional paid-in capital from other long-term liabilities at November 30, 2007. In addition, we reclassified $35

million and $15 million as a reduction to additional paid-in capital instead of against other long-term liabilities

during fiscal 2009 and 2008, respectively, related to the net reduction attributable to our noncontrolling interests.

We did not separately present our noncontrolling interests in the consolidated financial statements for all periods

presented since the amounts are insignificant.

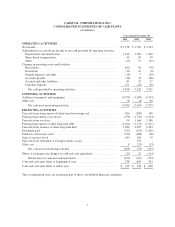

Cash and Cash Equivalents

Cash and cash equivalents include investments with maturities of three months or less at acquisition, which are

stated at cost. At November 30, 2010 and 2009, cash and cash equivalents are comprised of cash on hand, money

market funds and time deposits.

Inventories

Inventories consist primarily of food and beverage provisions, hotel and restaurant products and supplies, gift

shop and art merchandise held for resale and fuel, which are all carried at the lower of cost or market. Cost is

determined using the weighted-average or first-in, first-out methods.

10